Residential Real Estate News

New Apartments in U.S. Are Leasing at Slowest Pace on Record

Residential News » Atlanta Edition | By WPJ Staff | March 10, 2025 8:43 AM ET

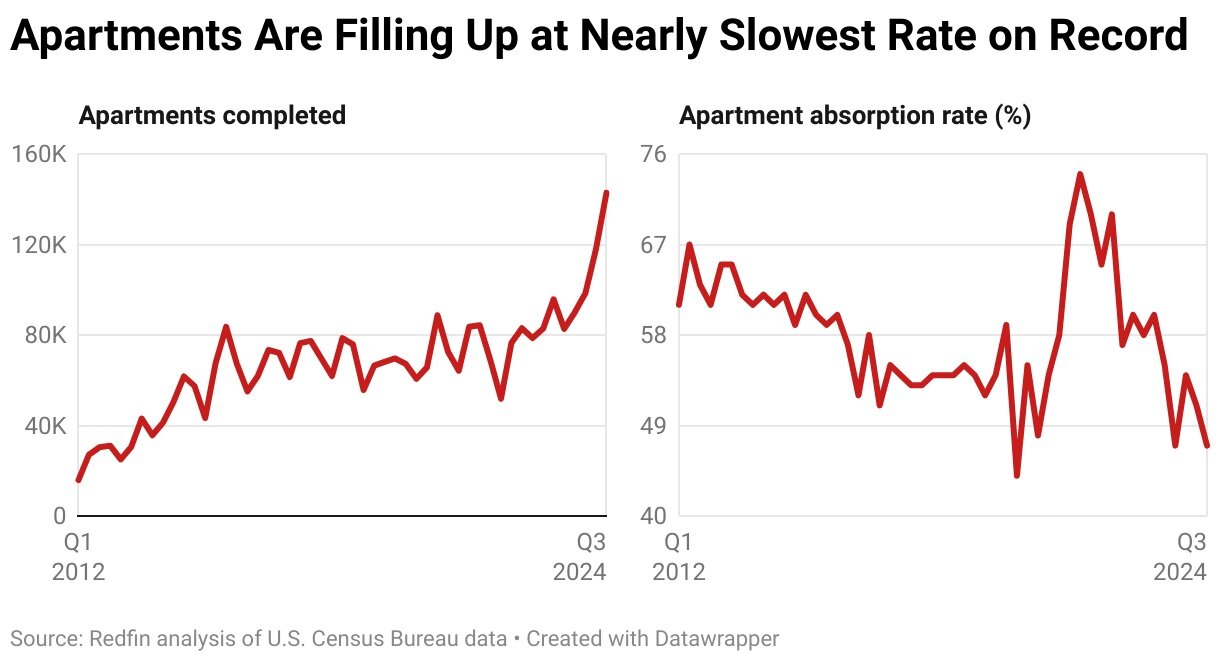

New data from Redfin reveals that less than half (47%) of newly built apartments completed in Q3 2024 were rented within three months. This matches Q4 2023 for the lowest absorption rate on record, aside from the early pandemic period.

Redfin's analysis is based on the U.S. Census Bureau's seasonally adjusted absorption rate data for unfurnished, unsubsidized, privately financed rental apartments in buildings with five or more units, dating back to 2012. The latest available data tracks apartments completed in Q3 2024 and whether they were rented within three months.

The slow leasing pace is due to the sheer volume of options available--142,900 new apartments were completed in Q3, the highest number on record.

"Some landlords are cutting prices and offering perks like free parking to attract tenants, but renters should be aware that these incentives might not last," said Redfin Senior Economist Sheharyar Bokhari. "Developers are pulling back, with apartment construction permits down nearly 10% year over year. As a result, renters will eventually have fewer choices, which could push landlords to raise rents--though that may not happen until next year, as many apartments built during the pandemic are still hitting the market."

During the pandemic, surging demand led to record-fast apartment absorption and soaring rents. In response, developers ramped up construction, which has since contributed to higher vacancy rates and lower rents. By the end of 2024, the rental vacancy rate for buildings with five or more units had climbed to 8.2%, the highest since early 2021. The median U.S. asking rent now stands at $1,607--up 0.4% year over year but about $100 below its peak. While rent declines have slowed compared to 2023, current rent growth is far from the double-digit increases seen during the pandemic.

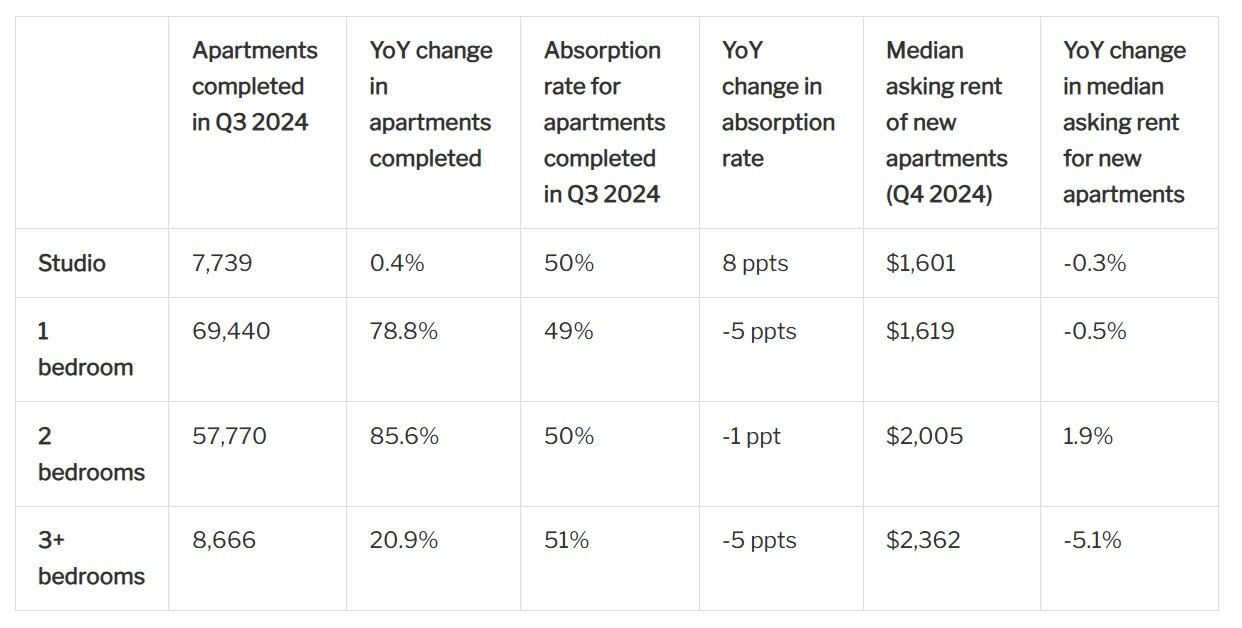

Absorption rates for apartments completed in Q3 were relatively uniform across unit types, hovering around 50%. However, studio apartments bucked the trend, with 50% rented within three months--up from 42% a year earlier. In contrast, absorption rates fell for other unit types:

- 1-bedroom apartments: 49%, down from 54%

- 2-bedroom apartments: 50%, down from 51%

- 3+-bedroom apartments: 51%, down from 56%

The resilience of the studio apartment market may stem from limited supply--while completions of all other unit types saw double-digit increases in Q3, studio completions edged up by just 0.4%.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

- Meet HAL, Real Estate Agent of the Future

- U.S. Homes Are Selling at Slowest Pace in 5 Years in Early 2025

- Pending Home Sales Dive Across America in December

- Greater Miami Residential Sales Uptick 3 Percent Annually in 2024

- U.S. Mortgage Applications Downtick in late January

- Under Biden, 2024 Marked the Slowest U.S. Home Sales Period in 30 Years

- Single-family Rent Growth in U.S. Slows to Lowest Rate in 14 Years

- Housing Starts Spike 15 Percent in America in Late 2024

- Day One: Trump Issues Executive Order on Emergency Price Relief for U.S. Housing

- 89 Percent of Homes Destroyed by Los Angeles Fires Were Single-Family Residences

- New AI-Powered Global Listings Service Under Construction

- World Property Media to Commence Industry Funding Round to Launch WPC TV

- Mortgage Rates in America Above 7 Percent, Again

- U.S. Residential Foreclosures Dip 10 Percent Annually in 2024

- U.S. Residential Asking Rents End 2024 at Lowest Levels in 3 Years

- World Property Markets to Commence Industry-wide Joint Venture Fundraise

- One Third of U.S. Homeowners Say They Will Never Sell

- Catastrophic Wildfires Devastating Tens of Billions of Dollars of Southern California Properties

- Is Greenland Soon Going to be Trump's Biggest Real Estate Deal?

- Greater Las Vegas Home Sales Jump 19 Percent Annually in December

- Active U.S. Residential Listings Spike 22 Percent in December

- U.S. Mortgage Rates Rise in Early 2025, Reach 6-Month High

- Greater Palm Beach Area Condo, Home Sales Collapse in November

- U.S. Pending Home Sales Increase Four Straight Months in November