Vacation Real Estate News

Covid Driven Vacation Home Boom in America Now Ending in 2022

Vacation News » Laguna Beach Edition | By Michael Gerrity | April 15, 2022 8:59 AM ET

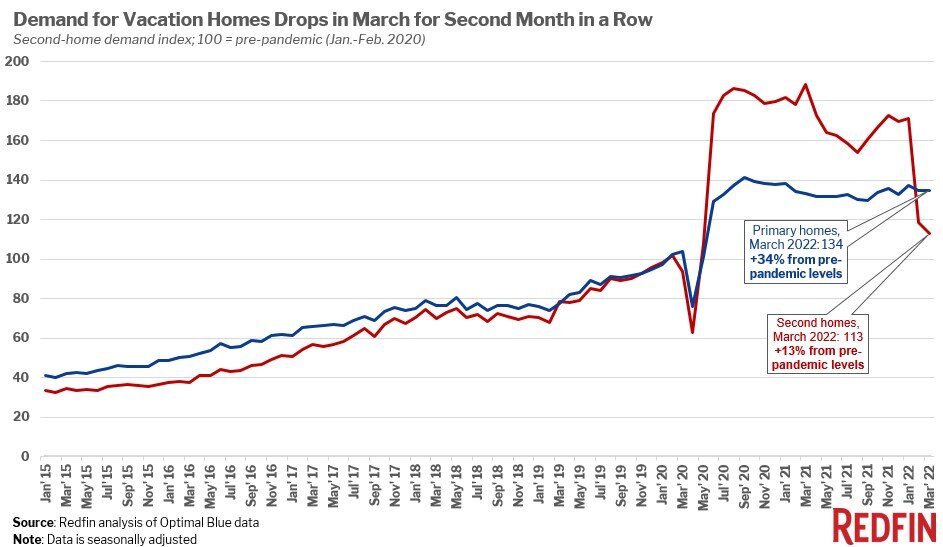

According to national property broker Redfin, demand for vacation homes in the U.S. has dropped sharply for the second month in a row in March 2022, with mortgage-rate locks for second homes at their lowest level since May 2020.

Demand for vacation homes was still up 13% from pre-pandemic levels, but it's declining after a pandemic-fueled second-home boom last year. Still, Redfin expects demand for second homes to remain above pre-pandemic levels in the future, as remote work is here to stay for many Americans.

The slowdown in demand for vacation homes joins other early signals that the historically fast rise in mortgage rates and record-high home prices are pricing out some buyers.

"The pandemic-driven surge in sales of vacation homes is coming to an end as mortgage rates rise at their fastest pace in history, causing some second-home buyers to back off," said Redfin Deputy Chief Economist Taylor Marr. "When rates and prices shoot up so much that a vacation home starts to look more like a burden than a good investment and a fun place to bring your family on the weekends, a lot of prospective buyers have second thoughts. The new second-home loan fees that kicked in on April 1 were also a deterrent. Plus, some buyers' down payments--and their nerves--probably took a hit when the stock market dipped over the last few months."

Growth in demand for primary residences outpaced that of second homes for the second month in a row, with mortgage-rate locks for primary homes up 34% from pre-pandemic levels. Demand for primary residences has remained at roughly the same level since June 2020.

Interest in vacation homes skyrocketed in mid-2020 as many affluent Americans started working remotely and mortgage rates dropped to record lows, with mortgage-rate locks for second homes reaching a peak of 88% above pre-pandemic levels in March 2021. Demand declined sharply over the last two months as mortgage rates shot up at their fastest pace in history, reaching 4.67% by the end of March, and some workers started returning to the office.

Another deterrent to demand was the impending rise in loan fees for second-home loans, which increased by about 1% to 4% starting on April 1. The change adds about $13,500 to the cost of purchasing a $400,000 home for the typical vacation-home buyer and will continue to cool interest in vacation homes in the coming months.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Despite Geopolitical Uncertainty, European Hotel Values Rise

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

- London Hotels Set to Weather High Inflation in 2022

- Almost 55 Million People to Travel This Thanksgiving Holiday in America

- Düsseldorf Hotels Enjoy Growing Corporate Demand in 2022

- Global Hotel Investment Activity in Asia Pacific to Rise 80 Percent in 2022

- Japan Lifts Foreign Inbound Covid Travel Restrictions in October

- Demand for Second Vacation Homes in the U.S. Decline

- Amsterdam Hotels Enjoy Comeback Post Covid Travel Restrictions

- 47.9 Million Americans Will Travel This July 4th Weekend