Residential Real Estate News

Mortgage Delinquency Rates Near Pre-Pandemic Levels in U.S.

Residential News » Irvine Edition | By Michael Gerrity | October 14, 2021 8:00 AM ET

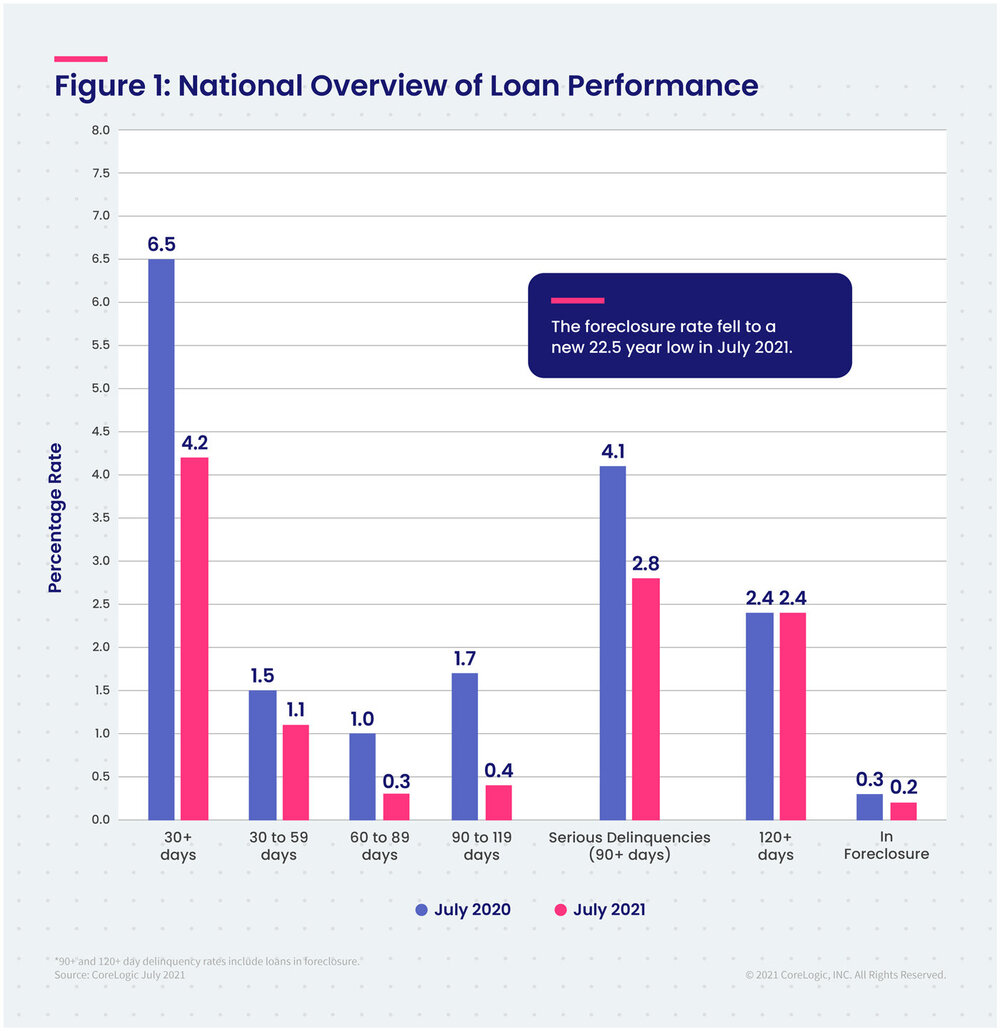

CoreLogic's latest monthly Loan Performance Insights Report shows that 4.2% of all mortgages in the U.S. during July 2021 were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 2.3-percentage point decrease in delinquency compared to July 2020, when it was 6.5%. While overall delinquencies remain above the February 2020, pre-pandemic rate of 3.6%, this is the lowest rate since last March.

To gain an accurate view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In July 2021, the U.S. delinquency and transition rates, and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.1%, down from 1.5% in July 2020.

- Adverse Delinquency (60 to 89 days past due): 0.3%, down from 1% in July 2020.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 2.8%, down from 4.1% in July 2020. While still high, this is the lowest serious delinquency rate since May 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.2%, down from 0.3% in July 2020. This is the lowest foreclosure rate recorded since CoreLogic began recording data (1999).

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, down from 0.8% in July 2020.

While we continue to see serious delinquencies improve, approximately one million people nationwide have been unable to make payments for at least half a year. In fact, the share of borrowers six months or more past due made up about one-half of the total delinquencies in July, with many still leaning on options such as forbearance, loan modifications and other government provisions to keep from entering foreclosure.

"Declining delinquency levels are an encouraging sign of economic improvement and the durability of the housing market," said Frank Martell, president and CEO of CoreLogic. "Looking ahead to the end of many forbearance and other assistance programs, many borrowers receiving support must consider their financial options, including a potential loan modification, to ensure they stay current and keep foreclosures at bay."

"Even if loan modification or income recovery is unable to help delinquent homeowners become and remain current on their payments, the double-digit rise in home prices may help them avoid a distressed sale," said Dr. Frank Nothaft, chief economist at CoreLogic. "Homeowners with substantial home equity are far less likely to experience a foreclosure sale, and fortunately, the CoreLogic Home Equity Report found the average owner gained $51,500 in equity in the past year -- a five-fold annual increase."

State and Metro Takeaways:

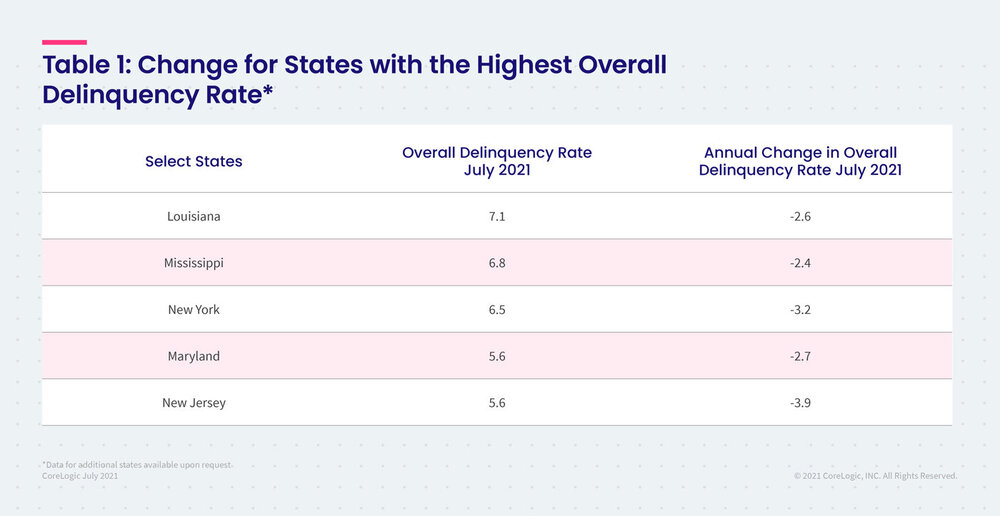

- In July, all U.S. states logged a decrease in annual overall delinquency rates, with New Jersey (down 3.9 percentage points), Florida (down 3.5 percentage points) and Nevada (down 3.3 percentage points) leading with the largest declines.

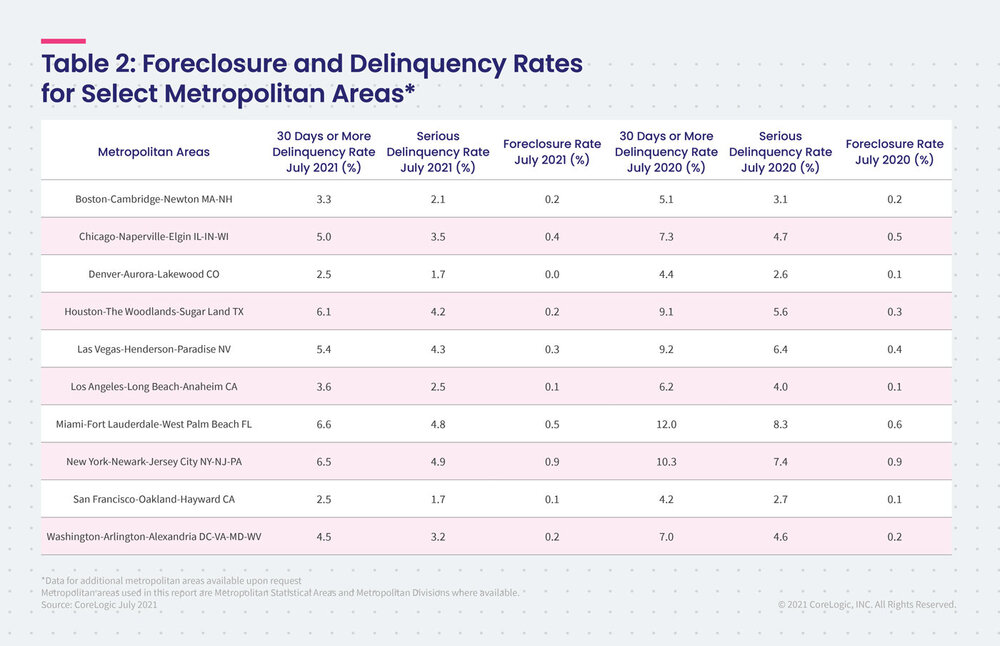

- All U.S. metros also posted an annual decrease in overall delinquency rates in July, with Miami (down 5.4 percentage points), Laredo, Texas (down 5.1 percentage points) and Kingston, New York (down 5 percentage points) posting the largest decreases.

- Nevertheless, elevated overall delinquency rates remain in some metros, including Odessa, Texas (11%); Pine Bluff, Arkansas (10.6%) and Laredo, Texas (10.5%).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years