The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

London Most Expensive Luxury Market in New Global City Rankings

Residential News » London Edition | By Michael Gerrity | December 9, 2014 9:00 AM ET

According to a new luxury residential property report from CBRE that compares world's key global cities favored by high net worth individuals called Global Living Survey: Global Cities Compared -- the rising surge of urban living is leading to heightened demand of prime residential properties in key global cities.

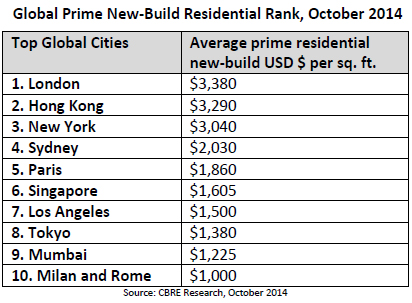

The report reveals that London leads the way in average prime residential new-build prices, which has now reached $3,380 per sq. ft., closely followed by Hong Kong and New York where the average prices are $3,290 and $3,040, respectively.

Depending on respective market trends, Hong Kong and London regularly oscillate between first and second place in the residential rankings. However, following the introduction of sales taxes in Hong Kong, transactions fell to a 17 year low last year, and as a result, prime property prices fell by 5-10% over the year.

Depending on respective market trends, Hong Kong and London regularly oscillate between first and second place in the residential rankings. However, following the introduction of sales taxes in Hong Kong, transactions fell to a 17 year low last year, and as a result, prime property prices fell by 5-10% over the year. See related story: London Enjoys Record-Setting $237 Million Penthouse Sale

In spite of this, there are signs that the Hong Kong market could be picking up. Marcos Chan, Head of Research for CBRE Hong Kong, Macau and Taiwan says that there have been price rises in the mainstream markets, reflecting strong pent-up demand buoyed by speculation of further easing from the government--including favorable stamp duty tax for first time buyers and low lending rates. "Improved sentiment related to recent capital market activity has also boosted the market," said Mr. Chan.

"The residential sector in Hong Kong remains very much under the influence of market cooling measures. This has stripped out many would-be speculative buyers, and also acted as a mild deterrent for overseas buyers, thus the mass market is now mostly led by local buyers who are upgrading," Mr. Chan adds.

With the surge in urban living and the subsequent massive upswing in population--Beijing and Kuala Lumpur's population grew by 18% and 25%, respectively--this has led to heightened demand for property. While Tokyo and Beijing managed to build an adequate level of housing, construction rates often fail to match these booms in population growth.

Elsewhere, in Bangkok, the overall condominium market was affected by the political unrest since December 2013, and with the completion of more than 100,000 condominium units in 2014 and 2015, this is a crucial test for the midtown and suburban market at a time of reduced demand.

In Vietnam, estimates suggest that around 300,000 people are looking to buy property in Ho Chi Minh City, however, supply remains focused at the high-end of the market and demand in the mass market outstrips supply. In contrast there are approximately 17,000 unsold condominiums.

Meanwhile, domestic demand is being driven by huge population growth in Sydney--the population is expected to continue to grow at 1.7% per year up to 2029, or 25% in total over this period. At 0.2% per year above previous historic levels, this puts further pressure on housing. Although there are over 26,600 apartments currently under construction across the city, this is set against a considerable back-log--the city is notably restricted by land availability through geographical limitations, zoning, planning restrictions and suitable infrastructure.

In Hong Kong, the housing demand is particularly low, with one house built per four new residents in a population of 7.2 million.

The Imbalance of Supply and Demand in Hong Kong

Private housing supply in Hong Kong for 2014 is projected to increase by around 17% year-on-year, which equates to an additional 2,270 units, compared with 2013 estimates. This would bring the total housing supply for the year to 15,820; however, this figure is still well below the government's target of 20,000 new units per year.

Even though this additional supply may have limited impact on the overall mass market prices this year, its geographic concentration is likely to have a noticeable impact at a sub-market level, with a focus on the New Territories--in particular Yuen Long, Tsuen Wan and Sha Tin--which combined will assume 40% of all new supply. Slight price movements could be reflected in these specific areas.

Whilst various stamp duty measures introduced last year were aimed to dissuade overseas buyers from the market, there is still continual interest in Hong Kong from the global elite. Jennet Siebrits, Head of Residential Research at CBRE says, "UK buyers are increasingly active in overseas markets. Those most popular locations with wealthy ex-pats include Hong Kong and Dubai."

Looking forward, CBRE expects the divergence between different segments of the Hong Kong market to continue, both in terms of sentiment and underlying dynamics. The luxury end of the market is likely to be relatively resilient, given the limitations on existing stock and future supply, whilst in the primary market, activity levels is anticipated to increase, reflecting a pick-up in supply, as well as the fact developers are still offering discounts.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More