Residential Real Estate News

Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

Residential News » Irvine Edition | By Michael Gerrity | November 27, 2024 5:20 AM ET

Home Rental Growth in U.S. Slows to Lowest Rate in Four Years

CoreLogic's latest Single-Family Rent Index Report (SFRI) examines changes in single-family rental prices both nationally and across major metropolitan areas. The report reveals a slowdown in rent growth across key U.S. metro areas that experienced population surges during the pandemic.

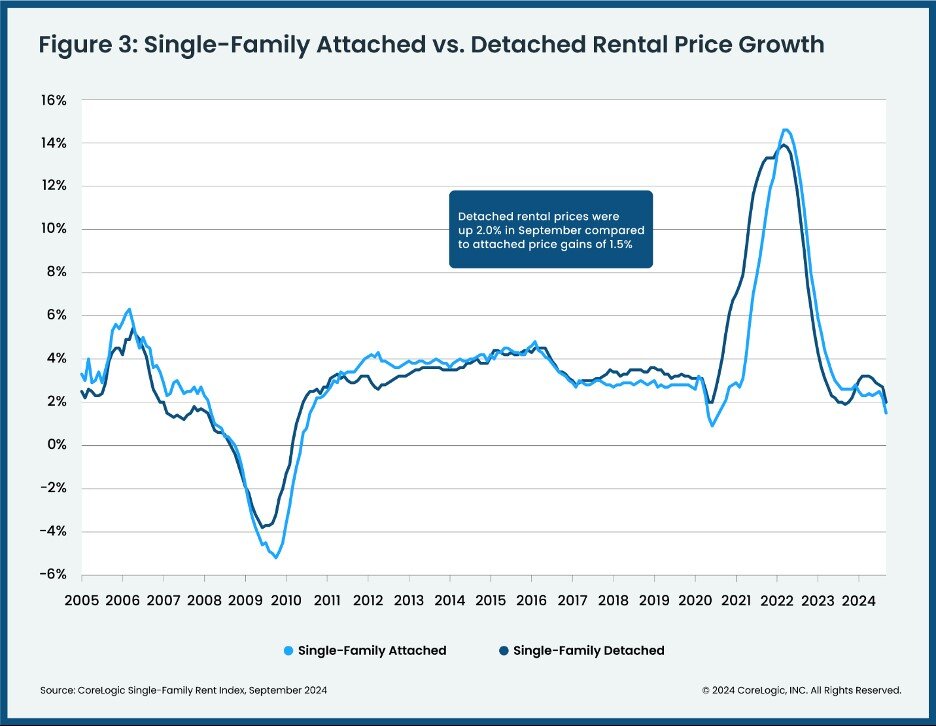

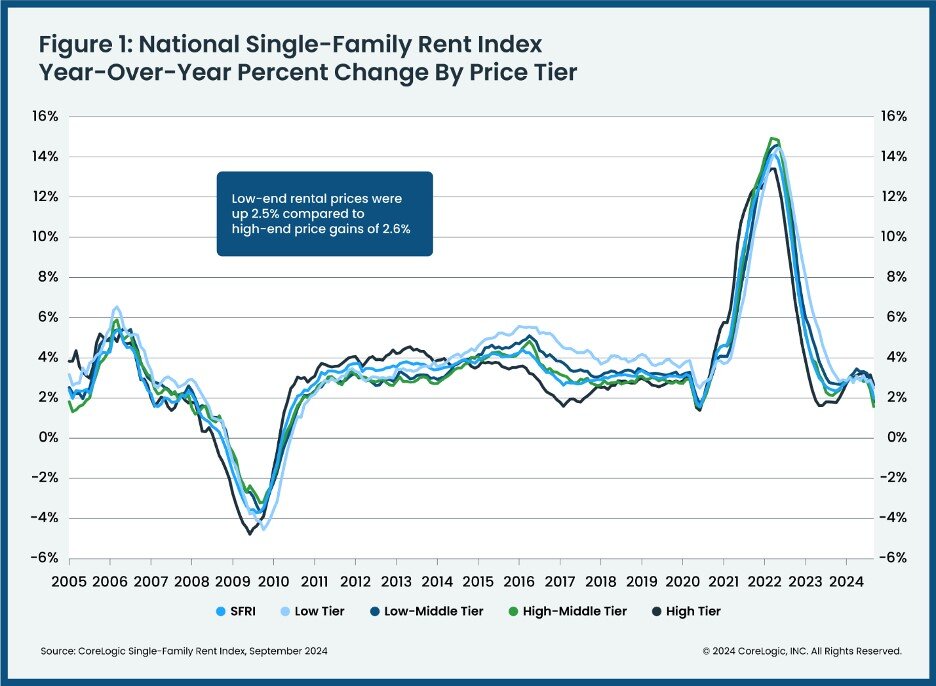

In September 2024, annual U.S. rent growth rose by 2%, continuing a deceleration that began earlier in the year. This rate is significantly lower than the pre-pandemic decade's average annual growth of 3.5%. High-end rental prices grew by 2.6%, slightly outpacing low-end price increases, reflecting a trend of renters capitalizing on favorable economic conditions--such as wages rising by 40% since last September--to move into higher-tier properties.

"Single-family annual rent growth slowed in September to the lowest rate in over four years, and monthly rent growth posted a second month of below-seasonal trend growth, making it clear that single-family rent growth is decelerating," said CoreLogic principal economist Molly Boesel. "While about one-third of metros showed stronger rent growth than in the previous year, more metros showed decreases in rents than in the prior report. While a slowing in rents will be welcome news to renters, increases since 2020 are still at 32%."

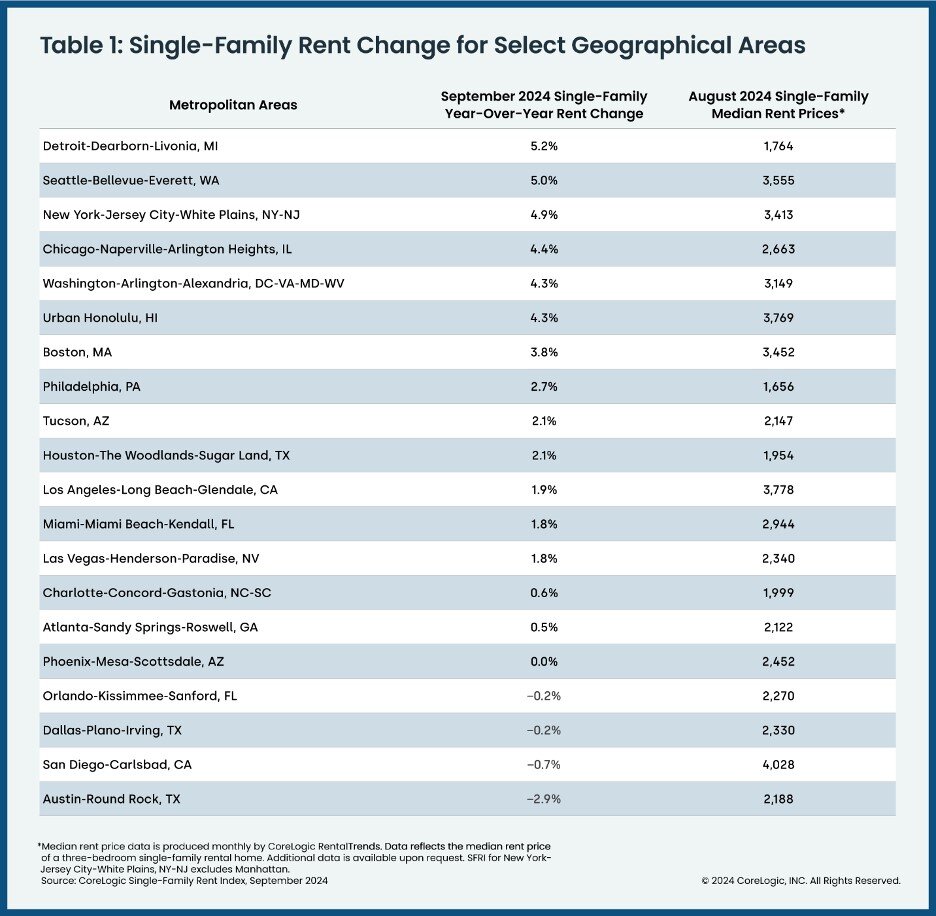

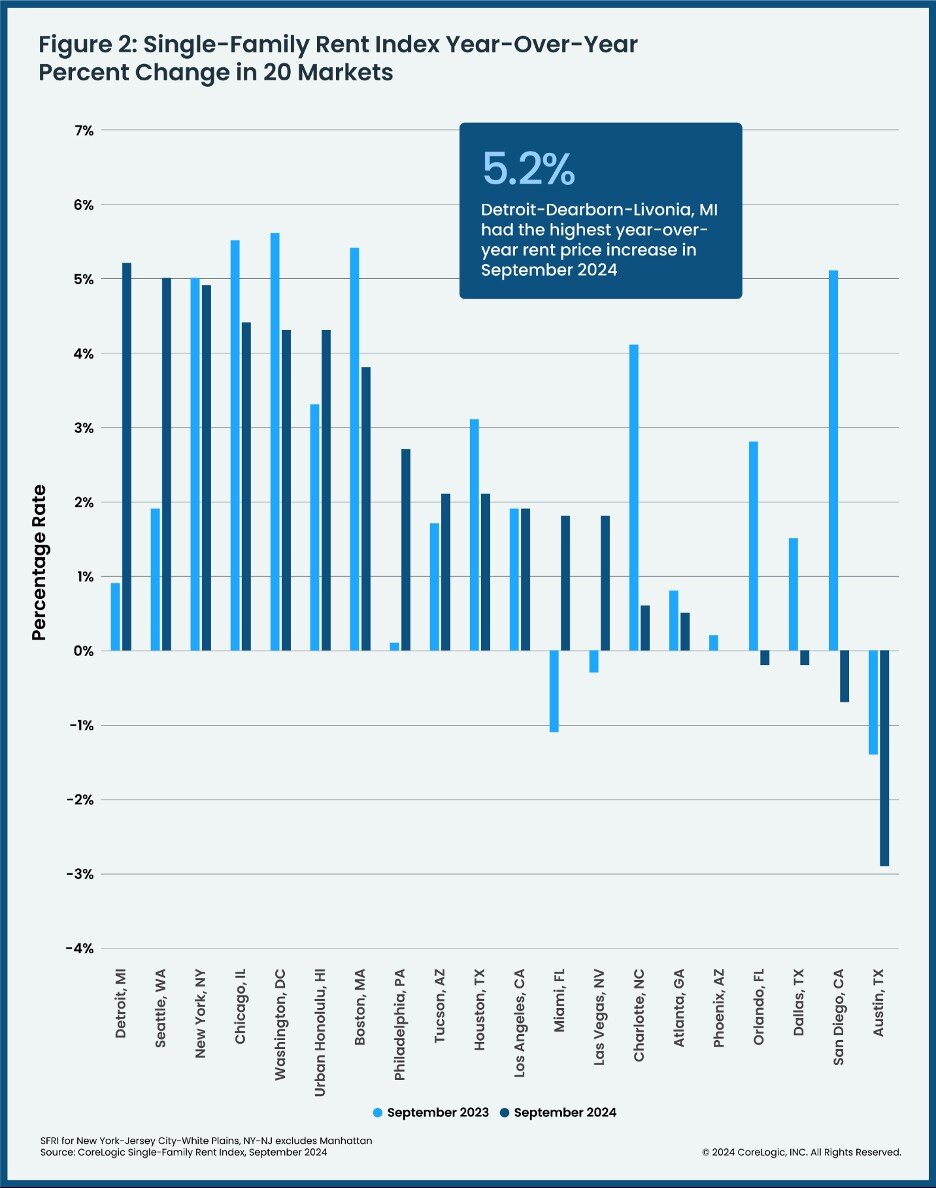

Among the top 20 core-based statistical areas (CBSAs) tracked by CoreLogic, two recorded rent increases of 5% or more, while seven metro areas reported median rents exceeding $3,000.

Detroit led the nation in year-over-year single-family rent growth for September 2024, with a 5.2% increase, followed by Seattle at 5%. Conversely, Austin, Texas, experienced the steepest decline, with rents dropping 2.9% year-over-year, followed by San Diego with a 0.7% decrease.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024