Residential Real Estate News

Driven by Tight Inventories and Deep Freezes, U.S. Home Sales Slide in February

Residential News » Dallas Edition | By WPJ Staff | March 23, 2021 8:15 AM ET

According to the National Association of Realtors, existing-home sales declined in February 2021, following two prior months of gains. Month-over-month, only one major region saw an increase in February 2021, but all four U.S. regions recorded year-over-year gains.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 6.6% from January to a seasonally-adjusted annual rate of 6.22 million in February. Sales in total climbed year-over-year, up 9.1% from a year ago (5.70 million in February 2020).

"Despite the drop in home sales for February - which I would attribute to historically-low inventory - the market is still outperforming pre-pandemic levels," said Lawrence Yun, NAR's chief economist.

He cautioned of a possible slow down in growth in the coming months as higher prices and rising mortgage rates will cut into home affordability.

"I still expect this year's sales to be ahead of last year's, and with more COVID-19 vaccinations being distributed and available to larger shares of the population, the nation is on the cusp of returning to a sense of normalcy," Yun said. "Many Americans have been saving money and there's a strong possibility that once the country fully reopens, those reserves will be unleashed on the economy."

The median existing-home price for all housing types in February was $313,000, up 15.8% from February 2020 ($270,400), as prices rose in every region. February's national price jump marks 108 straight months of year-over-year gains.

NAR's 2021 Home Buyers and Sellers Generational Trends Report, released last week, highlights some of the effects of these price leaps, including buyers' struggles with saving enough money for a down payment.

"Home affordability is weakening," Yun said. "Various stimulus packages are expected and they will indeed help, but an increase in inventory is the best way to address surging home costs."

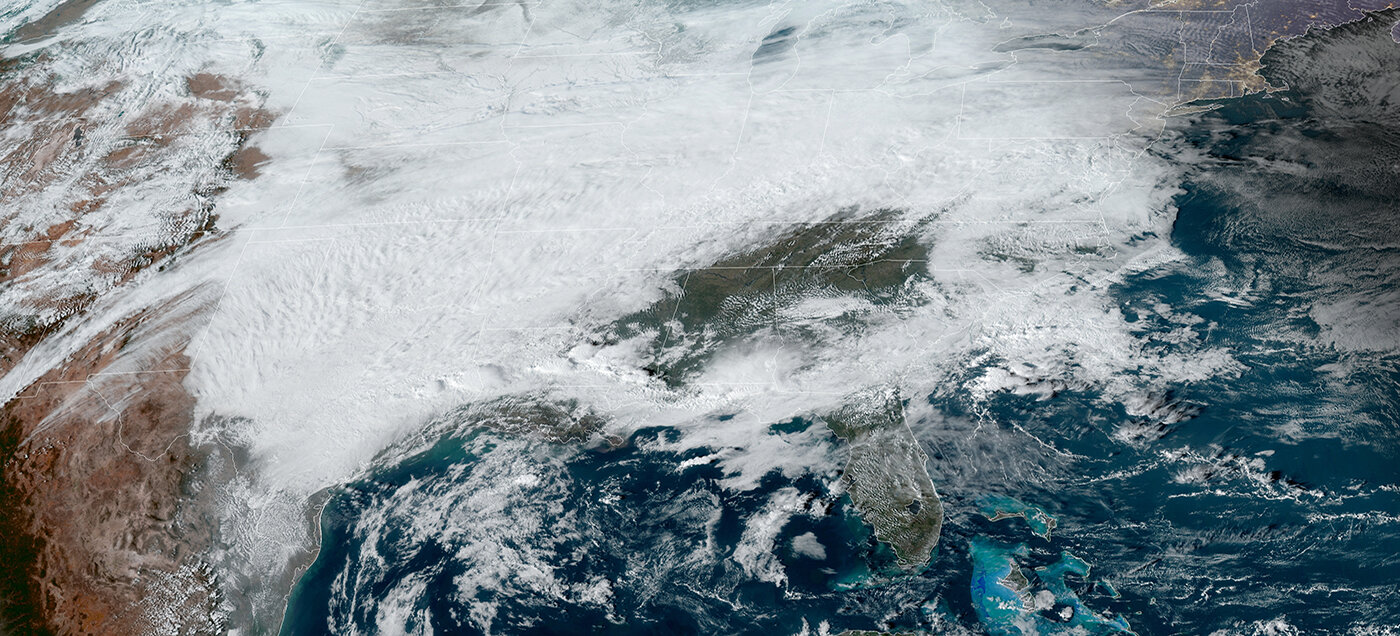

Florida and Texas resident, and veteran real estate consultant Tonya Giddens of CFRP Realty also commented, "The U.S. housing market slowdown was partially attributable to the fact that almost half the country was in a deep freeze for an entire week during mid-February."

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage was 2.81 in February, up from 2.74% in January. The average commitment rate across all of 2020 was 3.11%.

Total housing inventory at the end of February amounted to 1.03 million units, equal to January's inventory and down 29.5% from one year ago (1.46 million). Unsold inventory sits at a 2.0-month supply at the current sales pace, slightly up from January's 1.9-month supply and down from the 3.1-month amount recorded in February 2020. NAR first began tracking the single-family home supply in 1982.

Properties typically remained on the market for 20 days in February, down from both 21 days in January and from 36 days in February 2020. Seventy-four percent of the homes sold in February 2021 were on the market for less than a month.

First-time buyers were responsible for 31% of sales in February, down from 33% in January and from 32% in February 2020. NAR's 2020 Profile of Home Buyers and Sellers - released in late 2020 - revealed that the annual share of first-time buyers was 31%.

Individual investors or second-home buyers, who account for many cash sales, purchased 17% of homes in February, up from 15% in January and equal to the percentage from February 2020. All-cash sales accounted for 22% of transactions in February, up from both 19% in January and from 20% in February 2020.

Distressed sales - foreclosures and short sales - represented less than 1% of sales in February, equal to January's percentage but down from 2% in February 2020.

Single-family and Condo/Co-op Sales

Single-family home sales decreased to a seasonally-adjusted annual rate of 5.52 million in February, down 6.6% from 5.91 million in January, and up 8.0% from one year ago. The median existing single-family home price was $317,100 in February, up 16.2% from February 2020.

Existing condominium and co-op sales were recorded at a seasonally-adjusted annual rate of 700,000 units in February, down 6.7% from January and up 18.6% from one year ago. The median existing condo price was $280,500 in February, an increase of 12.3% from a year ago.

Regional Breakdown

Compared to one year ago, median home prices increased in each of the four major regions.

- February 2021 saw existing-home sales in the Northeast fall 11.5%, recording an annual rate of 770,000, a 13.2% increase from a year ago. The median price in the Northeast was $356,000, up 20.5% from February 2020.

- Existing-home sales in the Midwest dropped 14.4% to an annual rate of 1,310,000 in February, a 2.3% rise from a year ago. The median price in the Midwest was $231,800, a 14.2% climb from February 2020.

- Existing-home sales in the South decreased 6.1%, posting an annual rate of 2,770,000 in February, up 9.9% from the same time one year ago. The median price in the South was $271,200, a 13.6% increase from a year ago.

- Existing-home sales in the West rose 4.6% from the month prior, recording an annual rate of 1,370,000 in February, a 12.3% jump from a year ago. The median price in the West was $493,300, up 20.6% from February 2020.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October