Residential Real Estate News

U.S. Home Sale Profit Margins Hit Another Record High in 2022

Residential News » Irvine Edition | By Michael Gerrity | August 1, 2022 8:38 AM ET

Home profits rise 56 percent in Q2, biggest quarterly gain in a decade

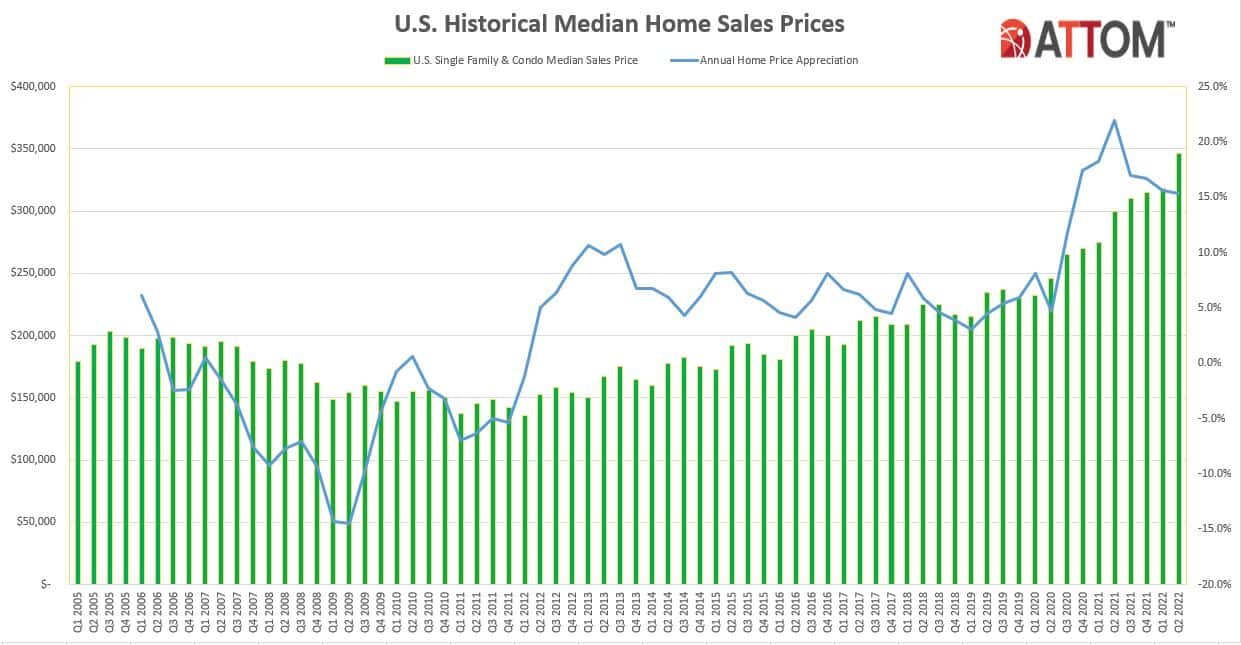

Based on ATTOM's newly released second-quarter 2022 U.S. Home Sales Report, profit margins on median-priced single-family home and condo sales across the United States hit another new record of 55.5 percent following the largest quarterly gain in a decade.

On the heels of a lackluster first quarter of 2022 that suggested possible weakness in the nation's long-running housing market boom, the latest typical profit margin was up from 48.3 percent in the first quarter of 2022 and 42.9 percent in the second quarter of 2021. It was more than 20 points above the 32 percent figure from the second quarter of 2020.

"Home sellers in the second quarter continued to benefit from the rapid growth in home price appreciation the country has experienced over the past few years," said Rick Sharga, executive vice president of market intelligence at ATTOM. "While price growth may slow down as higher mortgage rates dampen demand from prospective homebuyers, home sellers should continue to profit from the record $27 trillion in homeowner equity in today's market."

While profit margins routinely go up during the Spring home-buying season, the latest spike of more than seven percentage points marked the largest quarterly gain since at least 2008. The year-over-year gain of 13 points in the typical return on investment was one of the largest in the past decade.

Gross profits also hit new highs in the second quarter of 2002, after dipping slightly in the early months of the year. The typical single-family home and condo sale across the country generated a gross second-quarter profit of $123,869, up 19 percent from $103,750 in the first quarter of 2022 and up 38 percent from $90,000 a year earlier.

The second-quarter records for gross profits and profit margins came as the national median home price hit a new high of $346,000 in the second quarter of 2022 - the 10th straight quarterly increase. The latest median value was up 8.8 percent from the first quarter of 2022 and 15.3 percent from the second quarter of 2021.

The second quarter profit figures showed how strong the nation's housing market prices remained despite rising economic uncertainty and home-mortgage rates that have surged this year. Average mortgage rates have nearly doubled from a year ago, reaching almost 6 percent for a 30-year fixed rate loan, making affordability a challenge for many potential homebuyers. These higher rates, coupled with rising home prices, the highest U.S. inflation rates in 40 years, and soaring food and fuel prices are all headwinds threatening to slow down what has been a white-hot housing market over the past few years. Still, home prices and seller profits surged anew in the second quarter, after a first quarter that saw a rare dip in investment returns.

Profit margins rise quarterly and annually across most of the U.S.

Typical profit margins - the percent change between median purchase and resale prices - increased from the first quarter of 2022 to the second quarter of 2022 in 162 (89 percent) of the 183 metro areas around the U.S. with sufficient data to analyze. They were up annually in 174 of those metros (95 percent). Metro areas were included if they had at least 1,000 single-family home and condo sales in the second quarter of 2022 and a population of at least 200,000.

The biggest annual increases in profit margins came in the metro areas of Fort Myers, FL (margin up from 47.1 percent in the second quarter of 2021 to 90.9 percent in the second quarter of 2022); Naples, FL (up from 40.4 percent to 83.1 percent); Ocala, FL (up from 44.4 percent to 85.2 percent); Gulfport, MS (up from a loss of 6.5 percent to a gain of 30.8 percent) and Yuma, AZ (up from 42.7 percent to 77.8 percent).

The biggest annual profit-margin increases in metro areas with a population of at least 1 million in the second quarter of 2022 were in Orlando, FL (margin up from 36.4 percent to 67.6 percent); Tampa, FL (up from 47.4 percent to 76.3 percent); Miami, FL (up from 38.9 percent to 66.8 percent); Cleveland, OH (up from 21.4 percent to 42.1 percent) and Jacksonville, FL (up from 43.4 percent to 63.4 percent).

Profit margins decreased annually in just 20 of the 183 metro areas analyzed (11 percent) and annually in only nine metro areas (5 percent). The biggest annual decreases were in Salem, OR (margin down from 87.5 percent in the second quarter of 2021 to 55 percent in the second quarter of 2022); Hilo, HI (down from 140.8 percent to 110.5 percent); Boise, ID (down from 122.8 percent to 100.1 percent); Salisbury, MD (down from 57.1 percent to 48.6 percent) and Albany, NY (down from 35.4 percent to 28.3 percent).

The largest annual decreases, or smallest gains, in profit margins among metro areas with a population of at least 1 million came in Atlanta, GA (down from 48.9 percent to 42.8 percent); Sacramento, CA (up from 61.5 percent to 62.5 percent); San Francisco, CA (up from 81.5 percent to 83.1 percent); Washington, DC (up from 44.9 percent to 46.7 percent) and Boston, MA (up from 49.8 to 52.9 percent).

Prices up in almost every metro area around the U.S.

Median home prices in the second quarter of 2022 exceeded values from the prior quarter in 181 (96 percent) of the 183 metropolitan statistical areas with enough data to analyze and were up annually in 180 of those metros (96 percent). Nationally, the median price of $346,000 in the second quarter was up from $318,000 in the first quarter of 2022 and $300,000 in the second quarter of last year.

The biggest annual increases in median home prices during the second quarter of 2022 were in Gulfport, MS (up 55.3 percent); Naples, FL (up 36 percent); Lakeland, FL (up 35.7 percent); Fort Myers, FL (up 31.7 percent) and Port St. Lucie, FL (up 29.8 percent).

The largest annual increases in metro areas with a population of at least 1 million in the second quarter of 2022 were in Tampa, FL (up 29.3 percent); Orlando, FL (up 25.5 percent); Phoenix, AZ (up 25.3 percent); Nashville, TN (up 24.3 percent) and Charlotte, NC (up 24.2 percent).

Home prices in the second quarter of 2022 hit or tied all-time highs in 168 percent of the 183 metro areas in the report, including New York, NY; Los Angeles, CA; Chicago, IL; Dallas, TX, and Houston, TX.

The largest annual decreases, or smallest increases, in median prices during the second quarter of 2022 were in Toledo, OH (down 3.4 percent); Davenport, IA (down 2.7 percent); Peoria, IL (down 0.8 percent); Rockford, IL (up 2.1 percent) and Trenton, NJ (up 2.2 percent).

The smallest annual increases in metro areas with a population of at least 1 million in the second quarter of 2022 were in Honolulu, HI (up 4.4 percent); Buffalo, NY (up 5.5 percent); Virginia Beach, VA (up 6.3 percent); Rochester, NY (up 6.7 percent) and Baltimore, MD (up 7.4 percent).

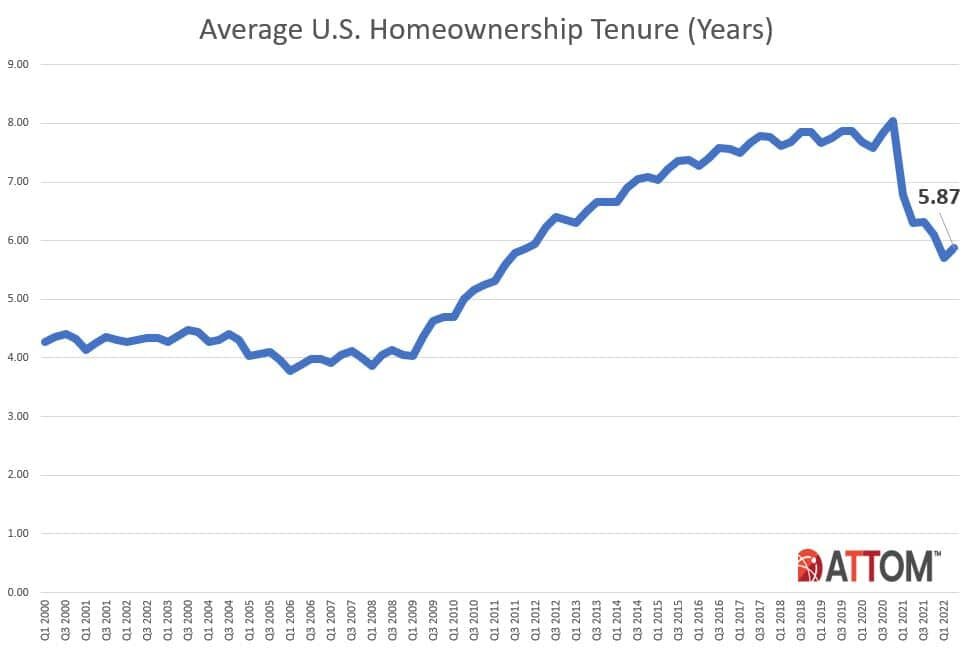

Homeownership tenure remains historically low

Homeowners who sold in the second quarter of 2022 had owned their homes an average of 5.87 years. That was up from 5.71 years in the first quarter of 2022, but down from 6.31 years in the second quarter of 2021. The latest figure was the second-shortest average time between purchase and resale since the first quarter of 2012.

Tenure decreased from the second quarter of 2021 to the same period this year in 88 percent of metro areas with sufficient data. They were led by Lakeland, FL (tenure down 61 percent); Salem, OR (down 51 percent); Yakima, WA (down 30 percent); Provo, UT (down 27 percent) and Eugene, OR (down 24 percent).

Twenty of the 25 longest average tenures among sellers in the second quarter of 2022 were in the Northeast or West regions. They were led by Bellingham, WA (9.6 years); Manchester, NH (9.13 years); Honolulu, HI (7.82 years); Bridgeport, CT (7.76 years) and New Haven, CT (7.52 years).

The smallest average tenures among second-quarter sellers were in Lakeland, FL (1.25 years); Memphis, TN (3.51 years); Tucson, AZ (3.79 years); Knoxville, TN (4.28 years); and Cleveland, OH (4.33 years).

Lender-owned foreclosures decline further to new low since 2000

Home sales following foreclosures by banks and other lenders represented just 1 percent of all U.S. single-family home and condo sales in the second quarter of 2022 - the lowest portion since at least the first quarter of 2000.

The latest portion of REO sales was down from 1.1 percent in the first quarter of 2022 and 1.5 percent in the second quarter of last year. REO sales represented only one of every 96 sales in the second quarter of 2022, a rate that was less than 1/30th of this century's high point of one in three in the first quarter of 2009.

Among metropolitan statistical areas with a population of at least 200,000 and sufficient data, those areas where REO sales represented the largest portion of all sales in the second quarter of 2022 included New Haven, CT (2.7 percent or one in 37 sales); Chicago, IL (2.7 percent); Syracuse, NY (2.7 percent), Mobile, AL (2.5 percent) and St. Louis, MO (2.3 percent).

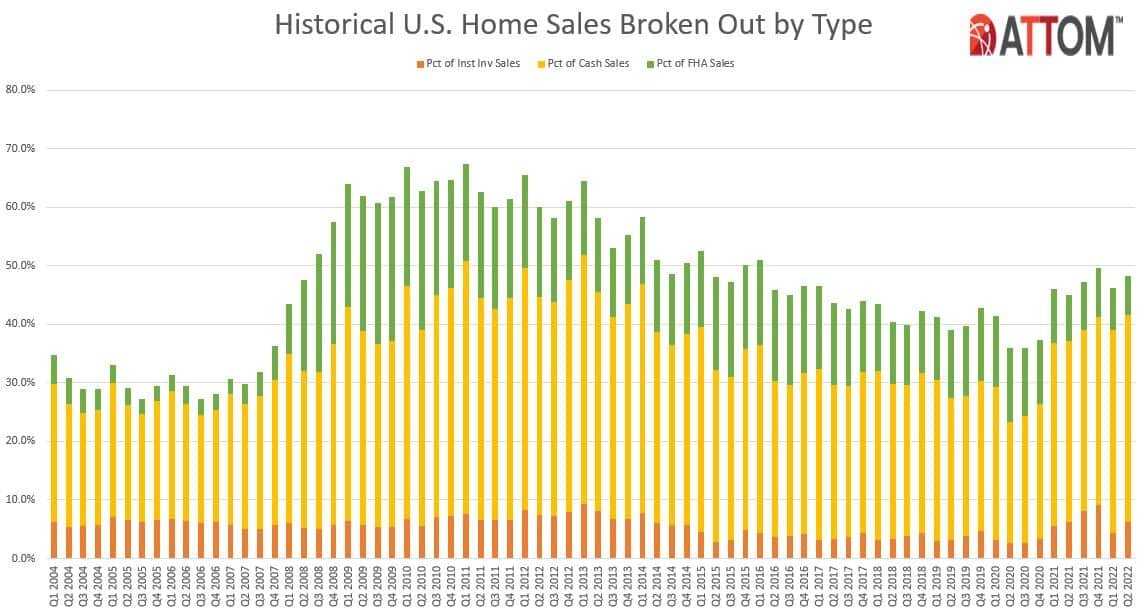

Cash sales at eight-year high

Nationwide, all-cash purchases accounted for 35.4 percent of all single-family home and condo sales in the second quarter of 2022, the highest level since the first quarter of 2014. The second-quarter-of-2022 number was up from 34.6 percent in the first quarter of 2022 and from 31 percent in the second quarter of last year.

"Cash buyers have continued to account for a higher percentage of home sales than usual, probably due in part to homeowners selling properties in high cost states and using the proceeds to buy a home with cash in lower cost areas," Sharga noted. "With mortgage rates almost doubling over the past year and the cost of financing soaring, cash buyers will be in an even stronger position of competitive advantage for the foreseeable future,"

Among metropolitan areas with a population of at least 200,000 and sufficient cash-sales data, those where cash sales represented the largest share all transactions in the second quarter of 2022 included Naples, FL (57.2 percent); Utica, NY (52.7 percent), Youngstown, OH (52.6 percent); Atlanta, GA (51.3 percent) and Salisbury, MD (51 percent).

Those where cash sales represented the smallest share of all transactions in the second quarter of 2022 included Gainesville, GA (5.1 percent of all sales); Athens, GA (14.4 percent); Lincoln, NE (16.2 percent); San Jose, CA (18 percent) and Des Moines, IA (18.1 percent).

Institutional investment rises

Institutional investors nationwide accounted for just 6.2 percent, or one of every 16 single-family home purchases in the second quarter of 2022. That was the same portion as in the second quarter of 2021, but up from 4.4 percent in the first quarter of 2022.

Among states with enough data to analyze, those with the largest percentages of sales to institutional investors in the second quarter of 2022 were Arizona (16.7 percent of all sales), Georgia (13.1 percent), Nevada (13 percent), North Carolina (9.9 percent) and Tennessee (8.9 percent).

States with the smallest levels of sales to institutional investors in the second quarter of 2022 included Maine (1 percent), New Hampshire (1 percent), Hawaii (1.2 percent), Louisiana (1.6 percent) and Vermont (1.6 percent).

FHA-financed purchases at lowest level in almost 15 years

Nationwide, buyers using Federal Housing Administration (FHA) loans comprised only 6.7 percent of all single-family home purchases in the second quarter of 2022 (one of every 15), the smallest portion since the fourth quarter of 2007. The latest figure was down from 7.3 percent in the previous quarter and from 7.9 percent a year earlier.

"FHA borrowers - and borrowers with VA loans - have been at a significant disadvantage in a housing market characterized by historically short sales cycles and near-record levels of cash buyers," Sharga added. "If days on market continue to increase, leveling the playing field a little bit for these borrowers, we could see the volume of homes purchased by FHA and VA borrowers climb back up to more normal levels."

Among metropolitan statistical areas with a population of at least 200,000 and sufficient FHA-buyer data, those with the highest levels of FHA buyers in the second quarter of 2022 included Visalia, CA (18.6 percent); Bakersfield, CA (18.4 percent); Beaumont, TX (16.9 percent); Merced, CA (16.2 percent) and Shreveport, LA (15.6 percent).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years