Commercial Real Estate News

U.S. Industrial Property Market Remains Robust in Late 2022

Commercial News » Dallas Edition | By David Barley | December 22, 2022 8:21 AM ET

According to CommercialEdge, the U.S. industrial sector's expansion maintained its 2022 momentum through November 2022, as intense demand for industrial space continued to fuel dynamic rent growth. The national average rent for in-place leases reached $7.00 per square foot last month.

The new development pipeline also continued to increase, undeterred by inflation-driven backlogs and bottlenecks along the supply chain. There were 742.3 million square feet of industrial space under construction at the end of November. And, despite record levels of new supply delivered in 2022, the national vacancy rate contracted steadily throughout the year, reaching 3.8% in the same month.

CommercialEdge also reports industrial rent growth accelerated at a steady pace in top U.S. markets throughout the year, with national in-place rents for industrial space increasing 6.5% year-over-year. In November, the national average increased another five cents from the previous month, to reach $7.00 per square foot.

For another consecutive month, port markets led the nation in both new leases and in-place rent growth. In line with trends observed during the previous two years, Southern California in-place rents have climbed at the fastest rate, driven by double-digit growth in the Inland Empire and Los Angeles markets. On the East Coast, Boston and New Jersey saw the strongest rent hikes.

Tenants signing new leases are paying more than ever for space. The average rate of a lease signed in the last twelve months was $9.07 per square foot -- $2.07 more than the average for all in-place leases. The markets with the highest premiums for new leases were in the West, where Los Angeles, the Inland Empire and Orange County dominated. Meanwhile, Nashville had the largest spreads in the South and Boston took the lead among northeastern markets.

The national vacancy rate stood at 3.8% in November, following a decrease of 20 basis points from the previous month. While many of the supply chain issues from the beginning of 2022 eased in the second half of the year, finding suitable industrial space in port markets remains one of the biggest challenges, as vacancy rates were still tight in the Inland Empire, Los Angeles, and New Jersey. Rapidly expanding non-port markets such as Nashville and Columbus, where demand is outstripping supply, are also seeing extremely low vacancy rates.

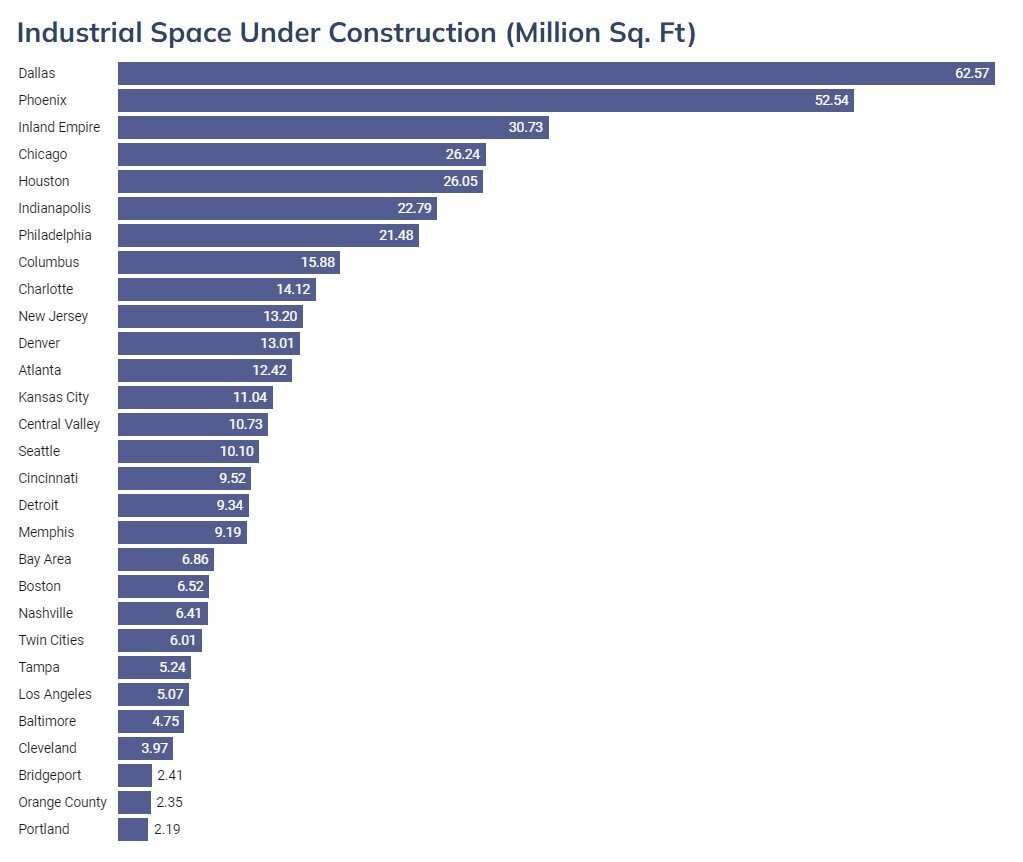

A total of 742.3 million square feet of industrial stock was under construction at the end of November, representing 4.0% of existing inventory. Moreover, data showed an additional 684.5 million square feet in the planning stages. With the national vacancy rate for the top 30 markets having dipped below 4%, space in the hottest markets is already pre-leased before delivery or, in some cases, before construction even begins.

While many markets are experiencing an industrial construction boom, much of the new supply being developed is concentrated in a handful of locations: Phoenix, Dallas - Fort Worth, the Inland Empire, Chicago and Houston account for more than a quarter of all under-construction space. Half of all under-development supply is in only 18 markets, concludes CommercialEdge.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.