Commercial Real Estate News

Record Warehouse Development Driven by Aging U.S. Inventory

Commercial News » Dallas Edition | By Michael Gerrity | September 28, 2022 8:00 AM ET

According to CBRE research, the 43-year average age of existing U.S. warehouse inventory--nearly 28% or 3.4 billion sq. ft. of which is more than 50 years old and at risk of functional obsolescence--justifies the nation's record 627 million sq. ft. of new warehouse space currently under construction. Nevertheless, this older, largely urban-infill inventory is more than 95% occupied, mainly by local or regional logistics operators that highly value proximity to customers and labor more than functionality.

Major e-commerce and retail distributors, on the other hand, require highly functional modern facilities to process a high volume of goods every day. Demand from these occupiers alone more than justifies the record level of new development.

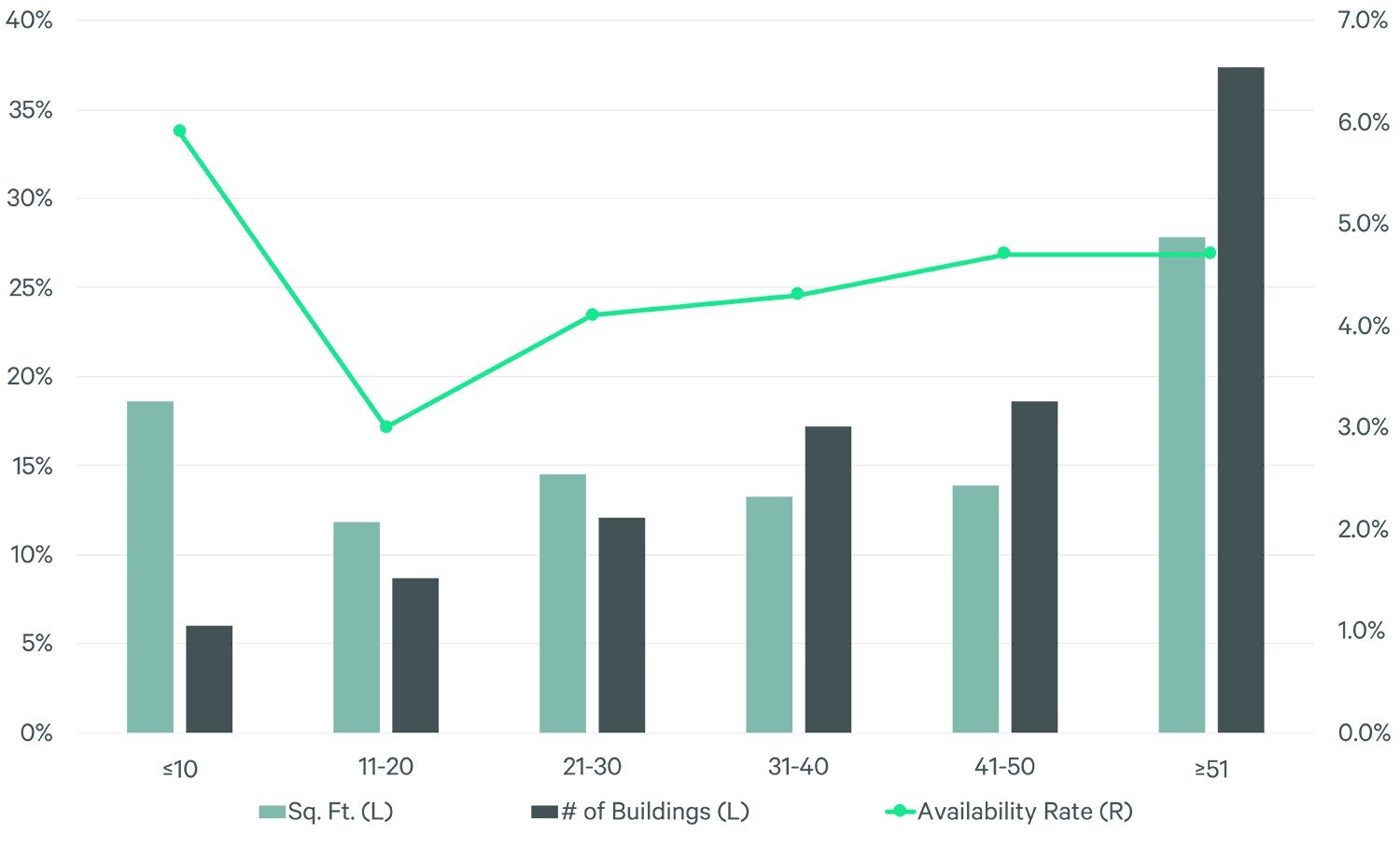

Only 6% of total U.S. warehouse buildings have been built within the past 10 years, yet they account for 18.6% of total inventory by square footage due to a more than 25% increase in average size. Large occupiers generally demand big-box facilities of at least 200,000 sq. ft. to serve a growing online consumer base, hold more inventory and accommodate voluminous distribution operations near ports of entry and manufacturers.

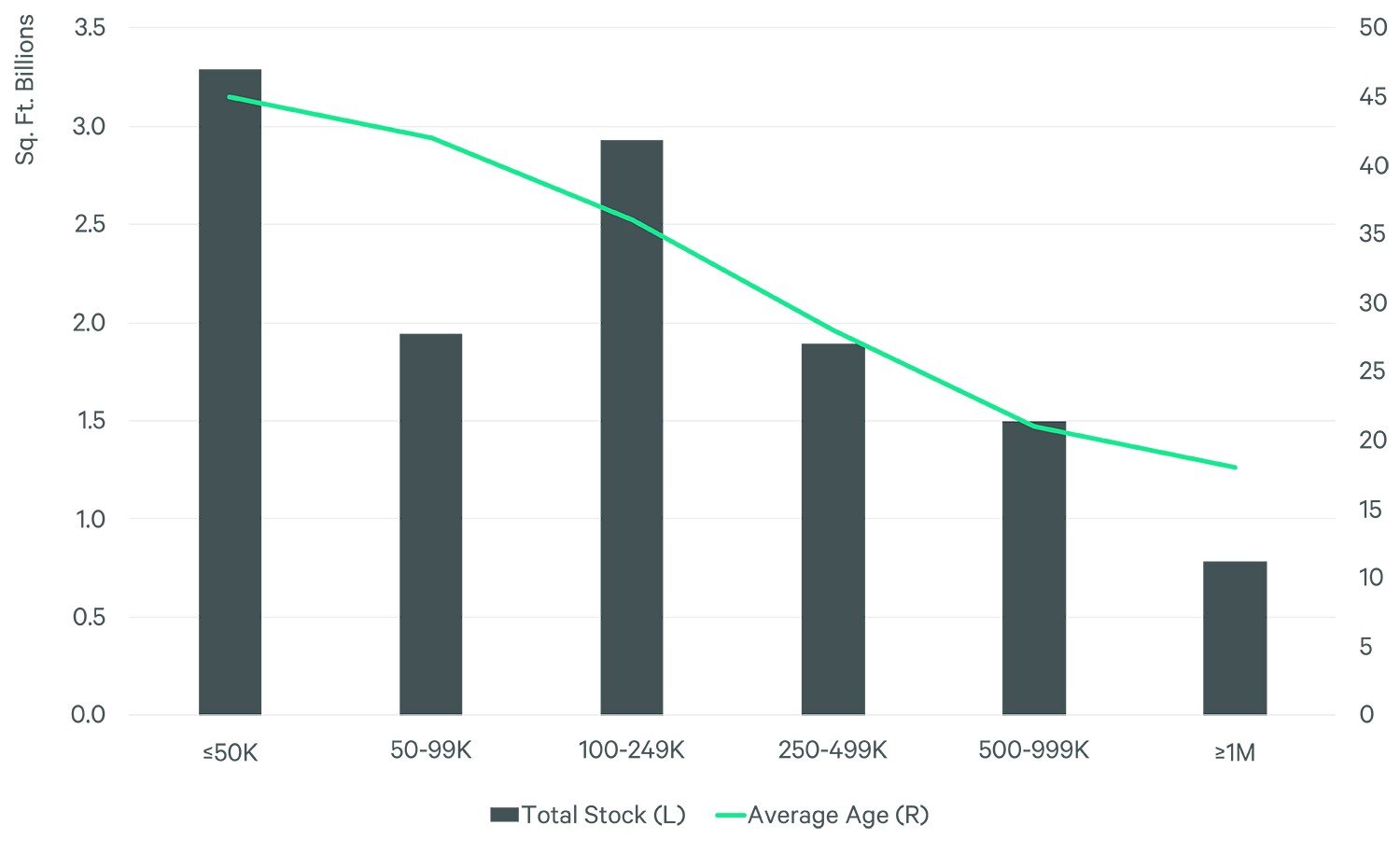

The average age of U.S. warehouse inventory ranges from 18 years for the largest segment (1 million sq. ft. or more per building) to 45 years for the smallest segment (less than 50,000 sq. ft. per building). Smaller buildings are typically in urban-infill locations with higher land values and higher barriers to entry, making it difficult to add new inventory.

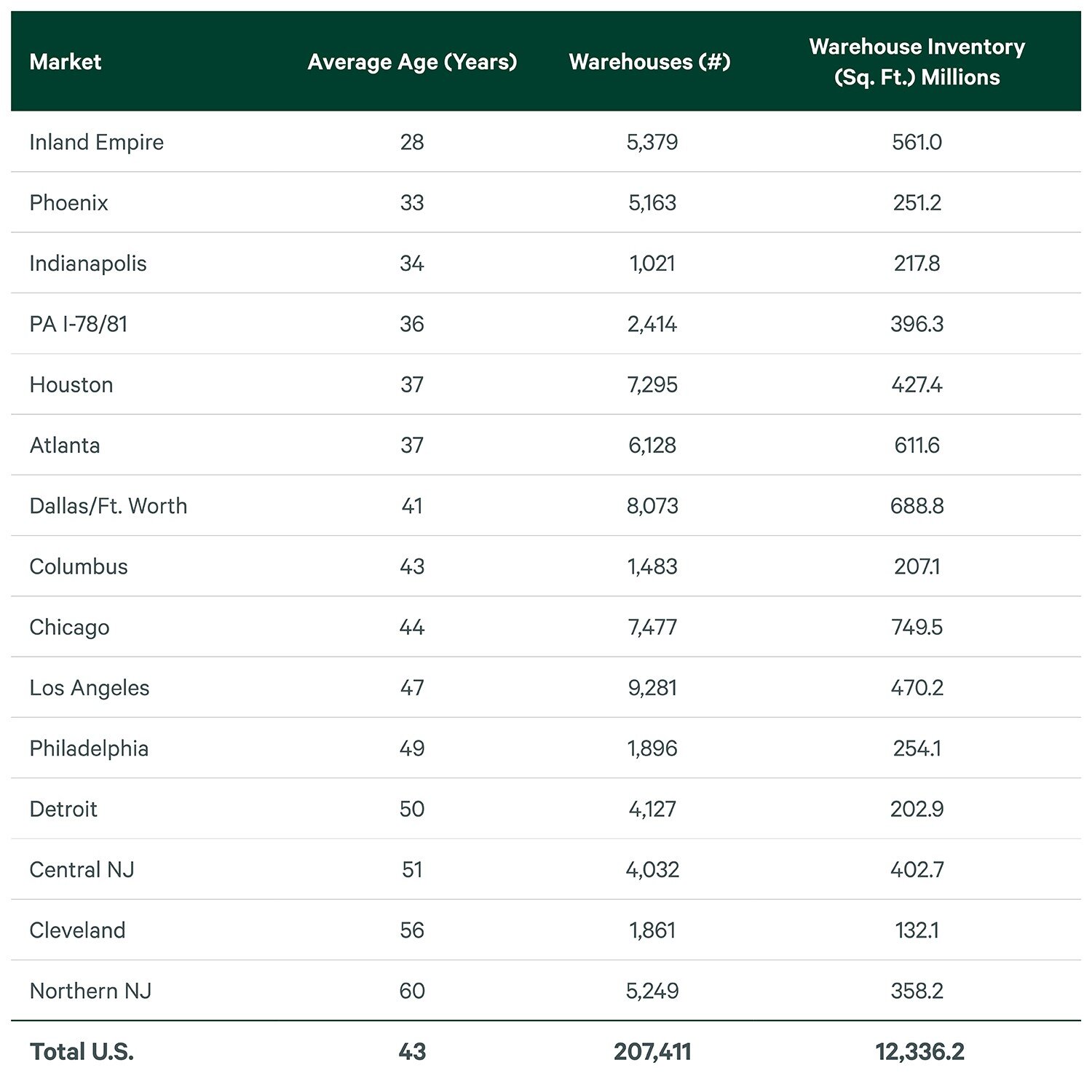

Markets with the newest inventory--the Inland Empire, Phoenix, Indianapolis, PA I-78/I-81 Corridor and Houston--have an average building age of between 28 and 37 years. This makes these major industrial hubs highly desirable for the biggest logistics operators and retailers. Sixteen percent of the total warehouse buildings in these markets was delivered within the past 10 years, more than double the national average.

Markets with the oldest inventory--Northern and Central New Jersey, Cleveland, Detroit, Philadelphia and Los Angeles--have an average building age of between 47 and 60 years. Given the continued growth of e-commerce and retailer omnichannel offerings, warehouses approaching obsolescence in these markets will present opportunities for redevelopment, particularly in infill locations that support last-mile delivery.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.