Residential Real Estate News

California Home Prices Continue to Set New Records in March

Residential News » Laguna Beach Edition | By Michael Gerrity | May 6, 2022 9:04 AM ET

Statewide average price per square foot eclipses $400 for the first time

According to the California Association of Realtors, housing demand in California remained strong in March 2022 as the effects of rising interest rates have yet to be borne out while the statewide median home price sets another record high, primarily due to a surge in sales of higher-priced homes.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 426,970 in March, according to information collected by C.A.R. The statewide annualized sales figure represents what would be the total number of homes sold during 2022 if sales maintained the March pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

March's sales pace ticked up 0.5 percent on a monthly basis from 424,640 in February and was down 4.4 percent from a year ago, when 446,410 homes were sold on an annualized basis. The year-over-year sales decrease was the ninth straight decline and the smallest in eight months.

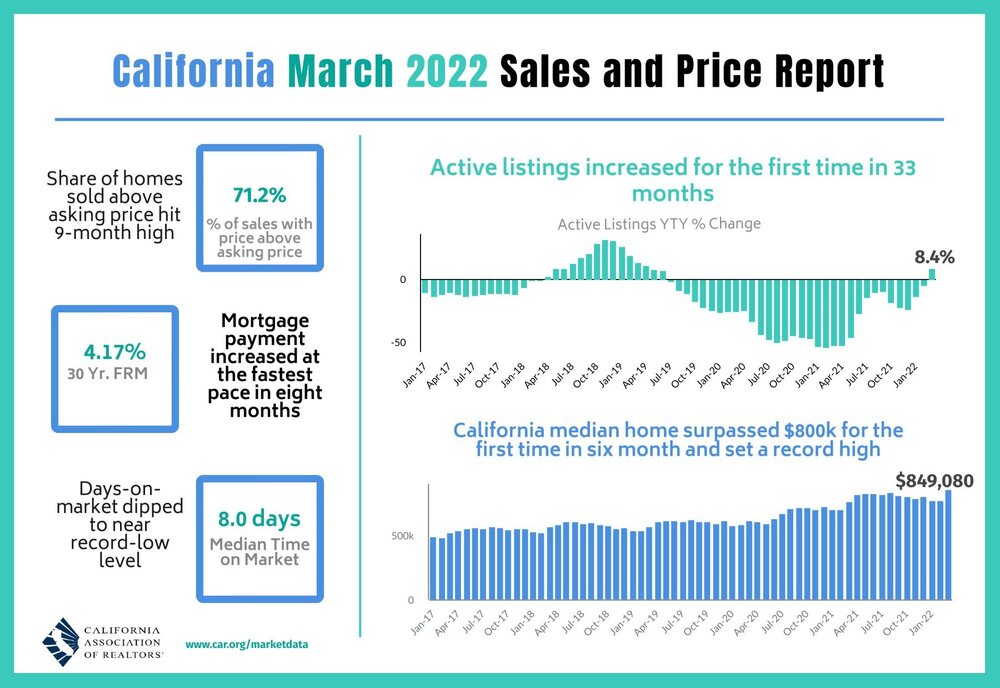

"With homes still selling at a rapid clip and more homes selling above asking price than last summer when prices were at record highs, California's housing market continues to perform remarkably well as buyers enter the market to get ahead of rising mortgage interest rates," said C.A.R. President Otto Catrina. "An increase in active listings for the first time since prior to the pandemic should give consumers more options and alleviate some of the upward pressure on home prices, which bodes well for prospective buyers."

California's median home price reached a new record high in March at $849,080 -- surpassing the previous record of $827,940 set in August 2021 and rising above the $800,000 benchmark for the first time in six months. The March price was 11.9 percent higher than the $758,990 recorded last March. The month-to-month percent change in median price was the highest pace since March 2013, and the 10.1 percent increase from February was the first time in nine years that the monthly price increase was in the double-digits.

A surge in sales at the top end of the market was the primary factor for the jump in the statewide median price at the end of the first quarter. The share of million-dollar home sales increased for the second consecutive month, surging to 32.9 percent in March, the highest level on record. Additionally, strong month-to-month sales growth in the San Francisco Bay Area contributed to the jump in sales of million-dollar homes statewide, as 70 percent of the region's sales were priced above $1 million, and sales in the region increased 70.5 percent from February.

"March sales data continues to suggest strong buying interest and a solid housing market, as the effects of higher mortgage interest rates won't be realized for a few more months," said C.A.R. Vice President and Chief Economist Jordan Levine. "With the Federal Reserve expected to announce two back-to-back half-point interest rate hikes in May and June to combat inflation, interest rates will be elevated for the foreseeable future, adversely affecting housing demand and lowering housing affordability in the coming months, but the effects may not be visible until the second half of the year as many of the homes that are, or will be, closing were negotiated before the sharp increase in rates."

Key points from C.A.R.'s March 2022 resale housing report:

- At the regional level, home sales in all major California regions, except the Central Valley recorded sales decreases on a year-over-year basis. The Central Coast region recorded the sharpest sales decline of all regions again, dropping 20.1 percent from a year ago. Housing demand in the Central Coast region was exceptionally strong last year though with sales climbing 31.8 percent in March 2021, and as such, a sizable dip was anticipated. The Far North had the second largest sales decline at 7.7 percent, followed by Southern California (-7.5 percent) and the San Francisco Bay Area (-2.7 percent). Sales in the Central Valley increased for the second straight month with a year-over-year increase of 2.8 percent.

- Nearly two-thirds (62.7 percent) of all counties tracked by C.A.R. experienced a decline in existing home sales from a year ago, compared to 72.5 percent the prior month. Thirteen counties in the state posted a sales drop of more than 10 percent from a year ago, with Plumas falling the most at 40.5 percent, followed by Glenn (-37.0 percent) and Tehama (-35.8 percent). Counties that experienced a sales drop from last year had an average decrease of -12.5 percent in March. The number of counties with a year-over-year sales increase improved from 14 in February to 19 in March, with Mono (88.9 percent) surging the most from a year ago, followed by Yuba (52.9 percent) and Mariposa (43.8 percent).

- At the regional level, home prices in all major California regions continued to surge from last year by double-digits, with four of them reaching a new record high in March. The Central Coast region recorded the highest year-over-year price growth with a 20.4 percent increase, followed by the Central Valley (19.3 percent), the San Francisco Bay Area (17.9 percent), Southern California (13.8 percent), and the Far North (12.9 percent). The Far North was the only region that did not set a new median high in March.

- At the county level, home prices continued to increase across the state, with 25 counties setting new record highs in March. Forty-six out of fifty-one counties tracked by C.A.R. experienced increases in their median prices in March, with 38 of them rising more than 10 percent from a year ago. Santa Cruz continued to post the biggest year-over-year price gain at 45.5 percent, followed by Tehama (34.4 percent) and Tuolumne (31.0 percent). Five counties recorded a decline from last year, with Mono dropping the most at -35.3 percent, followed by Lassen (-3.6 percent) and Monterey (-2.1 percent).

- Housing supply conditions in California appear to be turning the corner as the Unsold Inventory Index (UII) was unchanged from a year ago at 1.7 months in March, marking the first time in nearly two years that the index did not decline on a year-over-year basis. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

- Active listings in March climbed to the highest level in five months and posted the first year-over-year gain since June 2019. Newly added listings in March also increased for the first time in nine months, reaching the highest level since August 2021. The month-to-month increase of 37.7 percent in newly added listings was also the highest since May 2020.

- The median number of days it took to sell a California single-family home was 8 days in March and 8 days in March 2021.

- C.A.R.'s statewide sales-price-to-list-price ratio was 103.9 percent in March 2022 and 102.2 percent in March 2021.

- The statewide average price per square foot for an existing single-family home rose above $400 for the first time. March's price per square foot was $418, up from $357 in March a year ago.

- The 30-year, fixed-mortgage interest rate averaged 4.17 percent in March, up from 3.08 percent in March 2021, according to Freddie Mac. The five-year, adjustable mortgage interest rate averaged 3.19 percent, compared to 2.78 percent in March 2021.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years