Commercial Real Estate News

North American Multifamily Market Begins to Stabilize in Q1

Commercial News » Atlanta Edition | By WPJ Staff | May 3, 2023 8:25 AM ET

Based on CBRE's latest research, the U.S. multifamily sector is beginning to stabilize as vacancy rate expansion and negative absorption ease -- trends that are expected to continue in 2023.

The overall multifamily vacancy rate increased by 30 basis points (bps) quarter-over-quarter in Q1 2023 to 4.9%. This was less than the 70-bps increase in Q4 2022 and the 90-bps jump in Q2 2022.

Negative net absorption of 1,900 units in Q1 2023 marked an improvement from the previous quarter's negative 14,000 units, and CBRE expects that absorption will turn positive in Q2 2023.

"The multifamily sector has been in search of stability after experiencing two significant shifts. First, the Fed began raising interest rates rapidly and then multifamily fundamentals abruptly changed course as supply growth began to outstrip demand. The good news is that the data over the past six months suggests the market is stabilizing," said Matt Vance, Americas Head of Multifamily Research for CBRE. "Vacancy is still climbing, but much less quickly as demand regains its footing."

The average monthly net effective rent increased by 4.5% year-over-year in Q1 2023, down significantly from the record 15.3% increase in Q1 2022, but well above the pre-pandemic, five-year average of 2.7%.

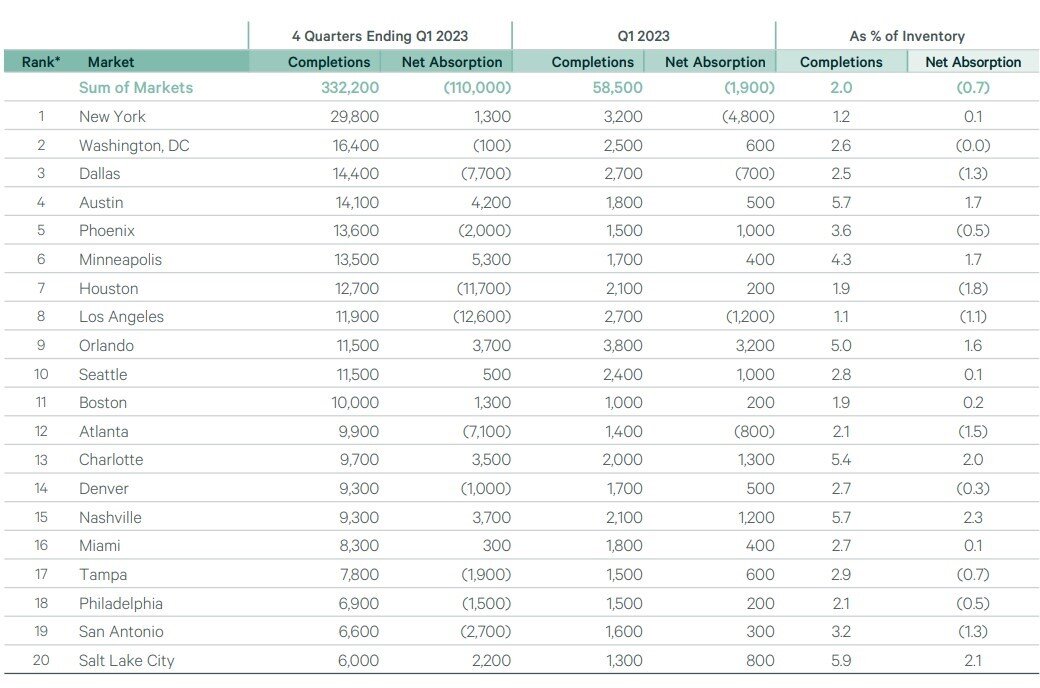

New construction deliveries of 58,600 units in Q1 2023 brought the four-quarter total to 332,200--slightly lower than the annual total of 343,300 in 2022. Construction timelines remain elevated and should help smooth out the delivery of the significant pipeline of new products underway.

Q1 2023 Multifamily Sector Highlights:

- The Northeast/Mid-Atlantic and Midwest regions supplanted the Southeast for the highest year-over-year rent growth in Q1 2023. The Northeast/Mid-Atlantic region led with 5.7% growth in Q1, driven by Newark (7.1%), New York (6.4%) and Hartford (6.0%). The Midwest region experienced year-over-year rent growth of 5.4%, followed by the Southeast (4.9%), South-Central (4.2%), Pacific (3.6%) and the Mountain West (1.4%).

- Slightly more than half (35) of the 69 markets tracked by CBRE recorded positive net absorption in Q1 2023, led by Orlando (3,200 units), Charlotte (1,300) and Nashville (1,200).

- The top five markets for new deliveries over the past four quarters (New York, Washington, D.C., Dallas, Austin and Phoenix) accounted for 26.5% of the national total.

- Nearly all (66 of 69) of the markets tracked by CBRE had vacancy rates at or above 3.0% and 57 had vacancy rates above 4.0%. New York remained the large market with the lowest vacancy rate at just 2.9%, well below its historical average of 3.5%.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.