Residential Real Estate News

UK Property Market Experiencing Property Listings Shortage in March

Residential News » London Edition | By WPJ Staff | May 3, 2021 8:37 AM ET

According to Knight Frank's latest OnTheMarket report, parts of the UK property market face a supply shortage. There were a quarter fewer properties listed for sale in England and Wales in March this year compared to 12 months ago.

Further Knight Frank analysis reveals how the imbalance has been caused by the pandemic rather than anything endemic.

First, the shortage is a problem facing the house rather than the flat market. The number of houses listed for sale was 33% lower over the 12-month period while the number of flats was 7% higher.

Second, it is more acute in parts of the country that have experienced stronger demand due to successive lockdowns. Among the house listings, the number was 3% down in London compared to a drop of 42% in south-west England.

So, why has it come about?

Part of the problem, says Knight Franks, relates to the first two months of this year. January and February were marked by uncertainty over new Covid variants and the vaccination programme was in its early stages. On top of that, many parents were home-schooling. All of which meant new sellers were reluctant to list their property and we are seeing the effects of that now.

When demand escalated sharply in March, supported by the original stamp duty deadline at the end of the month, the best properties sold relatively quickly.

As those properties went under offer, sellers hesitated as they were unable to find anywhere to move into themselves, exacerbating the supply shortage and putting upwards pressure on prices.

"The current supply shortage represents a bumpy exit from the pandemic and tells us very little about how the property market is going to perform over the next 12 months," said Tom Bill, head of UK residential research at Knight Frank. "The last year has shown the importance of looking beyond short-term distortions in the property market."

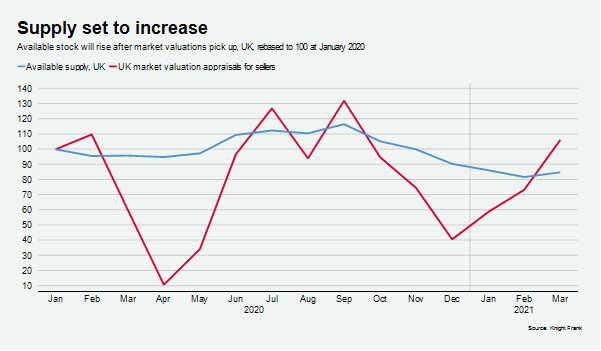

One reason to believe the imbalance will correct is that the number of market valuation appraisals is rising, as the chart below shows. Appraisals take place when owners want to know the market price of their property before listing and is a leading indicator of supply.

The number of appraisals was above the level seen in January 2020 for the first time in six months in March. Last January was marked by a pick-up in demand and supply following the general election. Total available supply also increased for the first time in six months in March although it was still 15% down on last January.

While the supply of houses fell by a quarter in the year to March, there was a 22% increase in the number of them going under offer.

If the UK wasn't emerging from a pandemic, you could argue this signalled a period of strong price inflation followed by a possible correction. However, downwards pressure on prices will return as supply increases.

In the meantime, property prices are not becoming detached from their underlying value in a meaningful way, the sign of an asset price bubble.

The market is certainly moving more quickly due to the lack of supply. The average number of days between listing and going under offer was down by a third in Q1 2021 compared to the same period last year.

However, there has been little evidence of exuberance around prices against the backdrop of the global pandemic. The number of properties that exchanged below the guide price was 68% in March this year, compared to 74% last March. The rest were at or above the asking price.

It is evidence of some short-term upwards pressure on prices but little else, concludes Knight Frank.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years