Residential Real Estate News

Ownership More Affordable Than Renting in Most U.S. Markets

Residential News » Irvine Edition | By David Barley | February 13, 2025 8:29 AM ET

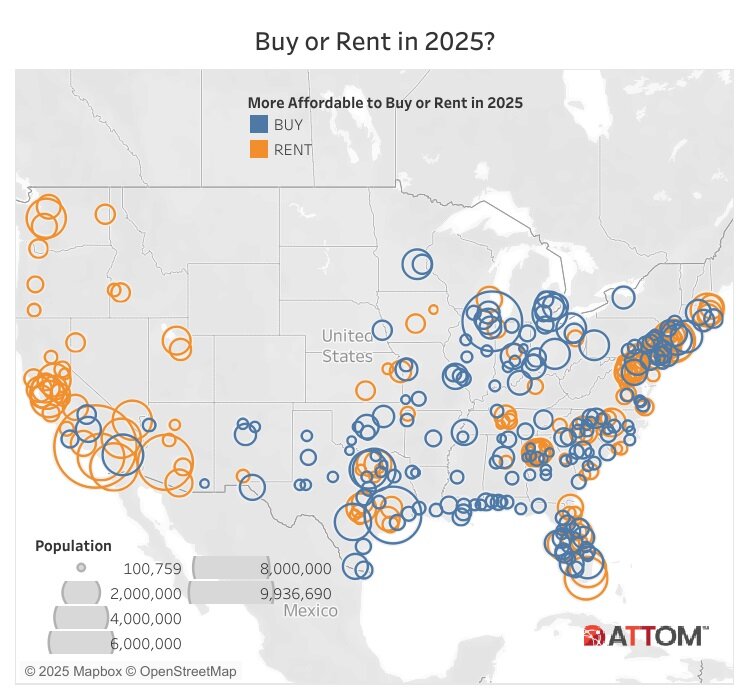

According to ATTOM's newly released 2025 Rental Affordability Report, purchasing a home is more affordable than renting a three-bedroom property in over half of county-level markets across the United States.

The report highlights that both homeownership and renting remain financially challenging for the average U.S. worker, with housing costs typically consuming between 25% and 60% of wages. However, in nearly 60% of the 341 counties analyzed, major homeownership expenses on single-family homes require a smaller share of average wages than renting a three-bedroom residence.

For those who can afford a down payment, buying a home remains the more cost-effective option, despite median home prices rising faster than average rents over the past year.

Data-Driven Analysis of Housing Affordability

The report's findings are based on ATTOM's data on average rents and public-record sales of single-family homes, combined with wage statistics from the Bureau of Labor Statistics.

"Finding an affordable home, whether to rent or buy, is like searching for a diamond in a pile of marbles--it's getting tougher as prices continue to climb," said Rob Barber, CEO of ATTOM. "However, in most areas, homeownership remains within reach for those who can manage down payments, which often exceed $200,000."

Barber also cautioned that rising mortgage rates could impact affordability, stating, "The situation remains fragile, particularly if rates continue their upward trend. But for now, homeownership is the better financial option."

Home Prices Outpacing Rent Increases in Most Markets

The report reveals that median home prices have risen--or declined at a slower rate--compared to average three-bedroom rents in 225 of the 341 counties analyzed (66%). The study included counties with populations of at least 100,000 and sufficient housing market data from 2024 to 2025.

Among the largest counties where home prices have increased more than rental rates are:

- Los Angeles County, CA

- Cook County (Chicago), IL

- Maricopa County (Phoenix), AZ

- San Diego County, CA

- Orange County, CA

Conversely, in 116 counties (34%), average rents have risen more than home prices. The most populous of these counties include:

- Harris County (Houston), TX

- Tarrant County (Fort Worth), TX

- Bexar County (San Antonio), TX

- Suffolk County, NY (outside New York City)

- Franklin County (Columbus), OH

Regional Disparities in Homeownership Affordability

The affordability of homeownership varies significantly by region. The Midwest and South present the most favorable conditions for buying, with ownership requiring a smaller share of wages in about:

- 80% of counties in the Midwest

- 60% of counties in the South

- 50% of counties in the Northeast

However, the West bucks this trend, where renting remains the more affordable option in roughly 80% of western markets.

Largest Gaps in Affordability Favoring Homeownership

Among the 341 counties examined, the biggest gaps where owning a home is more affordable than renting include:

- Suffolk County, NY - 59% of wages for homeownership vs. 159% for renting

- Atlantic County, NJ (Atlantic City) - 48% vs. 111%

- Collier County, FL (Naples) - 79% vs. 127%

- Indian River County, FL (Vero Beach) - 47% vs. 83%

- Charlotte County, FL (Punta Gorda) - 43% vs. 69%

In counties with populations over 1 million, the largest affordability gaps in favor of homeownership are:

- Riverside County, CA - 71% vs. 91%

- Wayne County, MI (Detroit) - 15% vs. 22%

- Cook County, IL (Chicago) - 31% vs. 36%

- Allegheny County, PA (Pittsburgh) - 21% vs. 25%

Counties Where Renting Remains the More Affordable Option

In some major markets, renting remains the less costly choice, including:

- Alameda County, CA (Oakland) - 48% for renting vs. 87% for homeownership

- Honolulu County, HI - 64% vs. 103%

- San Mateo County, CA - 31% vs. 69%

- Santa Clara County, CA (San Jose) - 27% vs. 64%

- Loudoun County, VA (outside Washington, D.C.) - 45% vs. 81%

While affordability remains a challenge nationwide, homeownership is the better financial choice in most markets -- particularly in the Midwest and South. However, factors such as rising mortgage rates and regional price trends could shift the balance in the future.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

- Meet HAL, Real Estate Agent of the Future

- U.S. Homes Are Selling at Slowest Pace in 5 Years in Early 2025

- Pending Home Sales Dive Across America in December

- Greater Miami Residential Sales Uptick 3 Percent Annually in 2024

- U.S. Mortgage Applications Downtick in late January

- Under Biden, 2024 Marked the Slowest U.S. Home Sales Period in 30 Years

- Single-family Rent Growth in U.S. Slows to Lowest Rate in 14 Years

- Housing Starts Spike 15 Percent in America in Late 2024

- Day One: Trump Issues Executive Order on Emergency Price Relief for U.S. Housing

- 89 Percent of Homes Destroyed by Los Angeles Fires Were Single-Family Residences

- New AI-Powered Global Listings Service Under Construction

- World Property Media to Commence Industry Funding Round to Launch WPC TV

- Mortgage Rates in America Above 7 Percent, Again

- U.S. Residential Foreclosures Dip 10 Percent Annually in 2024

- U.S. Residential Asking Rents End 2024 at Lowest Levels in 3 Years

- World Property Markets to Commence Industry-wide Joint Venture Fundraise

- One Third of U.S. Homeowners Say They Will Never Sell

- Catastrophic Wildfires Devastating Tens of Billions of Dollars of Southern California Properties

- Is Greenland Soon Going to be Trump's Biggest Real Estate Deal?

- Greater Las Vegas Home Sales Jump 19 Percent Annually in December

- Active U.S. Residential Listings Spike 22 Percent in December

- U.S. Mortgage Rates Rise in Early 2025, Reach 6-Month High

- Greater Palm Beach Area Condo, Home Sales Collapse in November

- U.S. Pending Home Sales Increase Four Straight Months in November

- Global Real Estate Podcasts Coming to WPC TV Next Year

- Ireland Home Prices Spike 9 Percent in 2024

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November