The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

ECB's Quantitative Easing to Boost Eurozone Property Markets

Commercial News » London Edition | By Michael Gerrity | January 23, 2015 8:34 AM ET

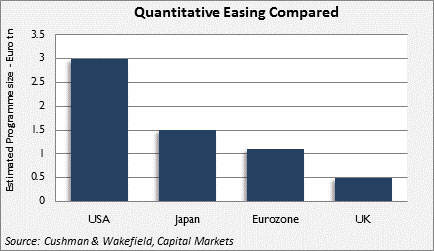

This week the ECB has taken markets somewhat by surprise with the scale of its quantitative easing (QE) program and this should help to consolidate recent bond yield and currency falls and hopefully pave the way for higher inflation expectations and also better GDP growth.

Maintaining market confidence will be crucial to making this happen in the short term of course but to deliver real and sustainable changes going forward, the QE program needs to encourage governments to get on with deeper structural reforms. In our opinion it will be the committed reformers like Spain who will be most rewarded with increased activity and inward investment.

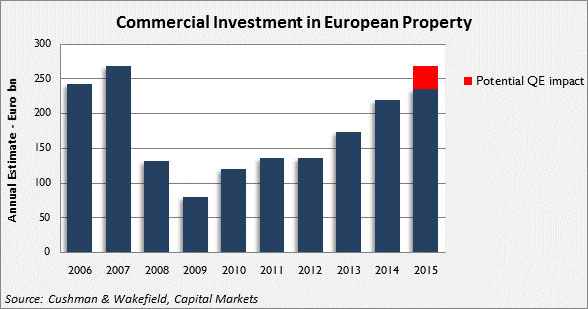

David Hutchings, Head of EMEA Investment Strategy at Cushman & Wakefield said, "If the QE program is successful, the impact on property markets in general could be substantial as even more demand will now be diverted into the market. As a result, yields are set to fall more than expected and volumes will be pushed further back towards record levels."

Cushman & Wakefield predicts that without QE, the market would be expecting a 5-10% increase in European investment volumes this year alongside a 20-30 basis points prime yield fall. With a successful QE package delivering lower for longer borrowing costs, more growth and some reform, that forecast is increased to a 40-70 basis point yield fall and a 20% plus jump in property trading.

Cushman & Wakefield further points outs that this assumes investors can find the stock to buy, which relies on bank sales and deleveraging as well as profit taking and stock recycling. Also however according to Hutchings, "We can expect increased interest in a range of global markets as Europeans export capital in search of opportunities, and also a move back into development, helped by recent falls in commodity prices softening build costs. In addition, we are now anticipating more corporate activity - including asset sales by corporates, joint ventures and takeovers."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More