Residential Real Estate News

Ultra Luxury Home Sales Globally Experience Slowdown in Q3

Residential News » London Edition | By Michael Gerrity | December 6, 2024 8:30 AM ET

London was sole market to enjoy a rise in $10 million+ home sales

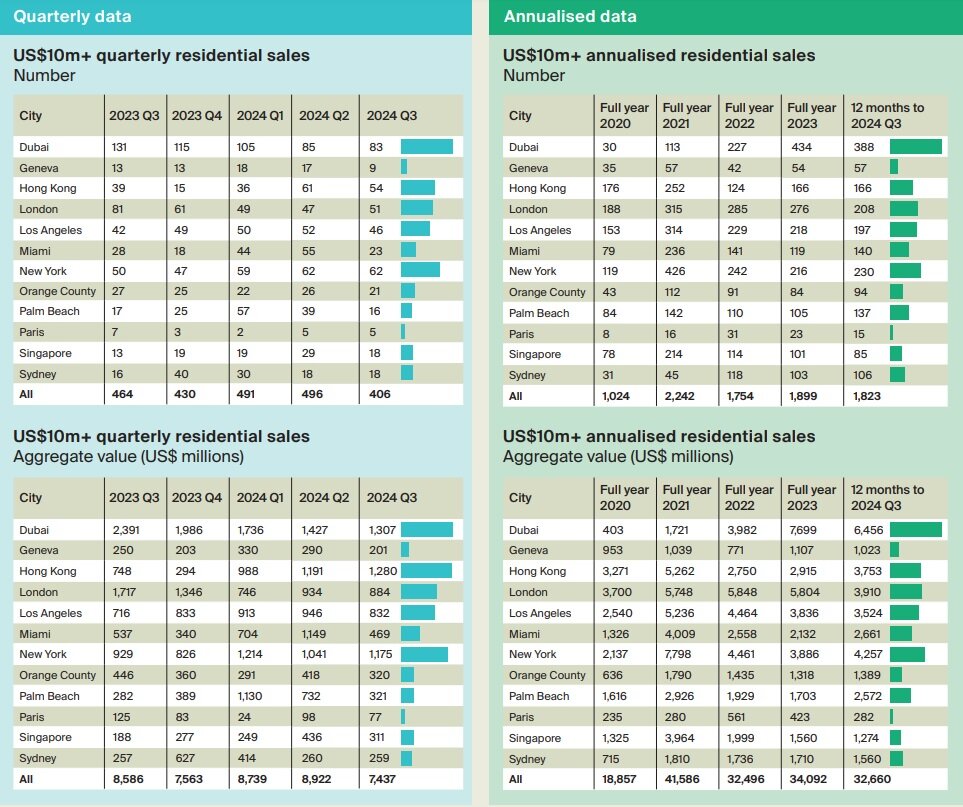

Based on Knight Frank's newly released Global Super-Prime Intelligence Report, a slowdown in luxury residential sales of properties priced over $10 million occurred across 12 major global cities during the three months leading up to September 2024. A total of 406 transactions were recorded, marking a decrease from 496 in the previous quarter and 464 during the same period last year. Uncertainty surrounding the U.S. election appeared to weigh heavily on the five American markets in the study, with none reporting a quarter-on-quarter increase. However, Los Angeles and New York City showed some year-on-year growth.

London was the sole market among the 12 cities to register a quarterly rise in $10 million+ sales. The city's 51 transactions slightly surpassed the 47 recorded in the second quarter, marking the first quarterly increase since Q3 2023. This improvement aligns with speculation that buyers were motivated to act ahead of the new Labour government's budget. Still, London remains well below its post-pandemic highs, when it averaged $1.5 billion in super-prime sales per quarter between 2021 and 2023. In contrast, 2024 has yet to see a quarter exceed $1 billion.

Dubai, as highlighted in the Prime Global Cities Index, is moving toward more sustainable growth following its pandemic-era surge. Despite recording 83 sales this quarter--well above the average since 2021--the figure reflects a nearly 40% year-on-year decline. Nevertheless, Dubai's annual performance remains strong, with sales more than tripling compared to 2021 and more than doubling compared to 2022.

In the U.S., super-prime markets showed a cautious approach, seemingly awaiting political stability post-election. Palm Beach recorded its lowest sales figures since late 2022, consistent with its seasonal peak in the first quarter. Similarly, Miami saw a sharp decline, with sales plunging nearly 60% compared to Q3 2023, a drop even steeper than usual seasonal variations.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024