Residential Real Estate News

U.S. Home Foreclosures Down 13 Percent Annually in Q3

Residential News » Irvine Edition | By Michael Gerrity | October 10, 2024 7:20 AM ET

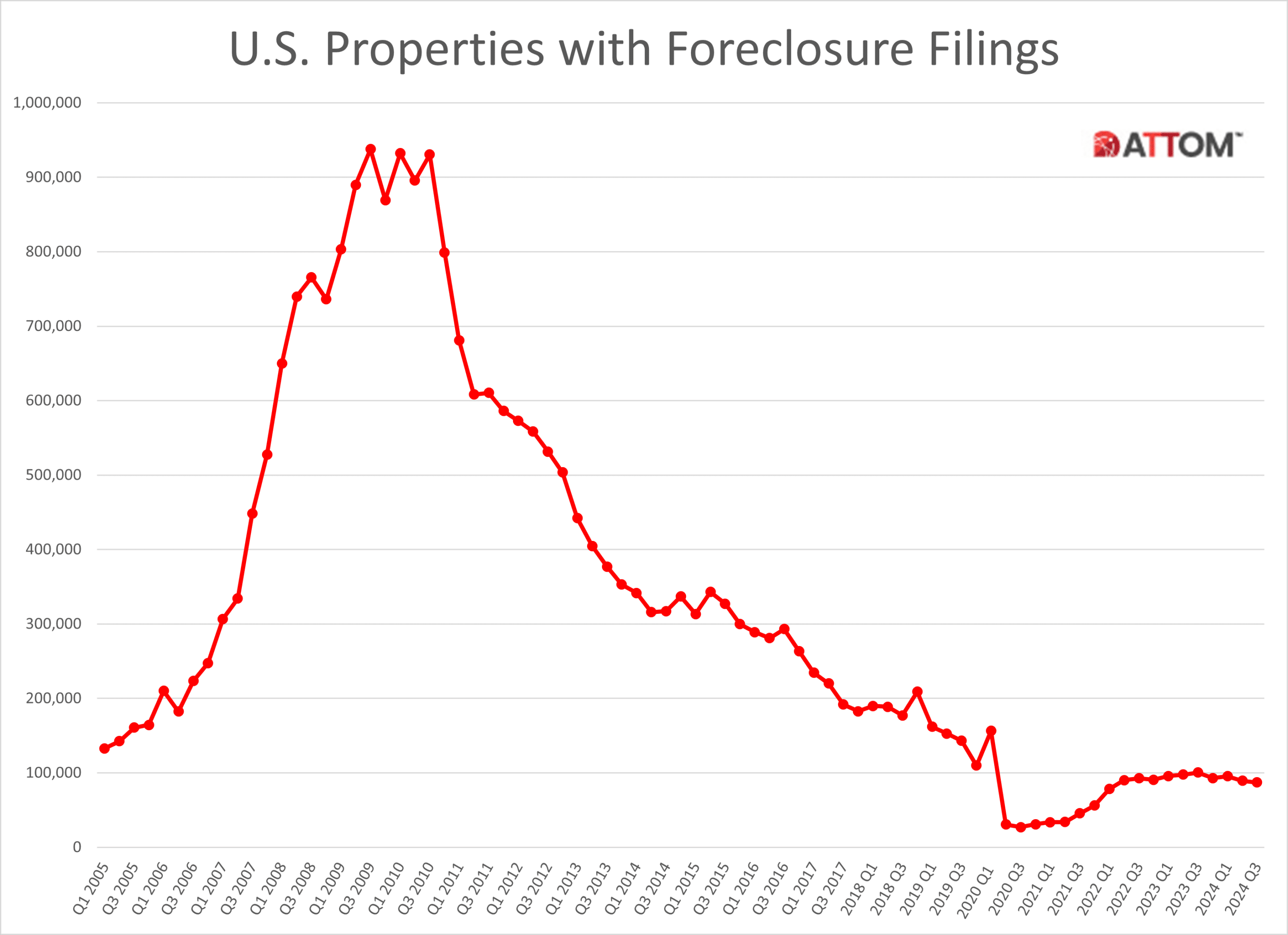

According to ATTOM's newly released Q3 2024 U.S. Foreclosure Market Report, a total of 87,108 U.S. properties had foreclosure filings in the third quarter of 2024, representing a 2 percent decrease from the previous quarter and a 13 percent decline from the same period last year. The report also shows that 29,668 properties had foreclosure filings in September 2024, down 2 percent from August and 19 percent from a year ago.

"While we are seeing a decrease in foreclosure starts and repossessions, it's crucial to remain vigilant, as any economic disruptions or changes in interest rates could shift the current trend," said Rob Barber, CEO of ATTOM. "Moving forward, we anticipate foreclosure levels will stay relatively low, but there could be localized increases in areas struggling with affordability or other market pressures."

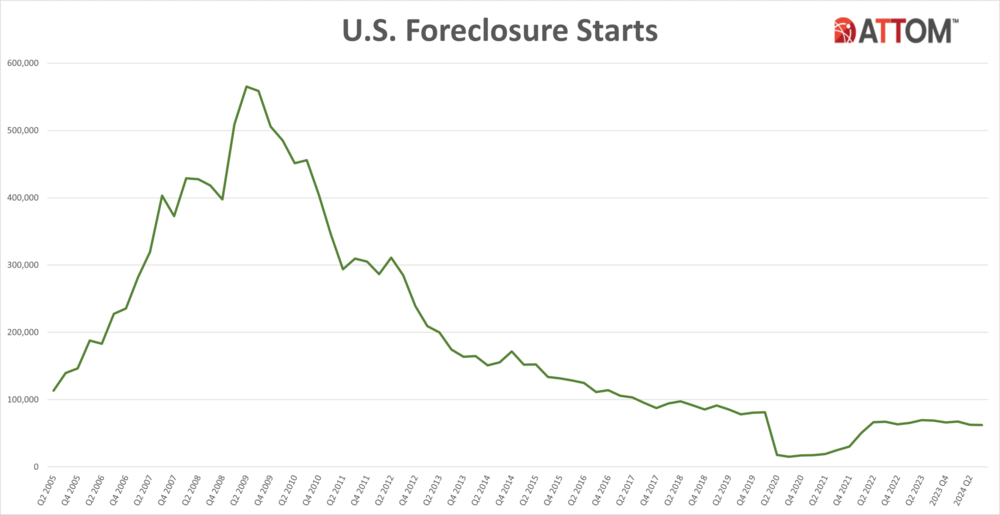

Nationwide Decline in Foreclosure Starts

In Q3 2024, 62,380 U.S. properties entered the foreclosure process, a decline of less than 1 percent from the previous quarter and 10 percent compared to a year earlier. States with over 1,000 foreclosure starts in Q3 2024 that saw the largest annual drops include North Carolina (down 44 percent), Georgia (down 29 percent), Maryland (down 22 percent), New Jersey (down 20 percent), and South Carolina (down 19 percent).

Among major metropolitan areas (population of 200,000 or more), those with the most foreclosure starts in Q3 2024 were New York, NY (3,776), Chicago, IL (3,231), Los Angeles, CA (2,166), Miami, FL (2,142), and Houston, TX (1,791).

Highest Foreclosure Rates in Illinois, Nevada, and Florida

Nationwide, one in every 1,618 housing units had a foreclosure filing in Q3 2024. States with the highest foreclosure rates were Illinois (one in every 904 housing units), Nevada (one in every 922), Florida (one in every 971), Delaware (one in every 1,060), and South Carolina (one in every 1,069).

Among the 224 metropolitan statistical areas with populations of at least 200,000, the highest foreclosure rates in Q3 2024 were recorded in Lakeland, FL (one in every 610 housing units), Provo, UT (one in every 647), Macon, GA (one in every 649), Columbia, SC (one in every 663), and Atlantic City, NJ (one in every 766). Other major metro areas with populations exceeding 1 million and foreclosure rates among the top 15 nationwide include Chicago, IL (one in every 775 housing units), Las Vegas, NV (one in every 796), Cleveland, OH (one in every 819), Orlando, FL (one in every 859), and Riverside, CA (one in every 867).

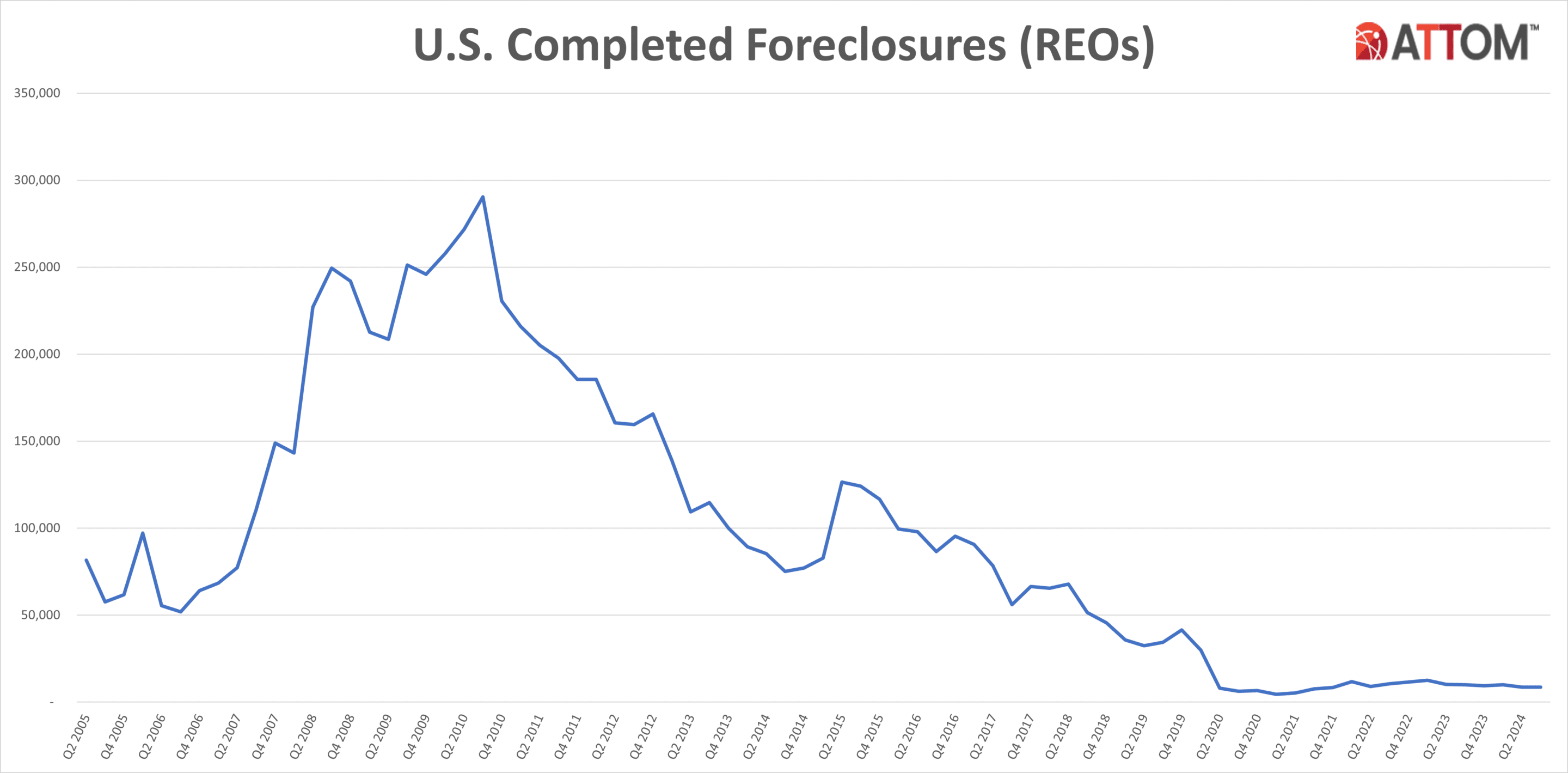

Decrease in Bank Repossessions

Lenders repossessed 8,795 properties in Q3 2024 through foreclosure (REO), marking a 1 percent increase from the previous quarter but a 12 percent decline compared to a year earlier. States with the most REOs in Q3 2024 included California (852), Pennsylvania (715), New York (670), Illinois (668), and Michigan (559).

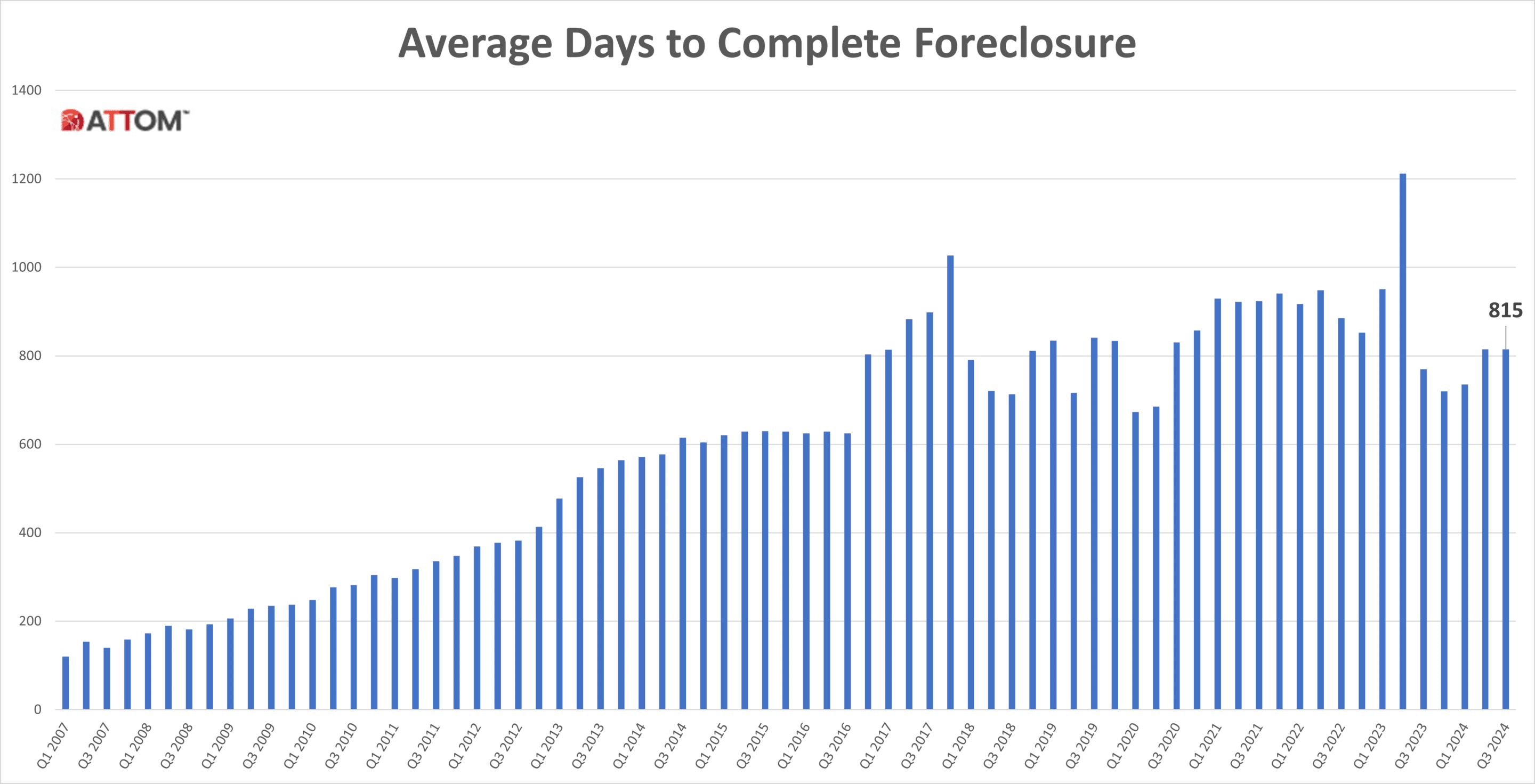

Increase in Average Foreclosure Timeline

Properties foreclosed in Q3 2024 took an average of 815 days to complete the foreclosure process, unchanged from the previous quarter but 6 percent longer than the same period in 2023. States with the longest foreclosure timelines included Louisiana (3,520 days), Hawaii (2,531 days), New York (2,087 days), Rhode Island (1,880 days), and Georgia (1,876 days). States with the shortest timelines included New Hampshire (165 days), Minnesota (172 days), Texas (181 days), Michigan (189 days), and Montana (248 days).

September 2024 Foreclosure Activity Highlights

- Nationwide in September 2024, one in every 4,750 properties had a foreclosure filing.

- States with the highest foreclosure rates in September 2024 were Illinois (one in every 2,494 housing units), Florida (one in every 2,670), Delaware (one in every 2,720), Nevada (one in every 2,735), and Indiana (one in every 3,159).

- 19,763 properties began the foreclosure process in September 2024, down 5 percent from the previous month and 21 percent from September 2023.

- Lenders completed foreclosures on 2,624 properties in September 2024, down 9 percent from August and 21 percent year-over-year.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership