The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

EMEA Property Investment Forecasted to Spike 20 Percent in 2015

Commercial News » United Kingdom Edition | By Michael Gerrity | December 22, 2014 9:50 AM ET

According to Cushman and Wakefield, Europe, Middle East and Africa (EMEA) will enjoy a significant increase of property investment activity in 2015.

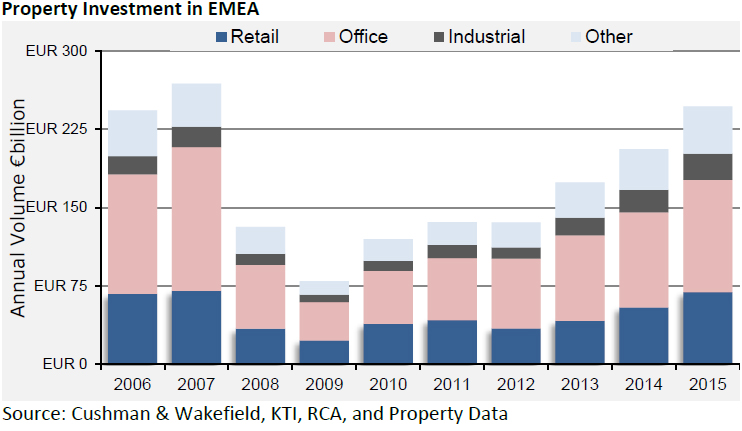

Investment volumes in EMEA are forecast to increase 20 percent next year to â¬247 billion ($300B USD) from an estimated â¬206 billion ($250B USD) this year. Demand is already strong but with fund allocations still increasing, occupational markets stirring in many cities and finance markets growing more competitive, markets will be even more liquid in 2015. What is more, short-term concerns such as stock market volatility, fears of deflation and limited economic growth could all point to yet stronger demand for property due to its relative yield and risk profile. Retail and logistics will win further market share but quality property in all sectors will be in demand and a notable increase in the appetite for development is to be expected, focusing initially on core office markets in the region.

Cushman & Wakefield further reports:

- The boost to liquidity to be provided by quantitative easing (QE) as well as the aftermath of the ECB bank stress tests - which both removes a constraint on the market from this year and paves the way for more sales as banks take action- could produce conditions for significantly stronger activity.

- Alongside loan and asset sales and deleveraging, profit taking and some new development should help to boost the range of investment opportunities available in the market. Interest in a broader range of markets and sectors should also continue and while some investors are being driven to this by necessity just to find opportunities, others are actively seeking to embrace more risk in pursuit of higher returns. Hence, while demand at the core end of the market will remain very significant, an increased focus on core-plus and value add opportunities is to be expected.

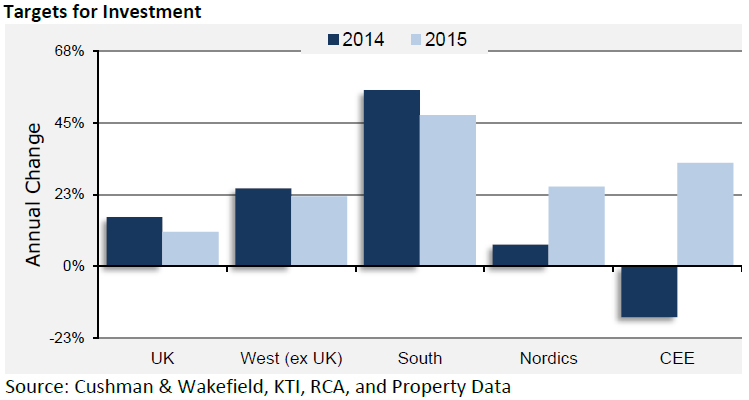

- Southern markets, notably Spain, led the upturn this year with volumes up an estimated 55%. This will continue in 2015, with forecast growth of 45-50%. Other areas more over-looked in 2014 should see better demand however, with the Nordics up a forecast 25% after a 7% increase this year thanks to their strong appeal as markets of low structural risk but also good relative growth prospects. CEE markets are also expected to bounce back, rising 30-35% after a 15-20% fall this year. Russia and some non-EU eastern markets may be held back by events in the Ukraine as well as commodity prices and general emerging market uncertainty. However, Central Europe is a different and more promising short-term prospect and other eastern markets within the EU may see stronger interest where the right stock is available. In Western markets meanwhile, we currently forecast growth of 15%, modestly down on the 20% increase seen this year reflecting the fact that these markets have already seen a fuller recovery.

- With strong competition to buy, prices are set to carry on rising, with prime yields forecast to fall 25-50bp over the year to an average across the sectors of 5.6% in larger cities.

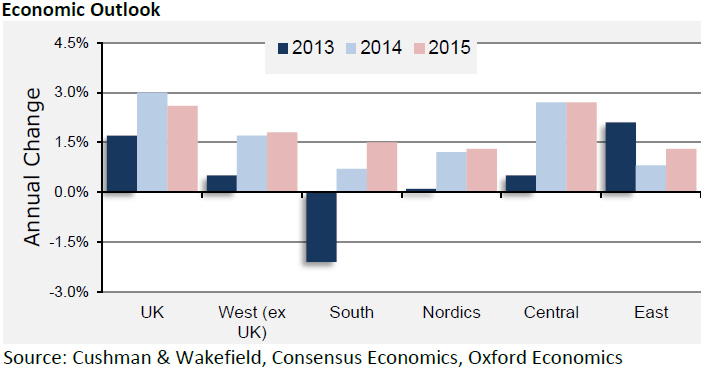

- Ongoing uncertainty, geopolitical risks and deflation will hold back growth but a slow if hesitant recovery is nonetheless continuing and 2015 should in general be a better year than 2014. For one thing, domestic demand in most of Europe should be boosted by improving purchasing power thanks to lower inflation and firmer Labour markets. At the same time, the fall in the euro and lower input prices should help production. The credit cycle also appears to have bottomed, with increasing bank lending and money supply pointing to a firming in conditions.

- Inflation will fall further thanks to tumbling energy prices and this will keep the spotlight on deflation despite the short-term benefits it brings to households and producers. This should slow the pace at which monetary policy normalizes and indeed prompt further easing in the Eurozone. With investment markets already some way ahead of occupier cycles this clearly brings the risk of a bubble but with liquidity so supportive, this will only be clear after 2015.

- Occupational trends in many markets are supply driven but needs are changing thanks to new technology and new living, working and shopping patterns and this will be a key driver of demand across all European markets.

- While low and volatile economic growth will keep businesses focused on affordability, demand for efficient space will start to push rents up and lower commodity prices may make this process easier if build costs ease. Led by Western markets, prime rents are expected to grow 2-3% in 2015 with good growth for dominant high streets and shopping centres although offices may lead over the cycle against a backdrop of limited new supply. Better than historic industrial performance is forecast as ecommerce raises the role of logistics but a risk of secondary market underperformance will persist in all sectors.

- ith improving supply and demand and increased liquidity courtesy of QE, Europe will continue to attract more than its fair share of global investment, albeit this may grow at a somewhat slower pace than in 2014 while domestic and regional spending will increase as fund allocations are raised. Overall, cross border investment is forecast to rise 30% versus 15% for domestic spending, with global investment up 30-35% and regional buying up by 20%.

According to Jan Willem Bastijn, head of EMEA Capital Markets for Cushman & Wakefield, "Our estimates for the market continue to be pushed higher as both the supply and the demand outlook improve. With volatile stock markets and rising liquidity boosted by quantitative easing, the push to demand is already evident and the boost to supply will come from deleveraging banks and businesses as well as profit taking and, in our opinion, a more notable pick up in development.

"Our central forecast is a 20% increase to nearly â¬250 billion - potentially making 2015 the second best year ever for volumes and just 8% down on the pre-crisis peak. However with the scale of liquidity we're now seeing, that could easily be beaten and the market will be setting a new all-time high by 2016 at the latest.

"The global focus on Europe of the last 1-2 years is expected to slowly reduce as other areas demonstrate stronger economic growth, a higher level of investor risk tolerance is sustained and an unwinding of quantitative easing reduces global liquidity. Parts of Asia and the USA in particular are like to attract more EMEA investment. Short term however, increased QE in the Eurozone as well as a greater supply of opportunities in Europe as banks and companies restructure and deleverage, will serve to keep the eye of the world on Europe for longer than expected."

David Hutchings, Head of EMEA Investment Strategy at Cushman & Wakefield says, "The risks in today's market are hard to judge - some in fact are hardly visible at present and others will bubble up, particularly perhaps in the political sphere this year. As a result, it's all about the lease for many investors and they need to make sure their strategy is as future-proofed as it can be - and that means focusing on property that meets occupiers needs and is flexible to change. Only the best property can be well placed to ride out a period of inflation or disinflation.

"Investors also need to expand further their scope of investment to take in new markets and new sectors and 2015 should mark a further move into areas such as multifamily residential and healthcare as erstwhile "alternative" sectors start to go mainstream.

"While a bubble may form further out driven by bond markets and excess liquidity, for 2015, bond yields look likely to stay low, putting further pressure on property yields in the process. Pricing will adjust anyway to the new reality of the market in which liquidity and income sustainability should be more highly rewarded in their price than they have been in the past and it will be those markets where income sustainability and security are below average that will be most subject to the bubble risk. "

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More