Residential Real Estate News

Zombie Foreclosures in U.S. Decline in Q3, Reaching Lowest Levels Since 2021

Residential News » Detroit Edition | By David Barley | August 27, 2024 7:10 AM ET

Based on ATTOM's newly released third-quarter 2024 Vacant Property and Zombie Foreclosure Report, almost 1.4 million (1,357,423) residential properties in the United States are vacant. That figure represents 1.3 percent, or one in 76 homes, across the nation - roughly the same as in the second quarter of this year.

The report also reveals that 222,934 residential properties in the U.S. are in the process of foreclosure in the third quarter of this year, down 6 percent from the second quarter of 2024 and down 29.3 percent from the third quarter of 2023. Foreclosure activity has declined over the past year following a surge in cases that hit after a nationwide moratorium on lenders pursuing delinquent homeowners, imposed during the Coronavirus pandemic, was lifted in the middle of 2021.

Among those pre-foreclosure properties, about 7,000 sit vacant as zombie foreclosures (pre-foreclosure properties abandoned by owners) in the third quarter of 2024. That figure is slightly above the number in the prior quarter, but down 20.2 percent from a year ago.

The latest count of zombie homes continues a long-term pattern of those properties representing only a tiny portion of the nation's total housing stock - currently at just one of every 14,776 homes around the U.S. The ratio is about the same as the level of one in 14,724 in the prior quarter, but well down from one in 11,565 in the third quarter of last year, marking the lowest level since early 2021. Zombie foreclosures remain so rare that most local housing markets around the country have little or no issues with the blight and decay those properties can attract and spread.

The portion of pre-foreclosure properties that have been abandoned into zombie status, meanwhile, ticked up a bit, from 2.9 percent in the second quarter of 2024 to 3.1 percent in the current quarter.

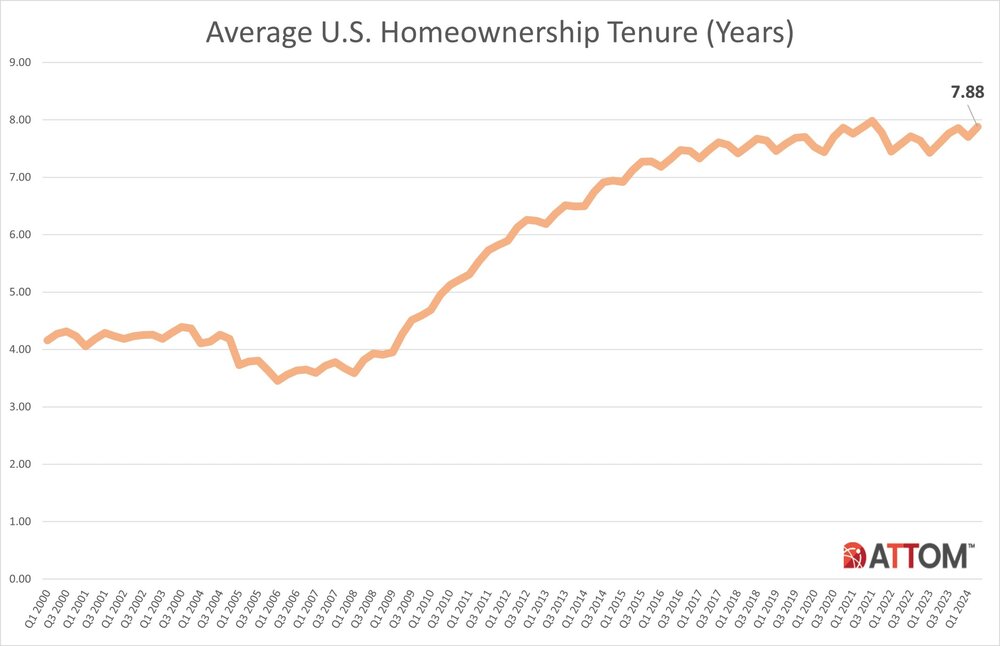

"Zombie foreclosures continue to be a mere blip on the radar screen - one of many measures of the overall strength of the U.S. housing market. After some worries about a rise in abandoned homes following the end of the COVID-era foreclosure clampdown, they remain an anomaly throughout most of the country," said Rob Barber, CEO for ATTOM. "One significant factor is the historically high levels of home equity. This provides homeowners who may be struggling with their mortgage payments a strong incentive to negotiate new payment plans, which in turn reduces the number of foreclosures. As a result, fewer owners are simply walking away from their properties like so many did after the Great Recession of the late 2000s."

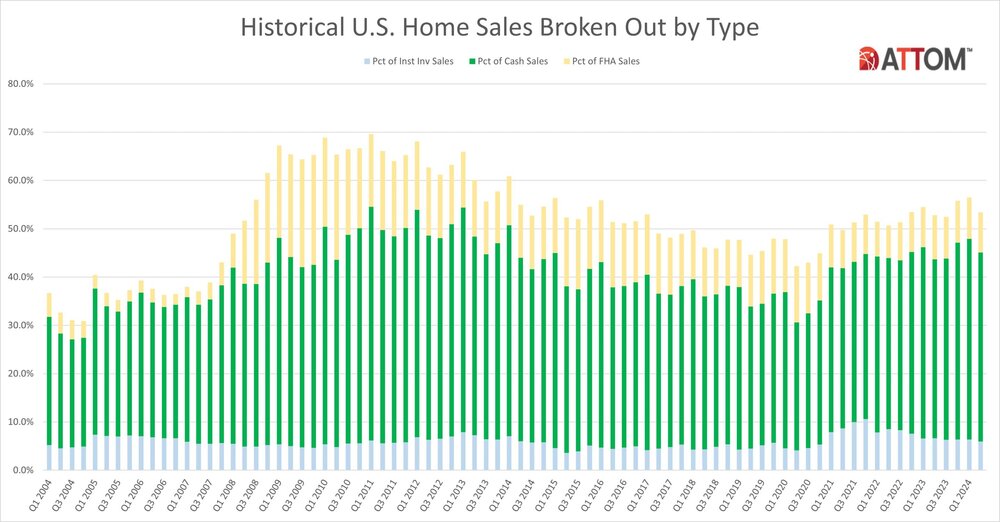

The hold-steady pattern of zombie properties during the third quarter comes as the nation's housing market boom continues into its 13th year, reversing signs of a slowdown in 2023.

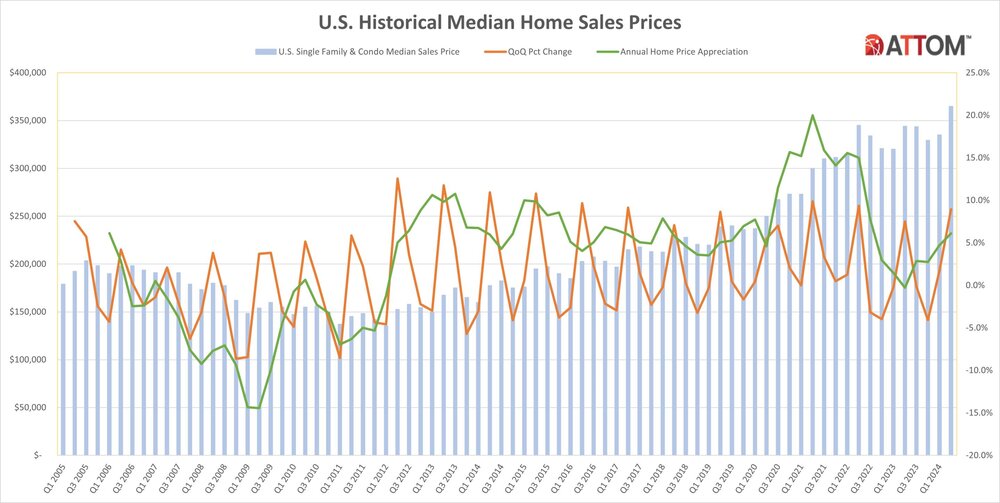

The nationwide median home value shot up 6 percent, year over year, in the Spring of 2024, reaching a new high of $365,000, according to ATTOM's home sales data. It has increased every year since 2011, more than doubling during that time. Those gains have led to historic improvements in homeowner equity, which has resulted in almost 95 percent of owners with mortgages having at least some equity built up and half owing less than 50 percent of the estimated value of their properties.

Zombie foreclosures mostly unchanged quarterly around U.S. while down annually

A total of 7,007 residential properties facing possible foreclosure have been vacated by their owners nationwide in the third quarter of 2024, up 0.9 percent from 6,945 in the second quarter of 2024 but down from 8,782 in the third quarter of 2023. The number of zombie properties stayed the same quarterly or went up slightly in 26 states - usually increasing by less than 20. The number declined in 24 states.

The biggest percent decreases from the third quarter of 2023 to the third quarter of 2024 in states that had at least 50 zombie homes a year ago are in Connecticut (zombie properties down 79 percent, from 87 to 18) Oklahoma (down 78 percent, from 199 to 43), Iowa (zombie properties down 78 percent, from 290 to 64), North Carolina (down 74 percent, from 191 to 50) and New Mexico (down 74 percent from 95 to 25).

The only annual increases among states that had at least 50 zombie foreclosures in the third quarter of 2023 have come in Florida (zombie properties up 64 percent, from 1,199 to 1,961), Texas (up 63 percent, from 112 to 183) and New Jersey (up 12 percent, from 205 to 230). Georgia's number has stayed the same, at 85.

Overall vacancy rates also about the same

The vacancy rate for all residential properties in the U.S. has remained virtually the same for 10 quarters in a row, hovering around 1.3 percent. The latest figure of 1.31 percent (one in 76 properties) is up slightly from 1.26 percent in both the second quarter of 2024 and the third quarter of last year.

States with the highest vacancy rates for all residential properties are Oklahoma (2.36 percent, or one in 42 homes, during the third quarter of this year), Kansas (2.32 percent, or one in 43), Missouri (2.11 percent, or one in 47), Alabama (2.09 percent, or one in 48) and West Virginia (2.08 percent, or one in 48).

Those with the smallest overall vacancy rates are New Hampshire (0.35 percent, or one in 282 homes), Vermont (0.41 percent, or one in 243), New Jersey (0.43 percent, or one in 231), Idaho (0.5 percent, or one in 201) and Utah (0.65 percent, or one in 153).

Other high-level findings from the third quarter of 2024:

- Among 170 metropolitan statistical areas in the U.S. with at least 100,000 residential properties in the third quarter of 2024, those with at least 100 properties facing possible foreclosure and the highest zombie foreclosure rates are Peoria, IL (23 percent of properties in the foreclosure process are vacant); Cedar Rapids, IA (10.9 percent); Youngstown, OH (8.1 percent); Wichita, KS (8 percent) and St. Louis, MO (7.5 percent).

- Aside from St. Louis, the highest zombie-foreclosure rates in major metro areas with at least 500,000 residential properties and at least 100 homes facing foreclosure in the third quarter of 2024 are in Cleveland, OH (7.4 percent of homes in the foreclosure process are vacant); Pittsburgh, PA (5.8 percent); Indianapolis, IN (5.7 percent) and San Antonio, TX (5.2 percent).

- Among the 36 million investor-owned homes throughout the U.S. in the third quarter of 2024, about 939,000 are vacant, or 2.6 percent. The highest levels of vacant investor-owned homes are in Indiana (5.5 percent vacant), Oklahoma (4.6 percent), Alabama (4.4 percent), Missouri (4.3 percent) and Kansas (4.2 percent).

- Among the roughly 12,000 foreclosed, bank-owned homes in the U.S. during the third quarter of 2024, 12.9 percent are vacant. In states with at least 50 bank-owned homes, the largest vacancy rates are in Kansas (24.1 percent vacant), New Mexico (23.4 percent), Ohio (23.4 percent), Indiana (22.5 percent) and Oregon (20 percent).

- The highest zombie-foreclosure rates in U.S. counties with at least 500 properties in the foreclosure process during the third quarter of 2024 are in Broome County (Binghamton), NY (15.5 percent of homes in the foreclosure process are vacant); Cuyahoga County (Cleveland), OH (7.9 percent); Pinellas County (St. Petersburg), FL (7.3 percent); Marion County (Indianapolis), IN (7.3 percent) and Erie County (Buffalo), NY (6.8 percent).

- Among zip codes with enough data to analyze, 89 of the top 100 where zombie properties represent the largest portions of all homes are in New York, Florida and Illinois. The largest portions are in zip codes 61605 in Peoria County, IL (one in 134 homes); 32206 in Duval County (Jacksonville), FL (one in 238); 13350 in Herkimer County, NY (one in 239 homes); 61603 in Peoria County, IL (one in 241) and 10993 in Rockland County (West Haverstraw), NY (one in 287).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024