Residential Real Estate News

Dubai, Palm Beach and Miami Lead World's Super Luxury Home Sales

Residential News » Dubai Edition | By Michael Gerrity | September 5, 2024 7:31 AM ET

Global super prime home sales rise 66 percent over last 5 years

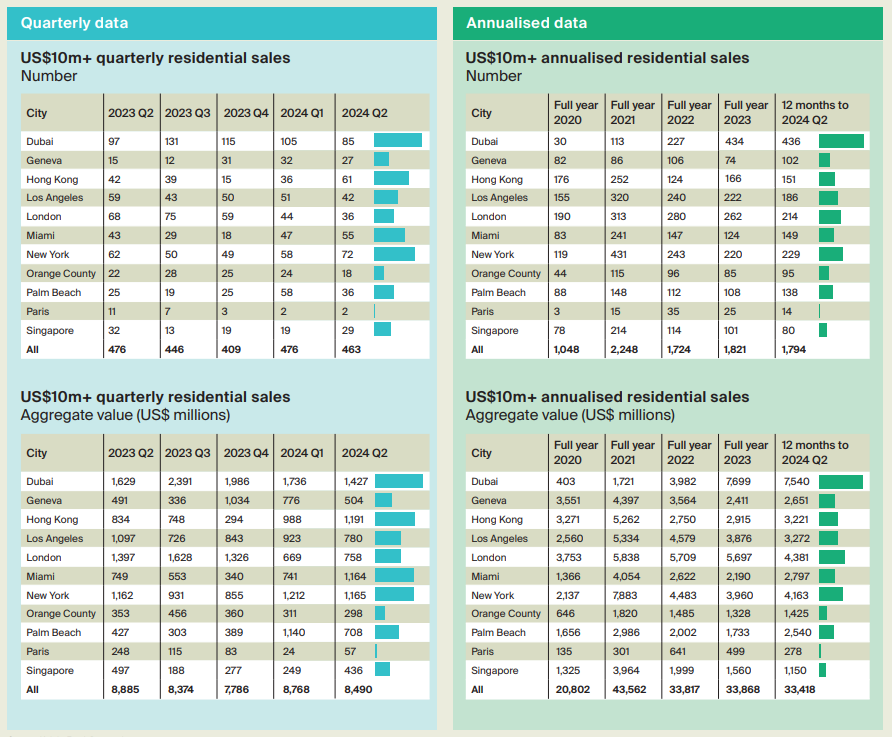

Based on new data from global property consultant Knight Frank, 463 sales of properties valued at $10 million or more were recorded in the three months leading up to June 2024 across 11 key markets. This figure is slightly lower than the 476 sales recorded in the previous quarter. However, sales volumes at the high end of the residential market remain nearly two-thirds higher than pre-pandemic levels.

Liam Bailey, Knight Frank's Global Head of Research says, "Substantial wealth creation has supported the growth in the global super-prime sales market. The transformation of markets like Dubai, Palm Beach and Miami has more than offset the slowing experienced by some more mature markets. With rates moving lower, total transaction volumes are likely to tick higher into 2025."

ANNUAL SALES VALUES STABILIZE

The total value of super-prime sales across the 11 markets reached $33.4 billion in the 12 months leading up to June 2024. Since the end of the pandemic-driven market boom, when total values peaked at nearly $44 billion in late 2021, annual sales values have stabilized between $32 billion and $34 billion, starting from Q4 2022.

GROWTH SINCE THE PANDEMIC

Although recent activity has slowed, the pandemic has led to a significant expansion of the super-prime market. This growth is particularly evident in markets like Palm Beach, Miami, and Dubai, where activity surged due to global shifts in wealth distribution. The current annual sales value of $33.4 billion represents a substantial increase from $20.1 billion in 2019.

KEY MARKET PERFORMANCE

Dubai stands out as the fastest-growing market, with sales of properties priced at $10 million or more skyrocketing from 23 in 2019 to 436 in the most recent 12-month period. Geneva has also seen a significant increase, with sales rising from 59 in 2019 to 102. Palm Beach sales jumped from 50 to 138, and Miami saw a remarkable increase from 41 to 149. While markets like New York, Singapore, Paris, and Hong Kong have been less affected by the recent growth, mature markets such as London and Los Angeles have experienced sales increases of 25% to 50% during this period.

WEALTH CREATION

The growth in this market has been driven by a broader increase in global wealth in recent years. Knight Frank's Wealth Report confirmed a 19% increase in the number of ultra-high-net-worth individuals (UHNWIs) globally over the past five years. The strong performance of some U.S. markets and Dubai is partly due to recent wealth creation in these regions, with the number of UHNWIs in the U.S. up by 8% in 2023 and by 6.2% in the Middle East.

THIS QUARTER IN DEPTH

Dubai led the market by the number of sales in Q2 of 2024, recording 85 transactions, although this represents a decline from the peak of 131 in Q3 2023. New York ranked second with 72 sales, marking its highest total in two years. Hong Kong's strong performance, with 61 sales, indicates a market rebound after several slow quarters, driven by increased demand from mainland Chinese buyers and high individual unit prices across the city.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024