The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

UK Office and Retail Sectors: A Tale of Two Markets

Commercial News » London Edition | By Michael Gerrity | June 19, 2015 9:04 AM ET

According to international real estate consultancy Knight Frank, the recovery for UK's commercial property is again turning multi-speed, with office and retail sectors living in different worlds.

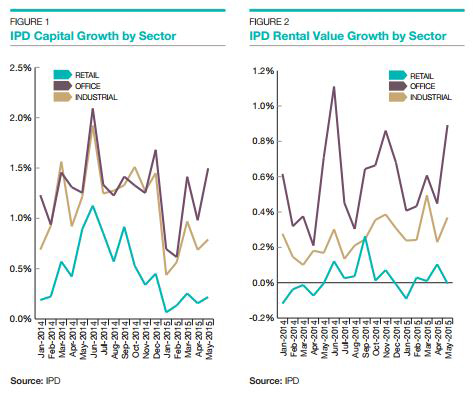

The winter and early spring were a time of deceleration for commercial property, following the heady capital growth seen in 2014. While in May IPD's capital growth index gained momentum, the improvement was not evenly spread across the sectors. As chart one shows, offices surged ahead, industrial achieved a less dramatic increase, and retail barely saw any improvement.

Why the disparity?

Industrial in recent years has enjoyed a fillip in the occupier and investment market from the rise e-commerce, but that is not 'news' any more. Possibly investors now view the internet effect as priced in, taking some of the heat out of the market.

This is perhaps a healthy downwards gear change, especially as the internet is no longer expanding its market share in retail as aggressively as a few years ago. In 2000 the office market became overheated in London and the South East, as property investors and developers overestimated the growth prospects of tech firms. Hopefully what we are seeing is a soft landing for industrial following its e-commerce boom of recent years.

This is perhaps a healthy downwards gear change, especially as the internet is no longer expanding its market share in retail as aggressively as a few years ago. In 2000 the office market became overheated in London and the South East, as property investors and developers overestimated the growth prospects of tech firms. Hopefully what we are seeing is a soft landing for industrial following its e-commerce boom of recent years.Explaining retail property's under performance is, however, getting harder. After all, the UK retail sales figures have been robust for some time, and the consumer has done much to support GDP growth by compensating for sluggish export demand and a retrenching government. Plus, there are the new occupier groups and shopping formats that have emerged to meet changing consumer trends, such as cafés, mini supermarkets, and click-and collect. These should be compensating for problems elsewhere in the sector.

Perhaps the explanation is to be found in leasing market fundamentals?

So far this year the UK shop vacancy rate has hovered around the 13% mark according to Local Data Company. This is in marked contrast to the steady decline in vacancy rates in many UK office markets, particularly in London and the South East where levels are in most cases lower than in 2007.

These dynamics are shaping rental growth, which is reasserting itself significantly in the office market, and barely in existence for retail. Admittedly, the rental growth for London and the South East is the driving force behind the IPD office figures, but there are signs this is spreading to the major regional city centres.

Consequently, rather than investors are missing a trick, it appears the weaker capital growth for retail is underpinned by leasing market fundamentals. Supply remains stuck at an elevated level, and probably dependent upon there being far less new development to bring stock in line with demand, unless some new occupier group appears that energizes the sector in the future.

In contrast, the rate of rental growth now being experienced by offices deserves special mention. Rental growth for IPD offices peaked at 8.6% (on a 12 month basis) in August 2007. Today the figure stands at 7.8% and rising, and London will power the IPD offices figure through that previous peak by the end of the year - in Victoria the vacancy rate is just 2.4%.

The development pipeline in London has been slow to respond to the pick-up in office demand, perhaps due to the general election, which is pushing up rents. In the financial sector in particular, occupiers are reviewing which business functions need to be in the capital, and other UK cities are starting to benefit. Investors may take the view that there are plenty of further opportunities to explore in the outperforming office sector before revisiting the more embattled parts of retail.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More