The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

26.7 Percent of all U.S. Residential Properties With a Mortgage are Equity Rich

Residential News » Irvine Edition | By Michael Gerrity | November 7, 2019 9:00 AM ET

Highest Equity Levels in San Jose, San Francisco, Los Angeles

According to ATTOM Data Solutions newly released third-quarter 2019 U.S. Home Equity & Underwater Report, 14.4 million residential properties in the United States were considered equity rich, meaning that the combined estimated amount of loans secured by those properties was 50 percent or less of their estimated market value.

The count of equity rich properties in the third quarter of 2019 represented 26.7 percent, or about one in four, of the 54 million mortgaged homes in the U.S.

The report also shows that just 3.5 million, or one in 15, mortgaged homes in the third quarter of 2019 were considered seriously underwater, with a combined estimated balance of loans secured by the property at least 25 percent more than the property's estimated market value. That figure represented 6.5 percent of all U.S. properties with a mortgage.

"The latest numbers reveal another profound impact of the extended housing boom, as far more homeowners find themselves on the right side of the balance sheet instead of the wrong side. This is a complete turnabout from what was happening when the housing market crashed during the Great Recession," said Todd Teta, chief product officer with ATTOM Data Solutions. "There are notable equity gaps between regions and market segments. But as home values keep climbing, homeowners are seeing their equity building more and more, while those with properties still worth a lot less than their mortgages represent just a small segment of the market."

Highest equity rich shares all in the Northeast and West

The top 10 states with the highest share of equity rich properties in the third quarter were all in the Northeast and West regions, led by California (40.8 percent); Hawaii (39.2 percent); Vermont (39.0 percent); New York (35.7 percent); and Washington (35.6 percent).

Among 107 metropolitan statistical areas analyzed in the report with a population greater than 500,000, those with the highest shares of equity rich properties were San Jose, CA (62.7 percent); San Francisco, CA (51.1 percent); Los Angeles, CA (46.6 percent); Santa Rosa, CA (46.5 percent); and Honolulu, HI (39.4 percent). The leader in the Northeast region was Boston, MA (35.4 percent) while Dallas, TX led the South (38.2 percent) and Grand Rapids, MI led in the Midwest (27.8 percent).

Top equity-rich counties concentrated in California

Among the 1,467 counties with at least 2,500 properties with mortgages in the third quarter, 10 of the top 25 equity-rich locations were in California.

Counties with the highest share of equity rich properties were San Francisco, CA (70.5 percent); San Mateo, CA (68.6 percent); Santa Clara, CA (63.6 percent); San Juan, WA (60.0 percent); and Kings County (Brooklyn), NY (55.6 percent).

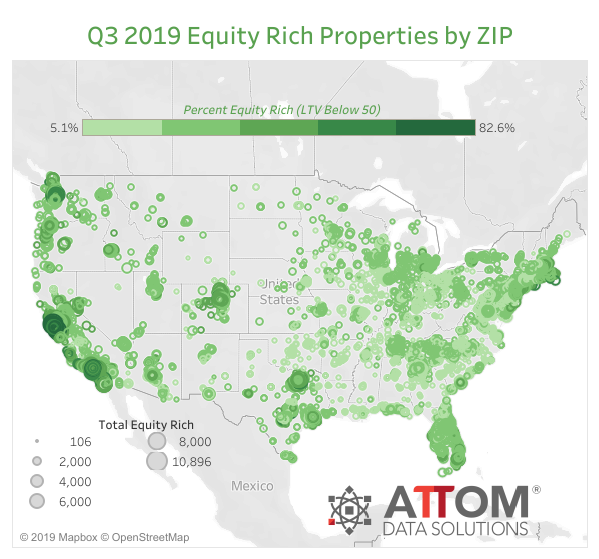

More than half of all properties were equity rich in 415 zip codes

Among 8,213 U.S. zip codes with at least 2,000 properties with mortgages, there were 415 zip codes where at least half of all properties with a mortgage were equity rich.

Forty-six of the top 50 were in California, with most in the San Francisco Bay area. They were led by zip codes: 94116 in San Francisco (82.6 percent equity rich); 94122 in San Francisco (81.1 percent equity rich); 11220 in Brooklyn, NY (78.3 percent equity rich); 94306 in Palo Alto, CA (77.9 percent equity rich); and 94112 in San Francisco (77.9 percent equity rich).

Highest seriously underwater shares in the South and Midwest

The top 10 states with the highest shares of mortgages that were seriously underwater in the third quarter were all in the South and Midwest, led by Louisiana (16.5 percent seriously underwater); Mississippi (15.8 percent); West Virginia (14.2 percent); Iowa (14.0 percent); and Arkansas (13.1 percent).

Among 107 metropolitan statistical areas analyzed in the report with a population greater than 500,000, those with the highest share of mortgages that were seriously underwater included Youngstown, OH (16.8 percent); Baton Rouge, LA (15.7 percent); Scranton, PA (14.3 percent); Cleveland, OH (14.0 percent); and Toledo, OH (13.8 percent).

More than 25 percent of all properties were seriously underwater in 160 zip codes

Among 8,213 U.S. zip codes with at least 2,000 properties with mortgages, there were 160 zip codes where more than a quarter of all properties with a mortgage were seriously underwater. The largest number of those zip codes were in the Cleveland, St. Louis, Philadelphia, Chicago and Milwaukee metropolitan statistical areas.

The top five zip codes with the highest share of seriously underwater properties were 71446 in Leesville, LA (65.1 percent seriously underwater); 44110 in Cleveland, OH (61.9 percent); 08611 in Trenton, NJ (61.8 percent); 53206 in Milwaukee, WI (60.3 percent); and 63115 in St. Louis, MO (59 percent).

According to ATTOM Data Solutions newly released third-quarter 2019 U.S. Home Equity & Underwater Report, 14.4 million residential properties in the United States were considered equity rich, meaning that the combined estimated amount of loans secured by those properties was 50 percent or less of their estimated market value.

The count of equity rich properties in the third quarter of 2019 represented 26.7 percent, or about one in four, of the 54 million mortgaged homes in the U.S.

The report also shows that just 3.5 million, or one in 15, mortgaged homes in the third quarter of 2019 were considered seriously underwater, with a combined estimated balance of loans secured by the property at least 25 percent more than the property's estimated market value. That figure represented 6.5 percent of all U.S. properties with a mortgage.

"The latest numbers reveal another profound impact of the extended housing boom, as far more homeowners find themselves on the right side of the balance sheet instead of the wrong side. This is a complete turnabout from what was happening when the housing market crashed during the Great Recession," said Todd Teta, chief product officer with ATTOM Data Solutions. "There are notable equity gaps between regions and market segments. But as home values keep climbing, homeowners are seeing their equity building more and more, while those with properties still worth a lot less than their mortgages represent just a small segment of the market."

Highest equity rich shares all in the Northeast and West

The top 10 states with the highest share of equity rich properties in the third quarter were all in the Northeast and West regions, led by California (40.8 percent); Hawaii (39.2 percent); Vermont (39.0 percent); New York (35.7 percent); and Washington (35.6 percent).

Among 107 metropolitan statistical areas analyzed in the report with a population greater than 500,000, those with the highest shares of equity rich properties were San Jose, CA (62.7 percent); San Francisco, CA (51.1 percent); Los Angeles, CA (46.6 percent); Santa Rosa, CA (46.5 percent); and Honolulu, HI (39.4 percent). The leader in the Northeast region was Boston, MA (35.4 percent) while Dallas, TX led the South (38.2 percent) and Grand Rapids, MI led in the Midwest (27.8 percent).

Top equity-rich counties concentrated in California

Among the 1,467 counties with at least 2,500 properties with mortgages in the third quarter, 10 of the top 25 equity-rich locations were in California.

Counties with the highest share of equity rich properties were San Francisco, CA (70.5 percent); San Mateo, CA (68.6 percent); Santa Clara, CA (63.6 percent); San Juan, WA (60.0 percent); and Kings County (Brooklyn), NY (55.6 percent).

More than half of all properties were equity rich in 415 zip codes

Among 8,213 U.S. zip codes with at least 2,000 properties with mortgages, there were 415 zip codes where at least half of all properties with a mortgage were equity rich.

Forty-six of the top 50 were in California, with most in the San Francisco Bay area. They were led by zip codes: 94116 in San Francisco (82.6 percent equity rich); 94122 in San Francisco (81.1 percent equity rich); 11220 in Brooklyn, NY (78.3 percent equity rich); 94306 in Palo Alto, CA (77.9 percent equity rich); and 94112 in San Francisco (77.9 percent equity rich).

Highest seriously underwater shares in the South and Midwest

The top 10 states with the highest shares of mortgages that were seriously underwater in the third quarter were all in the South and Midwest, led by Louisiana (16.5 percent seriously underwater); Mississippi (15.8 percent); West Virginia (14.2 percent); Iowa (14.0 percent); and Arkansas (13.1 percent).

Among 107 metropolitan statistical areas analyzed in the report with a population greater than 500,000, those with the highest share of mortgages that were seriously underwater included Youngstown, OH (16.8 percent); Baton Rouge, LA (15.7 percent); Scranton, PA (14.3 percent); Cleveland, OH (14.0 percent); and Toledo, OH (13.8 percent).

More than 25 percent of all properties were seriously underwater in 160 zip codes

Among 8,213 U.S. zip codes with at least 2,000 properties with mortgages, there were 160 zip codes where more than a quarter of all properties with a mortgage were seriously underwater. The largest number of those zip codes were in the Cleveland, St. Louis, Philadelphia, Chicago and Milwaukee metropolitan statistical areas.

The top five zip codes with the highest share of seriously underwater properties were 71446 in Leesville, LA (65.1 percent seriously underwater); 44110 in Cleveland, OH (61.9 percent); 08611 in Trenton, NJ (61.8 percent); 53206 in Milwaukee, WI (60.3 percent); and 63115 in St. Louis, MO (59 percent).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More