The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Growing E-Commerce Sales Drives Warehouse Leasing in U.S.

Commercial News » Dallas Edition | By Michael Gerrity | January 26, 2021 8:00 AM ET

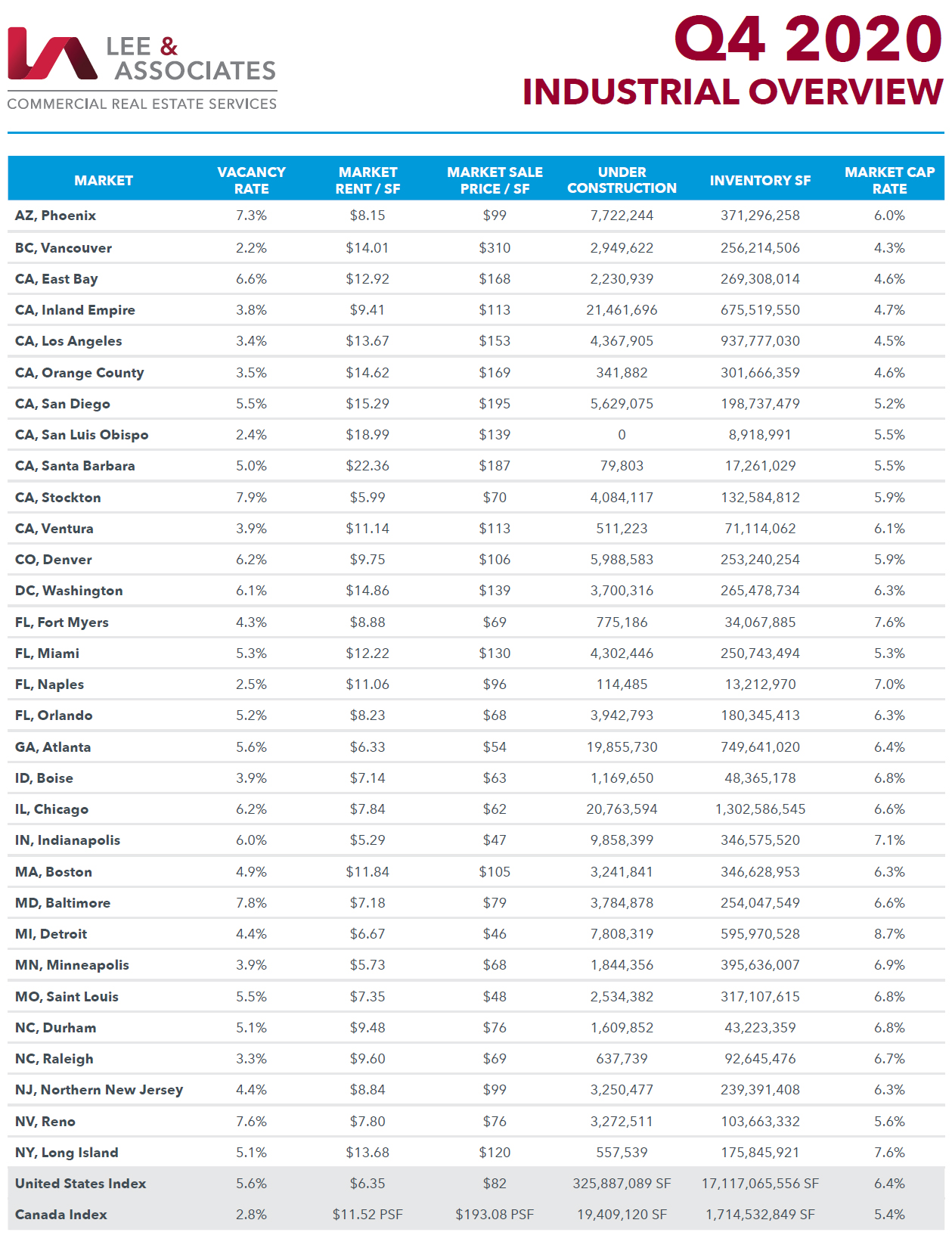

According to commercial property consultant Lee & Associates -- driven by pandemic-fueled e-commerce sales -- 2020 tenant expansion outpaced last year's total after a fourth-quarter surge in demand by companies seeking additional warehouse and distribution space to improve supply-chain efficiencies.

There was a net 99.2 million SF of industrial space absorbed in Q4 - the strongest quarter on record - and 203.7 million SF absorbed for the year, a 27% increase over 2019's net growth. An array of evidence supports the consensus that the lockdown was an accelerant that gave several trends in commercial real estate a push.

Despite damage to the labor market, national and world economies, companies positioned for e-commerce have won a dramatically increased share of total sales. Consequently, skyrocketing online sales have intensified already-strong demand in key markets for big-box and last-mile distribution facilities.

Lee & Associates further reports record-setting inbound cargo is straining U.S. ports, and officials nationwide are steaming ahead with expansion plans. As the year ended, dozens of container ships were anchored off the Los Angeles-Long Beach port complex waiting weeks for berths and with more ships arriving daily. Amazon's growth represents 10% of all leasing volume, but Target, Walmart and a number of major general merchandisers were stepping up their leasing activity along with Home Depot and others in the home improvement sector. Radial, a competitor to Amazon, leased a 760,000-SF building southwest of Atlanta.

Amazon, however, is planning development of a multi-story facility of some 3.8 million SF in Pflugerville, Texas. The industrial market's strength has not escaped the notice of developers as more than 330 million SF are under construction, a record, with 93 million SF getting underway in Q3. Since deliveries will slightly exceed current demand, the national vacancy rate will tick upward to more than 6% for most of 2021. About 180 million SF are slated for delivery in the first half of 2021. Major national distribution markets Dallas-Fort Worth, Atlanta, Lehigh Valley, PA, San Antonio, Austin, Phoenix and Southern California's Inland Empire counties of Riverside and San Bernardino have led the way in net absorption, says Lee & Associates.

Unlike leasing volume, sales remain below the record levels seen in late 2019 through the first quarter. Institutional investors as well as REITs and other public buyers, which continue to be attracted by the sector's strong performance, emerged as the only net buyers through the third quarter. Although private equity investors also were active through the summer months, private buyers and owner/users have been net sellers throughout the year. Transaction volume increased 30% in the third from Q2, reaching $17 billion. Industrial's strong fundamentals notwithstanding, cap rates are expected to trend upward, and pricing momentum is anticipated to downshift from its prior year annual pace of 5% as investors and lenders grow more cautious and risk premiums widen.

There was a net 99.2 million SF of industrial space absorbed in Q4 - the strongest quarter on record - and 203.7 million SF absorbed for the year, a 27% increase over 2019's net growth. An array of evidence supports the consensus that the lockdown was an accelerant that gave several trends in commercial real estate a push.

Despite damage to the labor market, national and world economies, companies positioned for e-commerce have won a dramatically increased share of total sales. Consequently, skyrocketing online sales have intensified already-strong demand in key markets for big-box and last-mile distribution facilities.

Lee & Associates further reports record-setting inbound cargo is straining U.S. ports, and officials nationwide are steaming ahead with expansion plans. As the year ended, dozens of container ships were anchored off the Los Angeles-Long Beach port complex waiting weeks for berths and with more ships arriving daily. Amazon's growth represents 10% of all leasing volume, but Target, Walmart and a number of major general merchandisers were stepping up their leasing activity along with Home Depot and others in the home improvement sector. Radial, a competitor to Amazon, leased a 760,000-SF building southwest of Atlanta.

Amazon, however, is planning development of a multi-story facility of some 3.8 million SF in Pflugerville, Texas. The industrial market's strength has not escaped the notice of developers as more than 330 million SF are under construction, a record, with 93 million SF getting underway in Q3. Since deliveries will slightly exceed current demand, the national vacancy rate will tick upward to more than 6% for most of 2021. About 180 million SF are slated for delivery in the first half of 2021. Major national distribution markets Dallas-Fort Worth, Atlanta, Lehigh Valley, PA, San Antonio, Austin, Phoenix and Southern California's Inland Empire counties of Riverside and San Bernardino have led the way in net absorption, says Lee & Associates.

Unlike leasing volume, sales remain below the record levels seen in late 2019 through the first quarter. Institutional investors as well as REITs and other public buyers, which continue to be attracted by the sector's strong performance, emerged as the only net buyers through the third quarter. Although private equity investors also were active through the summer months, private buyers and owner/users have been net sellers throughout the year. Transaction volume increased 30% in the third from Q2, reaching $17 billion. Industrial's strong fundamentals notwithstanding, cap rates are expected to trend upward, and pricing momentum is anticipated to downshift from its prior year annual pace of 5% as investors and lenders grow more cautious and risk premiums widen.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More