Commercial Real Estate News

U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

Commercial News » Dallas Edition | By Michael Gerrity | September 8, 2023 7:36 AM ET

According to new research by CBRE, demand for data center space overshadowed economic uncertainty and concerns around power availability in the first half of the year. Construction of North American data centers is at an all-time high in part due to the continued growth of artificial intelligence.

CBRE's latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased. At the same time last year, there was 1,830.3 MW under construction. Companies are leasing space up to 36 months in advance of construction completion in anticipation of future demand and to secure data center space at current pricing.

"Data center construction is at an all-time high, driven by strong demand from all users, including AI, hyperscale and enterprise," said Pat Lynch, executive managing director for CBRE's Data Centers Solution. "New and existing uses of artificial intelligence cases grew tremendously in the first half of the year, and we expect demand to remain strong with AI driving leasing opportunities in the second half of the year."

Absorption in the eight primary U.S. data center markets remained resilient in H1 2023, totaling 468.8 MW despite challenges within the supply chain. While supply increased 19.2% year-over-year, vacancy remains near a record low of 3.3%. Strong demand paired with a lack of available power and extended timelines have kept asking rental rates climbing. Average primary market asking rents rose to $147.80 per kW/month from $127.50 (a 15.9% year-over-year increase).

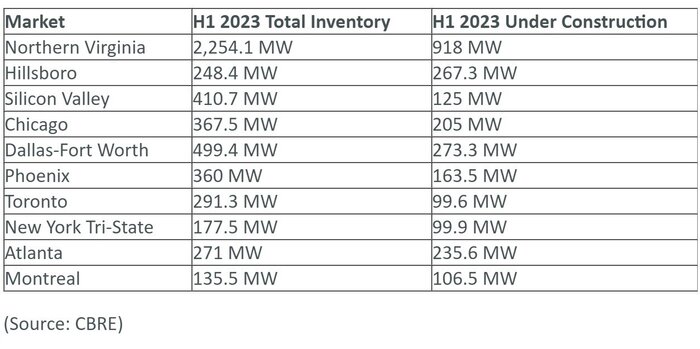

Top Data Center Markets

Northern Virginia remained the most active data center market in the first half of 2023 with 918 MW under construction. The market set a record low vacancy rate of 0.94% while power improvement projects are underway. Separately, Chicago recorded a 125% spike in under-construction activity - the largest increase among all U.S. data center markets.

"Most major markets are grappling with power constraints, and developers are facing challenges within their supply chain, but it's not slowing down the demand for data center space," said Gordon Dolven, director of Americas Data Center Research at CBRE. "Data center operators are prioritizing power availability, rather than selecting markets based on traditional factors such as location, connectivity, water and land pricing."

Other market highlights include Dallas-Fort Worth, which saw the greatest year-over-year increase in absorption of 327%, jumping to 110.6 MW from 25.89 MW. Hillsboro also experienced the largest inventory growth of all primary markets, increasing to 248.4 MW from 139.4 MW (78% year-over-year growth).

Top 10 Most Active Markets

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.