The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Office Absorption in U.S. Could Slow if Hiring Pace Slows

Commercial News » Dallas Edition | By Michael Gerrity | October 5, 2018 9:06 AM ET

Based on a new report by Transwestern, with U.S. economic fundamentals showing fortitude against trade fears, interest rate hikes and diverging global economies, the tightening labor market appears to be the biggest threat to the pace of continued economic growth.

Transwestern's Chief Investment Officer Tom McNearney reports that to date, the national office and industrial sectors have performed well across most metros with construction balanced by absorption, but low unemployment is likely to keep future performance in check.

"Continued strong job growth coupled with increasing wages has fueled office and industrial real estate absorption across the country in 2018, and there remain billions in dry powder in the capital markets," said McNearney. "Americans are benefitting from higher disposable income - particularly after tax - that has resulted in rising retail sales. This, in turn, has continued to drive the industrial sector."

"Continued strong job growth coupled with increasing wages has fueled office and industrial real estate absorption across the country in 2018, and there remain billions in dry powder in the capital markets," said McNearney. "Americans are benefitting from higher disposable income - particularly after tax - that has resulted in rising retail sales. This, in turn, has continued to drive the industrial sector."

While the commercial real estate industry is expected to finish out the year strong, there are notable headwinds in addition to worker shortages.

For example, industry disrupter WeWork has turned the traditional office leasing model upside-down, but has yet to turn a profit, and Moody's announced it will discontinue rating WeWork's debt because it lacks information to gauge its creditworthiness.

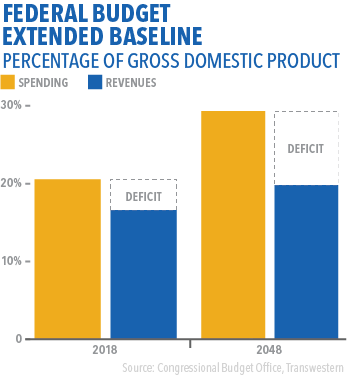

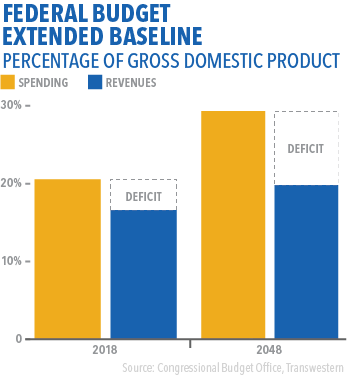

Additionally, the trade deficit rose to its highest level in a decade during the summer, the U.S. Treasury had to increase borrowing to service the widening budget deficit, and interest rates are likely to climb.

Transwestern's Chief Investment Officer Tom McNearney reports that to date, the national office and industrial sectors have performed well across most metros with construction balanced by absorption, but low unemployment is likely to keep future performance in check.

"Continued strong job growth coupled with increasing wages has fueled office and industrial real estate absorption across the country in 2018, and there remain billions in dry powder in the capital markets," said McNearney. "Americans are benefitting from higher disposable income - particularly after tax - that has resulted in rising retail sales. This, in turn, has continued to drive the industrial sector."

"Continued strong job growth coupled with increasing wages has fueled office and industrial real estate absorption across the country in 2018, and there remain billions in dry powder in the capital markets," said McNearney. "Americans are benefitting from higher disposable income - particularly after tax - that has resulted in rising retail sales. This, in turn, has continued to drive the industrial sector."While the commercial real estate industry is expected to finish out the year strong, there are notable headwinds in addition to worker shortages.

For example, industry disrupter WeWork has turned the traditional office leasing model upside-down, but has yet to turn a profit, and Moody's announced it will discontinue rating WeWork's debt because it lacks information to gauge its creditworthiness.

Additionally, the trade deficit rose to its highest level in a decade during the summer, the U.S. Treasury had to increase borrowing to service the widening budget deficit, and interest rates are likely to climb.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More