Residential Real Estate News

U.S. Foreclosure Starts Increase 15 Percent in First Half of 2023

Residential News » Irvine Edition | By Michael Gerrity | July 13, 2023 8:45 AM ET

Based on ATTOM's Midyear 2023 U.S. Foreclosure Market Report, there were a total of 185,580 U.S. properties with foreclosure filings -- default notices, scheduled auctions or bank repossessions -- in the first six months of 2023. That figure is up 13 percent from the same time period a year ago and up 185 percent from the same time period two years ago.

"Similar to the first half of 2022, foreclosure activity across the United States maintained its upward trajectory, gradually approaching pre-pandemic levels in the first half of 2023," stated Rob Barber, CEO for ATTOM. "Although overall foreclosure activity remains below historical norms, the notable surge in foreclosure starts indicates that we may continue to see a rise in foreclosure activity in the coming years."

States that saw the greatest increase in foreclosure activity compared to a year ago in the first half of 2023 included Maryland (up 100 percent); Oregon (up 99 percent); Alaska (up 95 percent); West Virginia (up 83 percent); and Arkansas (up 72 percent).

Illinois, New Jersey, and Maryland post highest state foreclosure rates

Nationwide, 0.13 percent of all housing units (one in every 752) had a foreclosure filing in the first half of 2023.

States with the highest foreclosure rates in the first half of 2023 were Illinois (0.25 percent of housing units with a foreclosure filing); New Jersey (0.24 percent); Maryland (0.23 percent); Delaware (0.23 percent); and Ohio (0.20 percent).

Other states with first-half foreclosure rates among the 10 highest nationwide were South Carolina (0.19 percent); Florida (0.19 percent); Nevada (0.19 percent); Indiana (0.18 percent); and Connecticut (0.16 percent).

Highest metro foreclosure rates in Cleveland, Atlantic City, and Fayetteville

Among the 223 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in the first half of 2023 were Cleveland, Ohio (0.33 percent of housing units with foreclosure filings); Atlantic City, New Jersey (0.33 percent); Fayetteville, North Carolina (0.30 percent); Columbia, South Carolina (0.29 percent); and Lakeland, Florida (0.29 percent).

Other major metro areas with foreclosure rates ranking among the top 10 highest in the first half of 2023 were Chicago, Illinois (0.28 percent of housing units with a foreclosure filing); Jacksonville, Florida (0.26 percent); Florence, South Carolina (0.26 percent); Philadelphia, Pennsylvania (0.25 percent); and Elkhart, Indiana (0.25 percent).

Foreclosure starts up 15 percent from last year

A total of 135,065 U.S. properties started the foreclosure process in the first six months of 2023, up 15 percent from the first half of last year and up 36 percent from the first half of 2020.

States that saw the greatest number of foreclosures starts in the first half of 2023 included California (14,217 foreclosure starts); Florida (13,837 foreclosure starts); Texas (13,419 foreclosure starts); New York (8,772 foreclosure starts); and Illinois (7,995 foreclosure starts).

Bank repossessions climb in first half of 2023 from last year

Lenders foreclosed (REO) on a total of 22,672 U.S. properties in the first six months of 2023, up 9 percent from the first half of 2022 and up 133 percent from the first half of 2021, but down 40 percent from the first half of 2020.

States that posted the greatest number of REOs in the first half of 2023 included Michigan (2,423 REOs); Illinois (2,059 REOs); Pennsylvania (1,420 REOs); California (1,362 REOs); and New York (1,350 REOs).

Q2 2023 foreclosure activity below pre-recession averages in 78 percent of major markets

There were a total of 97,608 U.S. properties with foreclosure filings during the second quarter of 2023, up 2 percent from the previous quarter and up 8 percent from a year ago.

The national foreclosure activity total in Q2 2023 was 65 percent below the pre-recession average of 278,912 per quarter from Q1 2006 to Q3 2007.

Second quarter foreclosure activity was below pre-recession averages in 173 out 223 (78 percent) metropolitan statistical areas with a population of at least 200,000 and sufficient historical foreclosure data, including New York, Los Angeles, Chicago, Dallas, Houston, Miami, Atlanta, San Francisco, Riverside-San Bernardino, Phoenix, and Detroit.

Metro areas with second quarter foreclosure activity above pre-recession averages included Honolulu, HI; Richmond, VA; Baltimore, MD; Virginia-Beach, VA; Albany, New York; and Montgomery, AL.

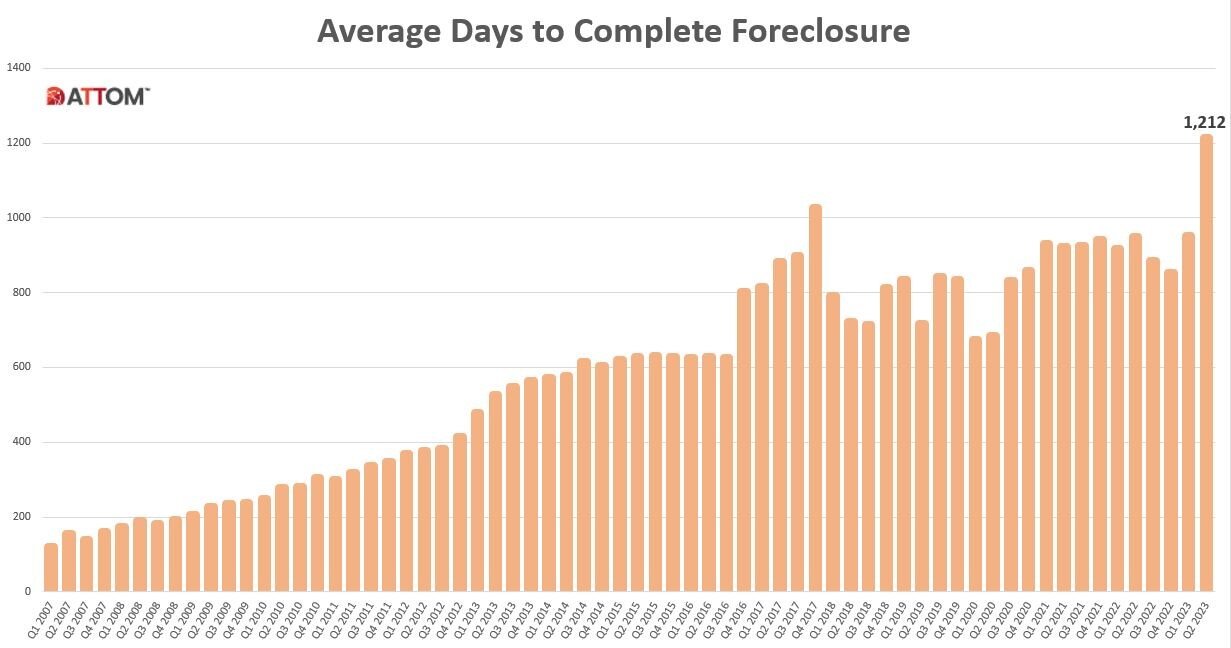

Average time to foreclose hits all-time high

Properties foreclosed in Q2 2023 had been in the foreclosure process an average of 1,212 days, the highest number of average days to foreclose since Q1 2018. That figure was up 28 percent from the previous quarter and up 28 percent from Q2 2022.

States with the longest average foreclosure timelines for homes foreclosed in Q2 2023 were Michigan (2,601 days); Louisiana (2,252 days); New York (1,966 days); Hawaii (1,934 days); and Kentucky (1,921 days).

States with the shortest average foreclosure timelines for homes foreclosed in Q2 2023 were Wyoming (104 days); Minnesota (145 days); Montana (160 days); Texas (162 days); and Missouri (170 days).

June 2023 Foreclosure Activity High-Level Takeaways

- Nationwide in June 2023, one in every 3,972 properties had a foreclosure filing.

- States with the highest foreclosure rates in June 2023 were Maryland (one in every 1,733 housing units with a foreclosure filing); Delaware (one in every 2,171 housing units); New Jersey (one in every 2,189 housing units); Connecticut (one in every 2,272 housing units); and Illinois (one in every 2,348 housing units).

- 24,019 U.S. properties started the foreclosure process in June 2023, up 3 percent from the previous month and up 8 percent from June 2022.

- Lenders completed the foreclosure process on 3,215 U.S. properties in June 2023, down 20 percent from the previous month and down 1 percent from June 2022.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years