Residential Real Estate News

Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

Residential News » Geneva Edition | By Michael Gerrity | February 20, 2025 7:55 AM ET

Switzerland has long been synonymous with stability and security, making it a top destination for ultra-high-net-worth individuals (UHNWIs). In an era of rising debt costs, growing government deficits, and political turbulence in major European nations like France and Germany, Switzerland stands out as a refuge, according to global property consultant Knight Frank.

A Stable Investment Environment

Knight Frank says Switzerland's appeal lies in its reputation for political neutrality and economic stability. Hosting major international organizations like the United Nations and the Red Cross in Geneva, the country rarely experiences sudden policy shifts, offering investors a predictable environment. Additionally, the Swiss franc is regarded as one of the world's strongest currencies, often appreciating during times of global uncertainty. The Swiss National Bank has also taken a proactive approach, leading the way in monetary easing by cutting interest rates four times in the latest cycle.

Mobility and Wealth Management

Advancements in technology, flexible work arrangements, and improved global mobility have made it easier than ever for UHNWIs to relocate. Executives, tech entrepreneurs, and commodity traders can now manage their businesses from Alpine chalets or lakeside estates while providing their families with a safe and high-quality lifestyle.

According to Knight Frank's Wealth Sizing Model, Switzerland is home to 14,307 individuals with wealth exceeding US$10 million. The country's well-established family office industry further enhances its appeal, with UHNWIs investing in globally diverse portfolios.

Unmatched Quality of Life

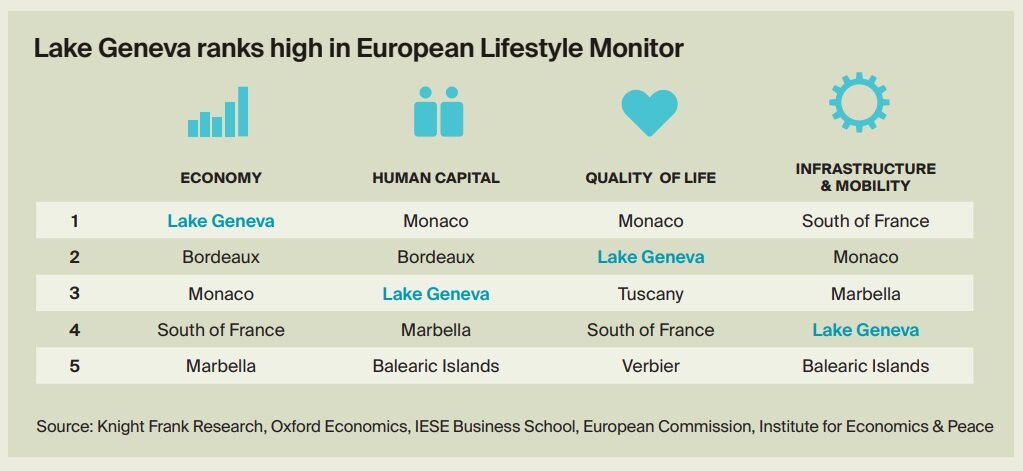

While non-residents face purchasing restrictions due to Switzerland's 1985 Lex Koller law, those acquiring residency can choose from prime locations around Lake Geneva, such as La Côte and the Swiss Riviera--both of which frequently rank among the world's top quality-of-life destinations.

Privacy and Security

Beyond favorable tax conditions, privacy and security are the primary motivations for UHNWIs relocating to Switzerland, as highlighted in Knight Frank's European Lifestyle Report. The Lake Geneva region, known locally as Lac Léman, offers a blend of safety, excellent schools, and financial advantages, all set against a breathtaking natural backdrop of mountains and lakes. Since the pandemic, demand for space and tranquility has surged, making areas like La Côte and Terre Sainte especially desirable for families seeking privacy and direct waterfront access.

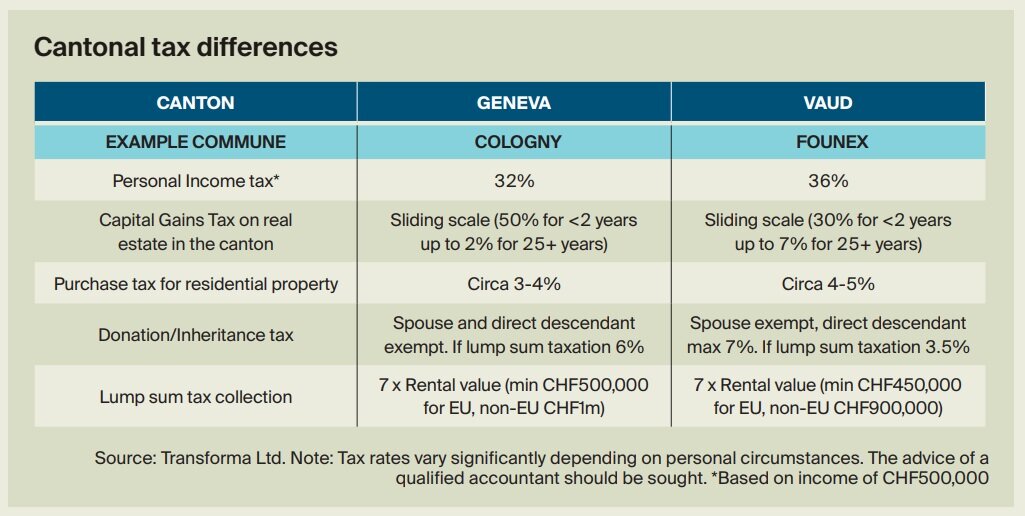

Attractive Tax Benefits

Switzerland's tax policies remain a significant draw. From 2025, the cantons of Geneva and Vaud, which border Lake Geneva, will lower income tax rates and cap wealth taxes. Both cantons also offer UHNWIs the option of advanced tax rulings, including lump-sum taxation agreements and clear definitions of taxable income and wealth.

World-Class Education

Knight Frank reports Switzerland is home to 105 international schools and 12 universities, including the prestigious EHL Hospitality Business School--widely regarded as the world's best hotel management institution. With 113 Nobel Prize-winning scientists among its alumni, Switzerland continues to uphold its reputation for academic excellence.

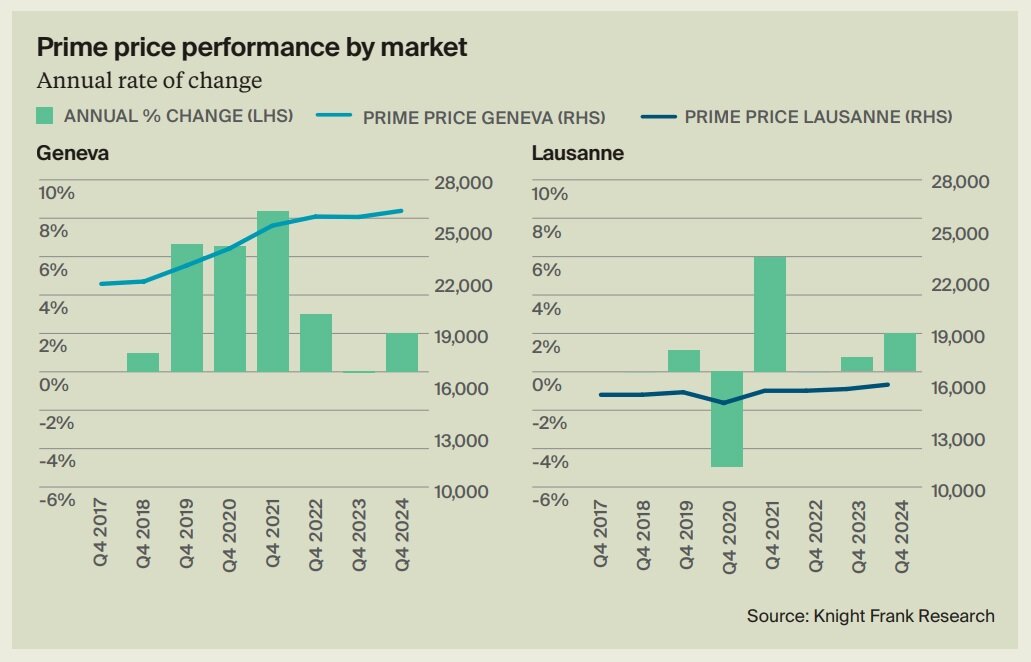

A Resilient Property Market

Switzerland's real estate market is renowned for its stability, with property values resisting major fluctuations. Despite a slight dip in sales volumes in 2024, the market remains a reliable investment for wealth preservation. As global uncertainties persist, Switzerland's status as a safe haven is only set to strengthen, says Knight Frank.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years