Residential Real Estate News

Overall U.S. Mortgage Delinquency Rates Dip in December

Residential News » Irvine Edition | By Michael Gerrity | March 6, 2025 8:11 AM ET

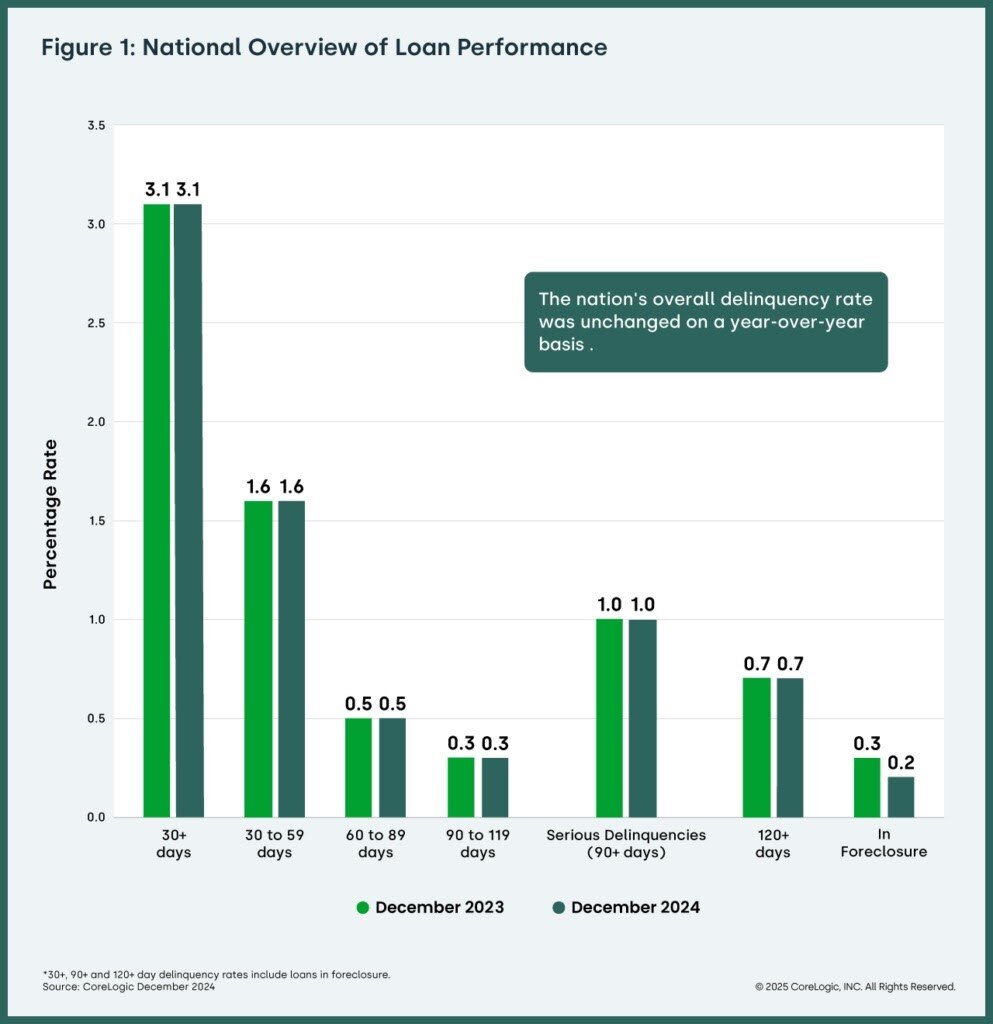

According to CoreLogic's latest Loan Performance Insights Report for December 2024, 3.1% of all U.S. mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure). This figure remains unchanged from December 2023. The report also highlights the foreclosure inventory rate, which stood at 0.2% in December 2024, reflecting a 0.1% decrease from the previous year and matching the lowest level recorded since at least January 1999. Notably, the foreclosure rate has consistently ranged between 0.2% and 0.3% since 2020.

Mortgage Delinquency Trends

CoreLogic analyzes all stages of delinquency to provide a comprehensive view of mortgage market health. In December 2024, delinquency and transition rates, along with their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30-59 days past due): 1.6%, unchanged from December 2023.

- Adverse Delinquencies (60-89 days past due): 0.5%, also unchanged year over year.

- Serious Delinquencies (90+ days past due, including foreclosure): 1%, holding steady from the previous year and continuing its decline from a peak of 4.3% in August 2020.

- Foreclosure Inventory Rate (mortgages in the foreclosure process): 0.2%, down from 0.3% in December 2023.

- Transition Rate (mortgages moving from current to 30 days past due): 0.8%, slightly lower than 0.9% in December 2023.

Market Resilience and Economic Strength

Overall, the national delinquency rate remained unchanged compared to December 2023. As home prices continue to rise, many homeowners are building equity, providing financial flexibility in times of need. While some areas still experience persistent pockets of serious delinquency, the 55% drop in metros recording delinquency increases is a positive sign for homeowners and suggests continued strength in the U.S. economy and labor market.

"December's national delinquency rates show a mortgage market that remains strong, with 97% of borrowers making on-time payments -- matching last year's rate and slightly improving from the previous month," said Molly Boesel, principal economist at CoreLogic. "At the metro level, promising trends have emerged, with the percentage of metropolitan areas experiencing rising delinquencies falling from 80% in November to 36% in December. This reflects the overall strength of the economy and labor market."

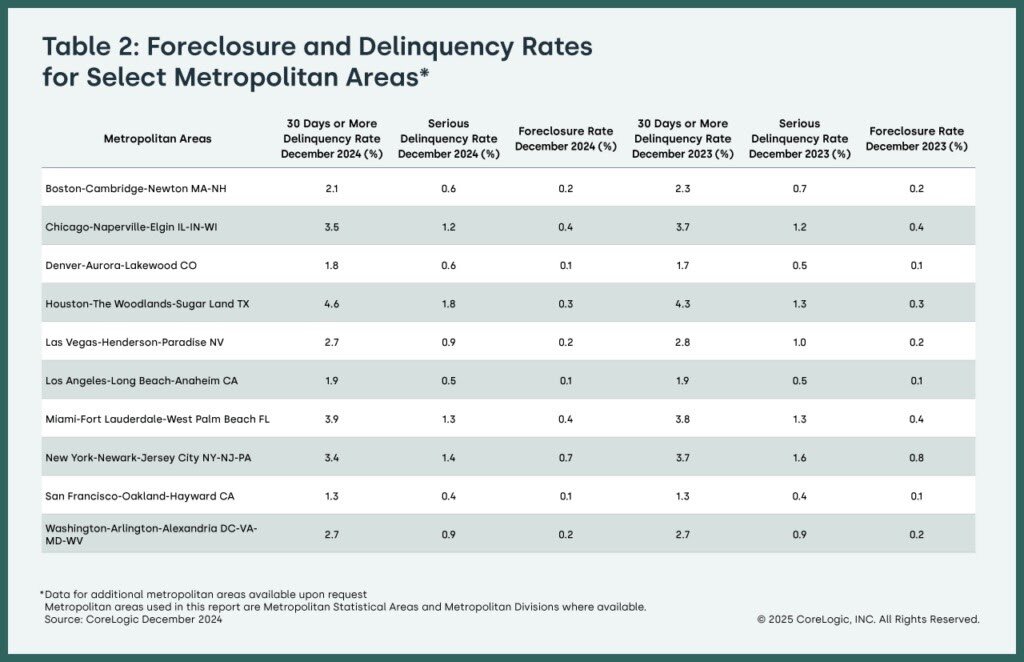

State and Metro Highlights

10 states saw year-over-year increases in mortgage delinquency rates, with the largest gains in:

- Florida (+0.7 percentage points)

- South Carolina (+0.4 percentage points)

- North Carolina & Georgia (both +0.3 percentage points)

- All other states ranged between -0.4 and +0.2 percentage points.

137 out of 384 U.S. metro areas recorded increases in delinquency rates over the past year. The metros with the most significant increases were:

- Asheville, NC (+3.0 percentage points)

- Tampa-St. Petersburg-Clearwater, FL (+2.0 percentage points)

- Augusta-Richmond County, GA-SC (+1.9 percentage points)

- Other year-over-year changes ranged from -2.2 to +1.6 percentage points.

144 metros reported an increase in serious delinquency rates (90+ days past due). The largest annual increases were observed in:

- Asheville, NC (+1.4 percentage points)

- Augusta-Richmond County, GA-SC (+1.2 percentage points)

- Tampa-St. Petersburg-Clearwater, FL & Valdosta, GA (both +0.1 percentage points)

- Other year-over-year changes ranged from -1.8 to +0.9 percentage points.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024