The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Home Flipping Profits in U.S. Reach 2020 High in Q3

Residential News » Irvine Edition | By Michael Gerrity | December 18, 2020 8:00 AM ET

Yet home flipping transaction decline during same timeframe

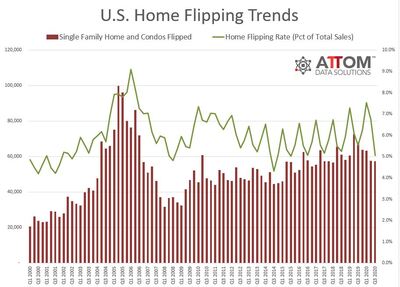

According to ATTOM Data Solutions third-quarter 2020 U.S. Home Flipping Report, 57,155 single-family homes and condominiums in the United States were flipped in the third quarter of 2020.

Those transactions represented 5.1 percent of all home sales in the third quarter of 2020, or one in 20 transactions. That figure was down from 6.7 percent of all home sales in the nation during the second quarter of 2020, or one in 15, and from 5.5 percent, or one in 18 sales, in the third quarter of last year.

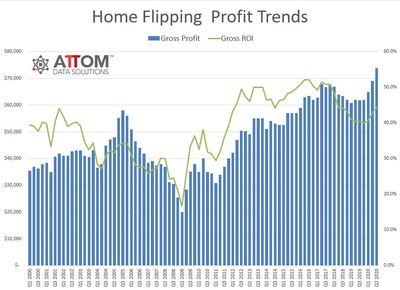

While the home-flipping rate dropped again in the third quarter, both profits and profit margins increased. The gross profit on the typical home flip nationwide (the difference between the median sales price and the median paid by investors) rose in the third quarter of 2020 to $73,766 - the highest amount since at least 2000. That amount was up from $69,000 in the second quarter of 2020 and from $61,800 in the third quarter of last year.

The gain pushed profit margins up, with the typical gross flipping profit of $73,766 in the third quarter translating into a 44.4 percent return on investment compared to the original acquisition price. The gross flipping ROI was up from 42.9 percent in the second quarter of 2020 and 40.3 percent a year ago. The improvement in the typical ROI marked the second consecutive year-over-year increase following nine straight quarters of declines.

The continuation of opposing trends, with flipping rates down but profits up, reflected broader national housing market patterns as the worldwide Coronavirus continued spreading across the United States. Home prices kept soaring throughout most of the country in the third quarter as buyers - often seeking larger or more wide-open spaces - chased a dwindling supply of homes for sale. Rising values continued pushing a nine-year boom in the housing market even as much of the economy struggled to overcome high unemployment and other damage from the pandemic.

"Home-flipping again generated higher profits on less transactions across the United States in the third quarter of 2020 as investors continued to make more money on a declining number of deals," said Todd Teta, chief product officer at ATTOM Data Solutions. "This all happened in the context of the pandemic, which has created unusual circumstances for the housing market to thrive, and that has included the home-flipping business. Too much is uncertain these days to say whether the latest trends will continue. But for now, the prospects continue looking up for home flipping after a period when they were trending the opposite way."

Home flipping rates down in more than 90 percent of local markets

Home flips as a portion of all home sales decreased from the second to the third quarter of 2020 in 148 of the 159 metropolitan statistical areas analyzed in the report (93.1 percent). (Metro areas were included if they had a population of 200,000 or more and at least 50 home flips in the third quarter of 2020.)

Among those metro areas, the largest quarterly decreases in the home flipping rate came in Killeen, TX (rate down 44.5 percent); Savannah, GA (down 43 percent); York, PA (down 42 percent); Greeley, CO (down 41.5 percent) and Springfield, MA (down 39.8 percent).

The biggest quarterly flipping-rate decreases in 53 metro areas with a population of 1 million or more were in Raleigh, NC (rate down 39.1 percent); Atlanta, GA (down 38.5 percent); Kansas City, MO (down 38.3 percent); San Diego, CA (down 38.1 percent) and Rochester, NY (down 37 percent).

The biggest increases in home-flipping rates were in Davenport, IA (rate up 18.5 percent); Hilton Head, SC (up 16.8 percent); Scranton, PA (up 12.2 percent); Amarillo, TX (up 10.9 percent) and Kalamazoo, MI (up 7.7 percent).

Typical home flipping returns rise in two-thirds of markets

Homes flipped in the third quarter of 2020 were sold for a median price of $240,000, with a gross flipping profit of $73,766 above the median investor purchase price of $166,234. That gross-profit figure was up from $69,000 in the second quarter of 2020 and from $61,800 in the third quarter of last year. The increase boosted the typical return on investment in the third quarter of 2020 to 44.4 percent, up from 42.9 percent in the second quarter of 2020 and from 40.3 a year ago. The ROI in the third quarter stood at its highest point since the first quarter of 2018, when it was 48 percent.

Home flipping profit margins increased from the third quarter of 2019 to the third quarter of 2020 in 104 of the 159 metro areas with enough data to analyze (65.4 percent). Markets with the biggest gains included Brownsville, TX (return on investment up 182.9 percent); Austin, TX (up 176.4 percent); Waco, TX (up 157.4 percent); Springfield, MO (up 145.3 percent) and Savannah, GA (up 143.6 percent).

Aside from Austin, TX, metro areas with a population of at least 1 million that had the biggest annual increases in flipping profit margins in the third quarter of 2020 were Raleigh, NC (ROI up 74 percent); Phoenix, AZ (up 69.8 percent); Kansas City, MO (up 55.9 percent) and Las Vegas, NV (up 54.4 percent).

The biggest year-over-year declines in investment returns on home flips during the third quarter of 2020 were in Corpus Christi, TX (ROI down 77 percent); Hilton Head, SC (down 72.9 percent); Boulder, CO (down 69.1 percent); Wilmington, NC (down 58.9 percent) and South Bend, IN (down 54.1 percent).

Investors sell for at least double their purchase price in 14 markets

Median resale prices on home flips in the third quarter of 2020 were at least twice the median investor purchase prices compared to a year earlier in 14 of the 159 metro areas with enough data to analyze (8.8 percent).

They were led by Pittsburgh, PA (151.9 percent return, up from 127.9 percent in the third quarter of 2019); Hickory, NC (136.3 percent return, up from 110.3 percent a year ago); Scranton, PA (117.1 percent return, up from 104.2 percent a year ago); Davenport, IA (114.7 percent return, up from 52.3 percent a year ago) and McAllen, TX (108.9 percent return, up from 81.2 percent a year ago).

The smallest third-quarter 2020 profit margins on typical home flips were in Boulder, CO (7.4 percent, down from 23.8 percent in the third quarter of 2019); Corpus Christi, TX (7.9 percent, down from 34.3 percent a year ago); Hilton Head, SC (9.4 percent, down from 34.6 percent a year ago); Reno, NV (14.3 percent, down from 21.3 percent a year ago) and Killeen, TX (16.6 percent, up from 13.4 percent a year ago).

Highest raw profits still in the West and Northeast and lowest in the South

The highest third-quarter 2020 home flipping profits, measured in dollars, were again concentrated in the West and Northeast. Among metro areas with enough data to analyze, 22 of the top 25 were in those regions, led by San Jose, CA (gross profit of $290,000); Ventura, CA ($180,000); Bridgeport, CT ($177,500); Los Angeles, CA ($161,500) and San Francisco, CA ($158,500).

Among the markets analyzed, 17 of 20 posted the smallest home flipping profits measured in dollars in the third quarter, and were spread across southern metro areas, led by Corpus Christi, TC ($14,817 profit); Hilton Head, SC ($24,000); Killeen, TX ($26,197); El Paso, TX ($27,116) and Lubbock, TX ($28,869).

Home flips purchased with financing or cash remain about the same

Nationally, the portion of flipped homes purchased with financing barely changed, rising from 42.4 percent in the second quarter of 2020 to 42.6 percent in the third quarter of 2020. But the rate was still well down from 49 percent in the third quarter of 2019. Meanwhile, 57.4 percent of homes flipped in the third quarter of 2020 were bought with all cash. That was virtually the same as the 57.6 percent figure in the prior quarter, but still up from 51 percent a year earlier.

Among metropolitan statistical areas with a population of 1 million or more and sufficient data to analyze, those with the highest percentage of flips purchased with financing in the third quarter of 2020 were Seattle, WA (61.2 percent); San Diego, CA (58.7 percent); San Jose, CA (58.2 percent); Louisville, KY (53.9 percent); and San Francisco, CA (53.8 percent).

Average time to flip nationwide rises to 192 days

Home flippers who sold homes in the third quarter of 2020 took an average of 192 days to complete the transactions - the highest level since the third quarter of 2003. The latest number is up from an average of 184 in the second quarter of 2020 and 176 days in the third quarter of last year.

FHA buyers purchase smaller portion of flipped homes

Of the 57,155 U.S. homes flipped in the third quarter of 2020, 14.7 percent were sold to buyers using loans backed by the Federal Housing Administration (FHA), down from 15.3 percent in the prior quarter, but up from 13.6 percent in the same period a year ago.

Among the 159 metro areas with a population of at least 200,000 and at least 50 home flips in the third quarter of 2020, those with the highest percentage of home flips sold to FHA buyers -- typically first-time homebuyers -- were El Paso, TX (37.2 percent); Roanoke, VA (36.4 percent); Beaumont, TX (36 percent); Waco, TX (36 percent) and McAllen, TX (35.4 percent).

Only 25 counties had a home flipping rate of at least 10 percent

Home flips accounted for more than 10 percent of all sales in just 25 of the 745 counties with at least 10 home flips in the third quarter of 2020. The top five were Millard County, UT (south of Provo) (15.2 percent); Warren County, TN (outside Murfreesboro) (14 .7 percent); White County (Sparta), TN (14.1 percent); Smith County, TN (outside Nashville) (13.7 percent) and Wayne County (Jesup), GA (13.2 percent).

According to ATTOM Data Solutions third-quarter 2020 U.S. Home Flipping Report, 57,155 single-family homes and condominiums in the United States were flipped in the third quarter of 2020.

Those transactions represented 5.1 percent of all home sales in the third quarter of 2020, or one in 20 transactions. That figure was down from 6.7 percent of all home sales in the nation during the second quarter of 2020, or one in 15, and from 5.5 percent, or one in 18 sales, in the third quarter of last year.

While the home-flipping rate dropped again in the third quarter, both profits and profit margins increased. The gross profit on the typical home flip nationwide (the difference between the median sales price and the median paid by investors) rose in the third quarter of 2020 to $73,766 - the highest amount since at least 2000. That amount was up from $69,000 in the second quarter of 2020 and from $61,800 in the third quarter of last year.

The gain pushed profit margins up, with the typical gross flipping profit of $73,766 in the third quarter translating into a 44.4 percent return on investment compared to the original acquisition price. The gross flipping ROI was up from 42.9 percent in the second quarter of 2020 and 40.3 percent a year ago. The improvement in the typical ROI marked the second consecutive year-over-year increase following nine straight quarters of declines.

The continuation of opposing trends, with flipping rates down but profits up, reflected broader national housing market patterns as the worldwide Coronavirus continued spreading across the United States. Home prices kept soaring throughout most of the country in the third quarter as buyers - often seeking larger or more wide-open spaces - chased a dwindling supply of homes for sale. Rising values continued pushing a nine-year boom in the housing market even as much of the economy struggled to overcome high unemployment and other damage from the pandemic.

"Home-flipping again generated higher profits on less transactions across the United States in the third quarter of 2020 as investors continued to make more money on a declining number of deals," said Todd Teta, chief product officer at ATTOM Data Solutions. "This all happened in the context of the pandemic, which has created unusual circumstances for the housing market to thrive, and that has included the home-flipping business. Too much is uncertain these days to say whether the latest trends will continue. But for now, the prospects continue looking up for home flipping after a period when they were trending the opposite way."

Home flipping rates down in more than 90 percent of local markets

Home flips as a portion of all home sales decreased from the second to the third quarter of 2020 in 148 of the 159 metropolitan statistical areas analyzed in the report (93.1 percent). (Metro areas were included if they had a population of 200,000 or more and at least 50 home flips in the third quarter of 2020.)

Among those metro areas, the largest quarterly decreases in the home flipping rate came in Killeen, TX (rate down 44.5 percent); Savannah, GA (down 43 percent); York, PA (down 42 percent); Greeley, CO (down 41.5 percent) and Springfield, MA (down 39.8 percent).

The biggest quarterly flipping-rate decreases in 53 metro areas with a population of 1 million or more were in Raleigh, NC (rate down 39.1 percent); Atlanta, GA (down 38.5 percent); Kansas City, MO (down 38.3 percent); San Diego, CA (down 38.1 percent) and Rochester, NY (down 37 percent).

The biggest increases in home-flipping rates were in Davenport, IA (rate up 18.5 percent); Hilton Head, SC (up 16.8 percent); Scranton, PA (up 12.2 percent); Amarillo, TX (up 10.9 percent) and Kalamazoo, MI (up 7.7 percent).

Typical home flipping returns rise in two-thirds of markets

Homes flipped in the third quarter of 2020 were sold for a median price of $240,000, with a gross flipping profit of $73,766 above the median investor purchase price of $166,234. That gross-profit figure was up from $69,000 in the second quarter of 2020 and from $61,800 in the third quarter of last year. The increase boosted the typical return on investment in the third quarter of 2020 to 44.4 percent, up from 42.9 percent in the second quarter of 2020 and from 40.3 a year ago. The ROI in the third quarter stood at its highest point since the first quarter of 2018, when it was 48 percent.

Home flipping profit margins increased from the third quarter of 2019 to the third quarter of 2020 in 104 of the 159 metro areas with enough data to analyze (65.4 percent). Markets with the biggest gains included Brownsville, TX (return on investment up 182.9 percent); Austin, TX (up 176.4 percent); Waco, TX (up 157.4 percent); Springfield, MO (up 145.3 percent) and Savannah, GA (up 143.6 percent).

Aside from Austin, TX, metro areas with a population of at least 1 million that had the biggest annual increases in flipping profit margins in the third quarter of 2020 were Raleigh, NC (ROI up 74 percent); Phoenix, AZ (up 69.8 percent); Kansas City, MO (up 55.9 percent) and Las Vegas, NV (up 54.4 percent).

The biggest year-over-year declines in investment returns on home flips during the third quarter of 2020 were in Corpus Christi, TX (ROI down 77 percent); Hilton Head, SC (down 72.9 percent); Boulder, CO (down 69.1 percent); Wilmington, NC (down 58.9 percent) and South Bend, IN (down 54.1 percent).

Investors sell for at least double their purchase price in 14 markets

Median resale prices on home flips in the third quarter of 2020 were at least twice the median investor purchase prices compared to a year earlier in 14 of the 159 metro areas with enough data to analyze (8.8 percent).

They were led by Pittsburgh, PA (151.9 percent return, up from 127.9 percent in the third quarter of 2019); Hickory, NC (136.3 percent return, up from 110.3 percent a year ago); Scranton, PA (117.1 percent return, up from 104.2 percent a year ago); Davenport, IA (114.7 percent return, up from 52.3 percent a year ago) and McAllen, TX (108.9 percent return, up from 81.2 percent a year ago).

The smallest third-quarter 2020 profit margins on typical home flips were in Boulder, CO (7.4 percent, down from 23.8 percent in the third quarter of 2019); Corpus Christi, TX (7.9 percent, down from 34.3 percent a year ago); Hilton Head, SC (9.4 percent, down from 34.6 percent a year ago); Reno, NV (14.3 percent, down from 21.3 percent a year ago) and Killeen, TX (16.6 percent, up from 13.4 percent a year ago).

Highest raw profits still in the West and Northeast and lowest in the South

The highest third-quarter 2020 home flipping profits, measured in dollars, were again concentrated in the West and Northeast. Among metro areas with enough data to analyze, 22 of the top 25 were in those regions, led by San Jose, CA (gross profit of $290,000); Ventura, CA ($180,000); Bridgeport, CT ($177,500); Los Angeles, CA ($161,500) and San Francisco, CA ($158,500).

Among the markets analyzed, 17 of 20 posted the smallest home flipping profits measured in dollars in the third quarter, and were spread across southern metro areas, led by Corpus Christi, TC ($14,817 profit); Hilton Head, SC ($24,000); Killeen, TX ($26,197); El Paso, TX ($27,116) and Lubbock, TX ($28,869).

Home flips purchased with financing or cash remain about the same

Nationally, the portion of flipped homes purchased with financing barely changed, rising from 42.4 percent in the second quarter of 2020 to 42.6 percent in the third quarter of 2020. But the rate was still well down from 49 percent in the third quarter of 2019. Meanwhile, 57.4 percent of homes flipped in the third quarter of 2020 were bought with all cash. That was virtually the same as the 57.6 percent figure in the prior quarter, but still up from 51 percent a year earlier.

Among metropolitan statistical areas with a population of 1 million or more and sufficient data to analyze, those with the highest percentage of flips purchased with financing in the third quarter of 2020 were Seattle, WA (61.2 percent); San Diego, CA (58.7 percent); San Jose, CA (58.2 percent); Louisville, KY (53.9 percent); and San Francisco, CA (53.8 percent).

Average time to flip nationwide rises to 192 days

Home flippers who sold homes in the third quarter of 2020 took an average of 192 days to complete the transactions - the highest level since the third quarter of 2003. The latest number is up from an average of 184 in the second quarter of 2020 and 176 days in the third quarter of last year.

FHA buyers purchase smaller portion of flipped homes

Of the 57,155 U.S. homes flipped in the third quarter of 2020, 14.7 percent were sold to buyers using loans backed by the Federal Housing Administration (FHA), down from 15.3 percent in the prior quarter, but up from 13.6 percent in the same period a year ago.

Among the 159 metro areas with a population of at least 200,000 and at least 50 home flips in the third quarter of 2020, those with the highest percentage of home flips sold to FHA buyers -- typically first-time homebuyers -- were El Paso, TX (37.2 percent); Roanoke, VA (36.4 percent); Beaumont, TX (36 percent); Waco, TX (36 percent) and McAllen, TX (35.4 percent).

Only 25 counties had a home flipping rate of at least 10 percent

Home flips accounted for more than 10 percent of all sales in just 25 of the 745 counties with at least 10 home flips in the third quarter of 2020. The top five were Millard County, UT (south of Provo) (15.2 percent); Warren County, TN (outside Murfreesboro) (14 .7 percent); White County (Sparta), TN (14.1 percent); Smith County, TN (outside Nashville) (13.7 percent) and Wayne County (Jesup), GA (13.2 percent).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More