The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

UK Housing Market Enjoys Fast Recovery 1 Month After COVID-19 Lockdown Ends

Residential News » London Edition | By Michael Gerrity | June 16, 2020 9:00 AM ET

International property consultant Knight Frank is reporting this week that home purchase offers are being accepted at record rates in UK property markets as traction returns and downwards pressure on prices eases in the first month since market lockdown measures were lifted.

The number of offers accepted outside the capital in the week to 6 June was the highest on record, and up 52% compared to the five-year average, as vendors agreed deals against a backdrop of narrowing price discounts and pent-up demand. In London, the figure was 34% above the five-year average and the third highest weekly figure this year.

"Enquiry activity has been extraordinary. I've never been contacted by so many people that want to live outside London," said Damian Gray, head of Knight Frank's Oxford office. "Vendors are generally listening to advice and a lot of the property being brought to market now is being priced more realistically. Buyers meanwhile are happy to pay the right amount and go for it."

Restrictions on UK property transactions were lifted on 13 May following an eight-week period during which physical viewings ground to a halt and demand remained muted. As the UK emerges from lockdown and the wider impact on the jobs market becomes clearer, this will have a bearing on the performance of the housing market.

For now, pressure from buyers that has built since the end of March has only bolstered pent-up demand that has formed against a backdrop of tax changes and political uncertainty over the last five years.

The number of new prospective buyers continues to increase. For markets outside London in the week ending 6 June, the figure was the highest it has been since May 2018 and was 14% ahead of the five-year average. In London, the number was 54% ahead of the five-year average but lower than levels recorded at the start of this year when the post-election bounce had an impact.

The reason that markets outside of the capital are currently setting records comes down to price said David Peters, head of Knight Frank's Country Business.

The average discount to the asking price for sales outside London is 1.2% since the market re-opened. That compared to 2.4% during the market lockdown. In London, the average discount has narrowed to 5.5% from 6.4% over the same period.

"What this reflects is that prices outside London have been more realistic for a longer period of time and are therefore now showing more resilience," said David.

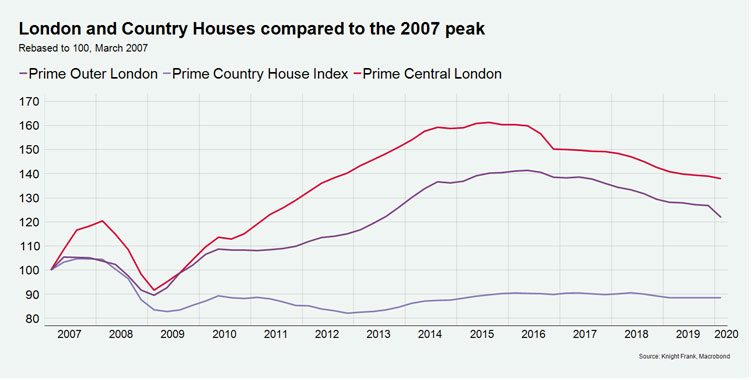

House prices outside the capital peaked in the third quarter of 2007, however they remain below this high point and growth has been subdued in recent years. Meanwhile, London prices are now between 20% and 40% above the pre-financial crisis peak of 2007, as the chart below shows.

This price differential has been allied to a trend for more buyers to seek outdoor space. While web views for London properties were 13% below the five-year average in the week ending 6 June, outside London there was a 13% increase.

"I had two offers in lockdown and advised the vendors to hold their nerve," said Shaun Hobbs, head of Knight Frank's Basingstoke office. "That really paid off with better prices in the end," he said.

Relatively tight supply levels have also put a brake on downwards price pressure in the first month since the property market re-opened but more balance should return in coming months.

New instructions to sell in London and Country markets were 4% ahead of the five-year average in the week to 6 June. That compared to a figure of -60% in the first full week of trading after market restrictions were lifted.

The number of offers accepted outside the capital in the week to 6 June was the highest on record, and up 52% compared to the five-year average, as vendors agreed deals against a backdrop of narrowing price discounts and pent-up demand. In London, the figure was 34% above the five-year average and the third highest weekly figure this year.

"Enquiry activity has been extraordinary. I've never been contacted by so many people that want to live outside London," said Damian Gray, head of Knight Frank's Oxford office. "Vendors are generally listening to advice and a lot of the property being brought to market now is being priced more realistically. Buyers meanwhile are happy to pay the right amount and go for it."

Restrictions on UK property transactions were lifted on 13 May following an eight-week period during which physical viewings ground to a halt and demand remained muted. As the UK emerges from lockdown and the wider impact on the jobs market becomes clearer, this will have a bearing on the performance of the housing market.

For now, pressure from buyers that has built since the end of March has only bolstered pent-up demand that has formed against a backdrop of tax changes and political uncertainty over the last five years.

The number of new prospective buyers continues to increase. For markets outside London in the week ending 6 June, the figure was the highest it has been since May 2018 and was 14% ahead of the five-year average. In London, the number was 54% ahead of the five-year average but lower than levels recorded at the start of this year when the post-election bounce had an impact.

The reason that markets outside of the capital are currently setting records comes down to price said David Peters, head of Knight Frank's Country Business.

The average discount to the asking price for sales outside London is 1.2% since the market re-opened. That compared to 2.4% during the market lockdown. In London, the average discount has narrowed to 5.5% from 6.4% over the same period.

"What this reflects is that prices outside London have been more realistic for a longer period of time and are therefore now showing more resilience," said David.

House prices outside the capital peaked in the third quarter of 2007, however they remain below this high point and growth has been subdued in recent years. Meanwhile, London prices are now between 20% and 40% above the pre-financial crisis peak of 2007, as the chart below shows.

This price differential has been allied to a trend for more buyers to seek outdoor space. While web views for London properties were 13% below the five-year average in the week ending 6 June, outside London there was a 13% increase.

"I had two offers in lockdown and advised the vendors to hold their nerve," said Shaun Hobbs, head of Knight Frank's Basingstoke office. "That really paid off with better prices in the end," he said.

Relatively tight supply levels have also put a brake on downwards price pressure in the first month since the property market re-opened but more balance should return in coming months.

New instructions to sell in London and Country markets were 4% ahead of the five-year average in the week to 6 June. That compared to a figure of -60% in the first full week of trading after market restrictions were lifted.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More