Commercial Real Estate News

U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

Commercial News » Atlanta Edition | By WPJ Staff | April 17, 2025 6:30 AM ET

According to recent data from CBRE, underwriting assumptions for core U.S. multifamily assets showed improvement in Q1 of 2025, while those for value-add assets saw a slight decline. Sentiment from both buyers and sellers grew more positive for both core and value-add assets, despite the Federal Reserve signaling a slower pace of interest rate cuts this year as it waits for clearer direction on policy shifts under the Trump administration.

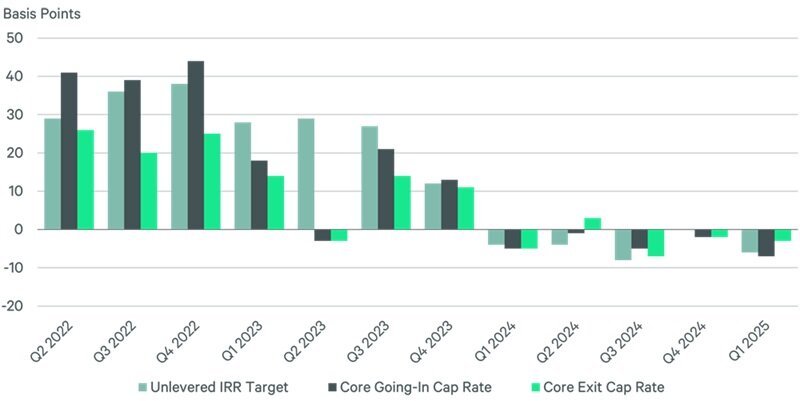

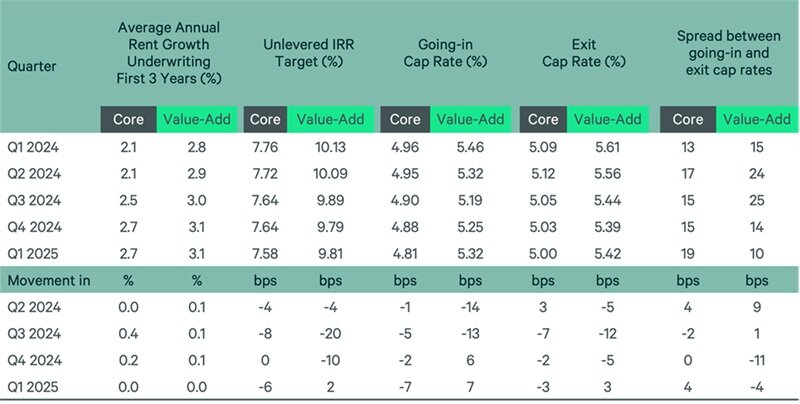

In Q1, the average core multifamily going-in cap rate decreased by 6 basis points (bps) to 4.83%, while the average exit cap rate dropped by 3 bps to 5.00%. Core unlevered internal rate of return (IRR) targets fell by 6 bps to 7.58%. These core underwriting metrics are now aligned with mid-2023 levels. The spread between going-in and exit cap rates for core assets widened to 19 bps in Q1. This gap is expected to expand further over the next two years, as going-in cap rates compress more than exit cap rates due to ongoing rate cuts by the Fed.

In CBRE's quarterly Multifamily Underwriting Survey, 16 out of 19 tracked markets showed stable IRR targets for core assets in Q1. Three markets--Los Angeles, Miami, and Washington, D.C.--saw a decrease in their core-asset IRR targets, and for the first time in three years, no markets reported an increase.

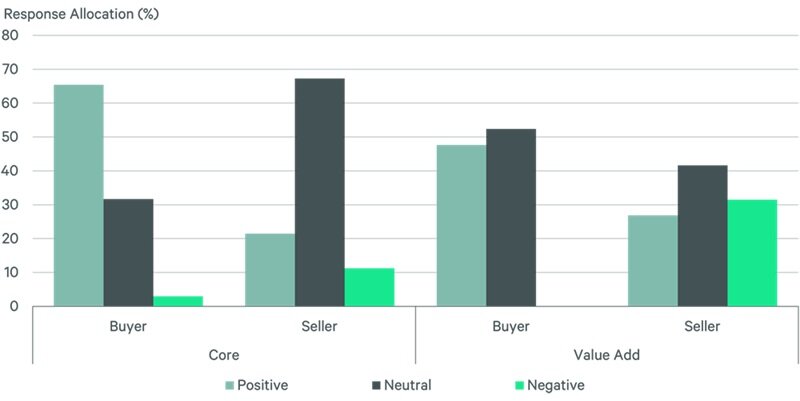

Core-asset buyer sentiment surged to 65% positive in Q1, up from 44% in Q4 2024. Core-asset seller sentiment also improved, with 67% of sellers adopting a neutral stance, compared to 57% in Q4 2024. Value-add buyers showed slight improvement in sentiment, while value-add sellers experienced a shift toward greater neutral sentiment. Overall, sentiment improvements were most pronounced in the Sun Belt across all property types, with San Francisco showing positive sentiment for core assets.

Underwriting assumptions for annual asking rent growth remained steady at 2.7% for core assets and 3.1% for value-add assets over the next three years. This stability aligns with a recovery in rent growth following a significant wave of new supply in many tracked markets.

For value-add assets, the going-in cap rate rose by 7 bps to 5.32%, and the exit cap rate increased by 3 bps to 5.42%. Unlike core assets, whose spread between going-in and exit cap rates expanded in Q1, the spread for value-add assets narrowed by 10 bps for the second consecutive quarter. Unlevered IRR targets for value-add assets increased by 2 bps to 9.81%.

Seven markets saw a decrease in going-in cap rates for core assets (Atlanta, Chicago, Houston, Los Angeles, Nashville, San Francisco, and Washington, D.C.), while Indianapolis experienced a slight increase. None of the markets saw changes of more than 25 bps in either direction. For value-add assets, two markets--Austin and Miami--saw lower going-in cap rates in Q1 compared to Q4, while four markets saw higher rates.

Despite slight weakening in overall value-add underwriting metrics, both buyer and seller sentiment improved across core and value-add assets in Q1. This positive shift occurred even as the market awaits more clarity on the Trump administration's policy changes. Looking ahead, we expect continued momentum in the multifamily sector as investors seek to capitalize on improving market fundamentals, particularly in the core segment.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.