Commercial Real Estate News

Industrial Market Rebalances as E-commerce Growth Normalizes in U.S.

Commercial News » Dallas Edition | By Michael Gerrity | October 30, 2023 8:35 AM ET

The e-commerce boom that began in the early days of the pandemic helped send demand for industrial real estate to never-before-seen heights, but as growth has normalized, a rebalancing has taken shape, according to CommercialEdge's latest 2023 U.S. industrial market report.

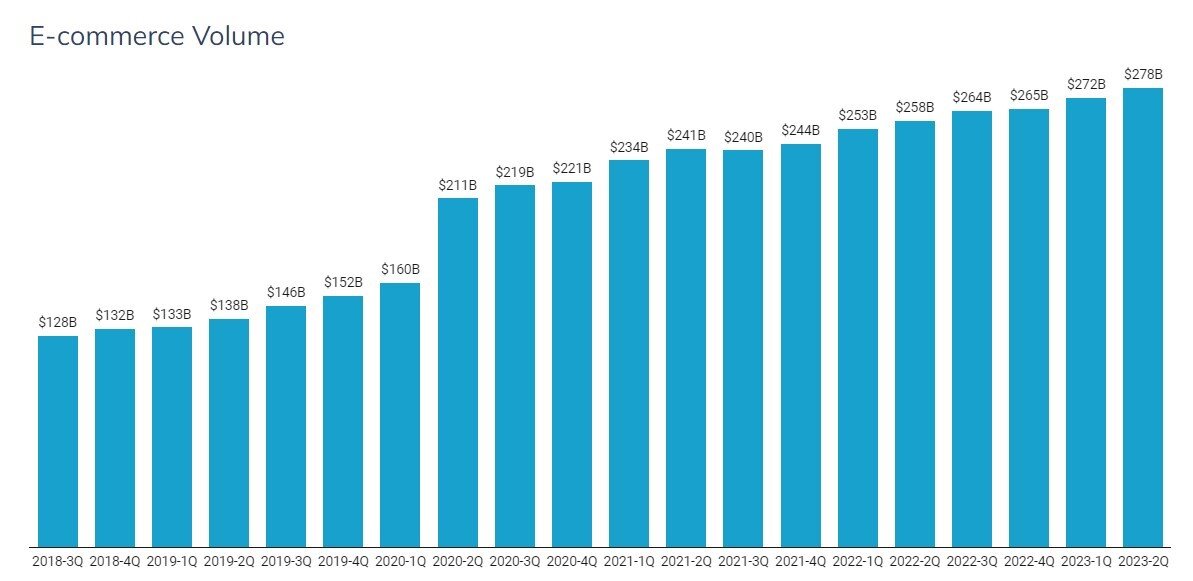

E-commerce sales volume exploded in 2020, a shock that reshaped retail as we knew it. While growth cooled in subsequent quarters, the gains made during the pandemic are now entrenched.

E-commerce sales volume has increased by 74% since the first quarter of 2021, although almost half of those gains were made in the initial spike in the second quarter of 2021. During the second quarter of this year, there was a total of $277.6 billion in e-commerce sales, according to the Census Bureau, an increase of 2.1% over the first quarter and 7.5% year-over-year.

While on the surface, these numbers look robust, there are caveats. From 2010 (when the Census Bureau began providing the data series) to the first quarter of 2020, e-commerce sales grew at an average rate of 3.6% per quarter. Following the initial COVID-induced spike, that average is just 2.2%. It is also important to note that these numbers are not inflation-adjusted, and increasing prices account for a portion of the growth. Still, e-commerce's share of core retail sales (excluding motor vehicles, their parts and gasoline) has increased from 14.2% in the first quarter of 2020 to 18.4% in the third quarter.

CommercialEdge Senior Manager Peter Kolaczynski says, "Naturally, construction is going to slow compared to levels from the COVID explosion, but we see e-commerce as a consistent driver for sustainable and normalized demand through the rest of the decade."

Even as online sales growth has normalized, it continues to drive significant demand for industrial space because e-commerce operations require much more logistics space than traditional brick-and-mortar. Prologis estimates the additional space necessary for online sales to be three times higher due to "piece picking, product variety, direct-to-consumer shipping and the need to process returns."

While Amazon made waves when it paused on canceled large fulfillment centers last year, traditional big box retailers are still in the process of adding those spaces. Wal-Mart recently opened a 1.5 million automated fulfillment center, the second of four such announced projects that will allow the company to reach 95% of the population with one- or two-day shipping.

CommercialEdge expects e-commerce to remain a considerable driver of growth in the industrial sector for the foreseeable future. Both multi-million-square-foot facilities and small-scale in-fill centers for last-mile delivery will be necessary for retailers to provide customers with a quick and efficient omnichannel experience. Many existing retailers will look to consolidate brick-and-mortar operations and streamline logistics networks, further fueling demand for space, the U.S. industrial property outlook predicts.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.