Residential Real Estate News

Homeownership Expenses Consume 34 Percent of Average Wages in U.S.

Residential News » Irvine Edition | By WPJ Staff | October 2, 2024 6:50 AM ET

Homes and condos across America remain less affordable compared to historical averages

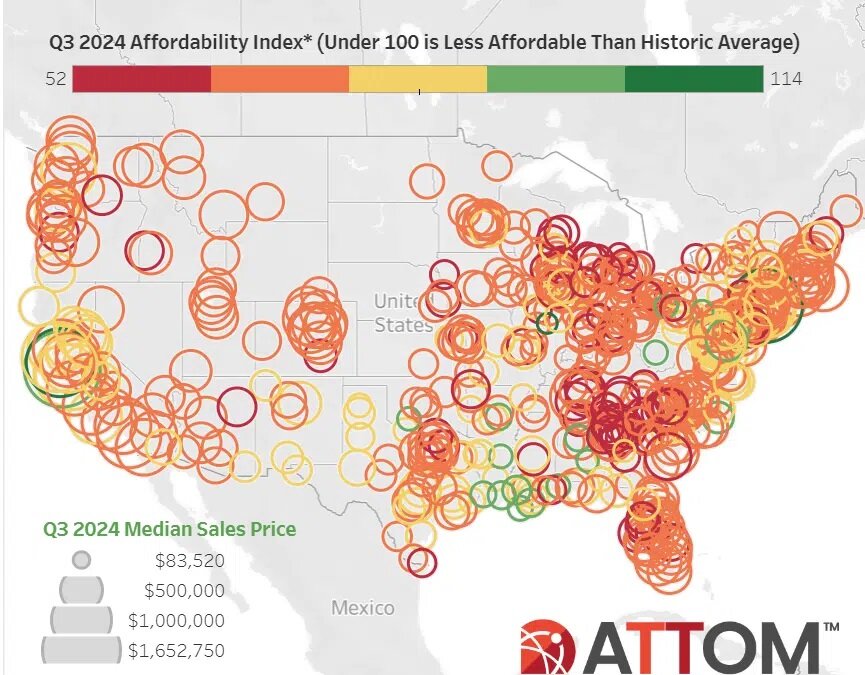

ATTOM Data's latest U.S. Home Affordability Report for the third quarter of 2024 reveals that single-family homes and condos across the nation remain less affordable compared to historical averages in 99% of counties with sufficient data. This trend, which began in early 2022, highlights the continued rise in U.S. home prices, pushing homeownership costs to levels that require historically high portions of average wages.

According to ATTOM, major expenses on median-priced homes now consume 33.5% of the average national wage. This figure represents a slight improvement from the second quarter of 2024 but remains virtually unchanged from a year ago. Importantly, it still exceeds the 28% benchmark preferred by lenders.

Despite some minor gains in affordability measures, homeownership continues to be a financial stretch for many workers as the national median home price reached $365,000 this quarter. Although mortgage rates have declined, they remain above 6%, keeping ownership costs high.

ATTOM's report shows that mortgage payments, property taxes, and insurance continue to consume a large portion of wages, sitting 12 percentage points above the low point reached in early 2021 when mortgage rates were at historic lows.

Rob Barber, ATTOM's CEO, acknowledged the slight improvement in affordability, driven mainly by declining interest rates. He noted that while homeownership costs still exceed lender-preferred levels, the trend is moving in a positive direction. Barber also pointed out that the Federal Reserve's recent half-point rate cut could improve buyer prospects, provided it doesn't lead to increased demand and higher prices amidst tight housing supply.

This small shift toward better affordability comes amid conflicting market forces. Rising home prices and property taxes continue to limit affordability, while falling mortgage rates in 2024 have helped offset these increases. The slower rise in the national median home price this quarter also contributed to a 3% reduction in major homeownership costs, as wages have grown.

The report calculates affordability based on the percentage of income needed for homeownership costs, including mortgage payments, taxes, and insurance, assuming a 20% down payment and a 28% debt-to-income ratio. Compared to historical averages, 575 of 578 counties analyzed in Q3 2024 remain less affordable. About 80% of counties are considered unaffordable using the 28% wage-to-expense ratio guideline, with major counties like Los Angeles, Cook (Chicago), and Maricopa (Phoenix) leading the list.

Conversely, the most populous affordable counties include Harris County (Houston), Wayne County (Detroit), and Philadelphia County. The report also highlights that home prices have risen in 63% of counties from the second to the third quarter of 2024, and are up annually in 85% of those counties.

Despite rising prices, wages have outpaced price growth in some areas. Counties like Maricopa (Phoenix) and Tarrant (Fort Worth) saw wages grow faster than home prices. However, in 71% of counties, home price increases have outpaced wage growth.

The share of wages required for homeownership dropped quarterly in 74% of the analyzed counties, though it remains unchanged annually. Nationally, it takes 33.5% of the average wage to cover major homeownership costs, down from 34.7% in the previous quarter but well above the 21.3% low of early 2021. The report shows that 78% of counties still require more than 28% of wages for homeownership, with some requiring as much as 43%, which is considered seriously unaffordable.

In the most expensive regions, particularly on the Northeast and West coasts, ownership costs can consume over 100% of average local wages, as seen in places like Santa Cruz County, CA, and Brooklyn, NY. On the other end, counties with the lowest ownership costs include Cambria County, PA, and Montgomery County, AL.

Overall, while homeownership remains historically unaffordable in most areas, some signs of improvement are evident, particularly in upscale markets. As wages grow and mortgage rates decline, affordability is slowly heading in a more positive direction.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership