The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Student Housing a Top Performer in UK for Foreign Investors

Residential News » London Edition | By WPJ Staff | November 25, 2014 8:02 AM ET

According to The Mistoria Group, there has been a surge in student housing investment activity in the last two years, and student accommodations is certainly big business in the UK now. Last year alone saw over £2 billion of investment from UK and overseas investors in this growing property sector.

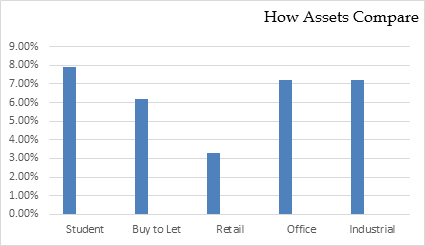

Since 2011, student accommodation has outperformed all other traditional property assets and has been the strongest growing investment property market in the UK. It has also continued to be one of the most resilient investment sectors, with rental incomes and property values remaining stable, or increasing. The attraction of the student accommodation sector has been driven by structural undersupply and positive rental growth year on, despite the economic downturn.

Since 2011, student accommodation has outperformed all other traditional property assets and has been the strongest growing investment property market in the UK. It has also continued to be one of the most resilient investment sectors, with rental incomes and property values remaining stable, or increasing. The attraction of the student accommodation sector has been driven by structural undersupply and positive rental growth year on, despite the economic downturn.The average gross cash rental yields for the student property sector in the North West of England were 13% for the first three quarters of 2014, well ahead of the 6.37%* forecast for average student property yields across the UK, for this year. (*Source: Savills Report: The UK's student housing sector, May 2014). What's more, the yields are 6-7 per cent higher on average than the buy-to-let market as a whole, which stood at 6.2%* between April and June 2014.

Mish Liyanage, Managing Director of The Mistoria Group comments, "Investing in student accommodation offers overseas investors a long-term investment option, as the property is highly likely to be in constant demand throughout the calendar year. Typical rents are significantly higher for student properties, than a comparable Buy-to-Let property in the same city.

"What's more, the domestic student population is continuing to expand, with an extra 30,000 university places offered in 2014. UCAS have reported they are expecting an all-time high of 500,000 applications this year.

"Students will pay more in the UK for high quality, well-maintained accommodation than for the traditional run down and neglected shared houses, because there really isn't a big price difference between poor and high quality accommodation. The vast majority of students want to live in high quality, shared accommodation, with good internet access and affordable bills, so the better quality properties are highly sought after.

"Whilst the number of students is rising, so are the costs of rent for student accommodation, providing investors with much higher yields. A HMO (House in Multiple Occupation) property can provide an 8% minimum cash yield, though we provide a typical 13% cash yield, including 5% capital appreciation.

"I believe it is realistic for numbers of international students in higher education to grow by 15%-20% over the next five years. There is no cap on the number of students who can come to study in the UK and the structural undersupply will continue to remain in all key university cities ensuring excellent sustainable rental growth."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More