Residential Real Estate News

Orange County, Chicago, Phoenix, and Washington DC Become Trillion Dollar U.S. Housing Markets

Residential News » Laguna Beach Edition | By Michael Gerrity | August 12, 2024 7:05 AM ET

Redfin reports that the total value of housing has now surpassed $1 trillion in eight U.S. markets. Orange County, Chicago, Phoenix, and Washington D.C. have recently joined Los Angeles, New York, Atlanta, and Boston in this exclusive group. This expansion highlights the significant surge in home prices over the past year.

Orange County California's housing market alone saw a $121 billion increase in value, reaching $1.11 trillion as of June 30, making it the fifth-most valuable market according to Redfin. The added $121 billion in value nearly matches the total worth of all homes in either Rochester, NY, or New Orleans.

To put this into perspective, Orange County's 12% increase in value over the past year ranks as the third-largest percentage gain among the 95 major U.S. markets analyzed.

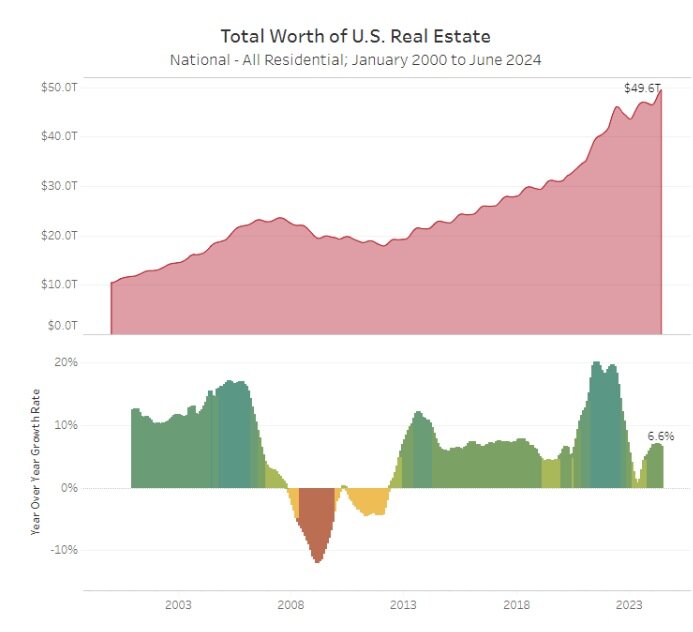

Redfin's report, which assessed the value estimates of over 95 million U.S. residential properties as of June 2024, also revealed that the total value of homes nationwide rose by $3.1 trillion, reaching a record $49.6 trillion in the past year.

Chen Zhao, a Redfin economist, predicts that the U.S. housing market will likely surpass the $50 trillion mark within the next 12 months, citing the limited number of homes on the market as a key factor driving prices higher. This shortage of supply has been a consistent theme in the U.S. housing market, leading to one of the most unaffordable housing markets in a generation.

Home prices saw a sharp rise during the pandemic, as families and remote workers took advantage of historically low borrowing costs to upgrade their living spaces. However, the Federal Reserve's aggressive interest rate hikes aimed at curbing inflation have caused mortgage rates to soar, significantly increasing monthly payments for new homeowners.

Redfin's report also found that home values in certain cities are rising faster than others. In New Jersey, two cities within commuting distance of New York City--New Brunswick and Newark--experienced the fastest year-over-year growth in home values, with increases of 13.3% and 13.2%, respectively.

On the other hand, Cape Coral, Florida, was the only metro area where home values declined, with a 1.6% drop over the past year. New Orleans and Austin also saw growth rates of less than 2%.

While existing homeowners have enjoyed the wealth boost from rising home values, prospective buyers face a challenging market. According to a May Gallup survey, only 21% of Americans believe it is a good time to buy a home.

However, mortgage rates have recently decreased, possibly in anticipation of a potential interest rate cut by the Federal Reserve in September. Although the Fed doesn't directly set mortgage rates, its actions influence borrowing costs across the economy.

Trillion Dollar U.S. Housing Markets in 2024

- New York: $2.5 trillion - up 8% in a year or a $190 billion jump.

- Los Angeles: $2.2 trillion - up 6% or $128 billion.

- Atlanta: $1.3 trillion - up 5% or $62 billion.

- Boston: $1.3 trillion - up 7% or $85 billion.

- Orange County California: $1.11 trillion - up 12% or $121 billion in a year.

- Chicago: $1.08 trillion - up 9% or $85 billion in a year.

- Washington, DC: $1.05 trillion - up 7% or $67 billion in a year.

- Phoenix: $1 trillion - up 6% or $53 billion in a year.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years