Vacation Real Estate News

Demand for Vacation Homes in U.S. Hit 7-Year Low in August

Vacation News » Laguna Beach Edition | By Michael Gerrity | September 15, 2023 7:56 AM ET

Mortgage rate locks for second homes are down nearly 50% from pre-pandemic levels

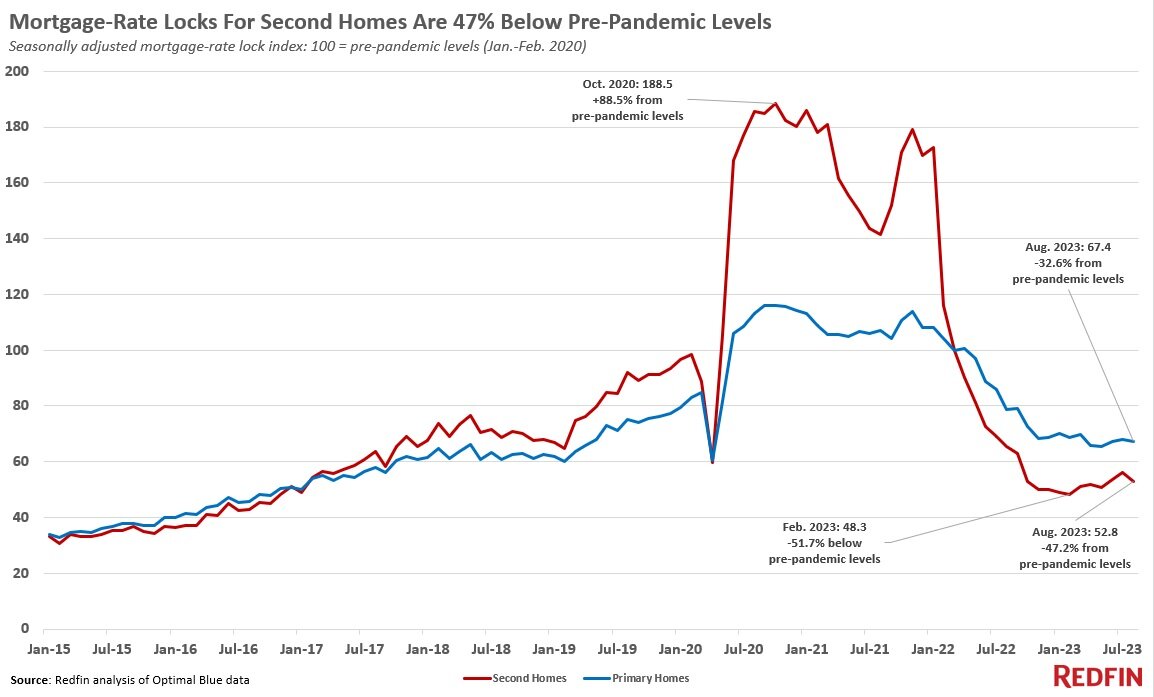

Based on new data from Redfin, mortgage-rate locks for second homes in the U.S. were down 47% from pre-pandemic levels on a seasonally adjusted basis in August, compared to a 33% decline for primary homes.

August marks the 14th-straight month that second-home demand has hovered at least 30% below pre-pandemic levels, as high housing costs and limited inventory deter would-be buyers. Rate locks for second homes hit a seven-year low in February, dropping to 52% below pre-pandemic levels.

A mortgage-rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time; roughly 80% of rate locks result in purchases.

Demand for second homes is also down from a year ago. Mortgage-rate locks for second homes is down 19% year over year, bigger than the 14% decline for primary homes.

The plunge in mortgage locks for vacation homes comes after they skyrocketed during the pandemic, hitting a peak of 88.5% above pre-pandemic levels in October 2020. Affluent Americans jumped at the chance to snap up second homes with record-low mortgage rates during a time when many of them could work remotely from vacation towns. Demand for primary homes jumped during that time, too, but the increase was much more modest, reaching a peak of 16% above pre-pandemic levels in late 2020.

High prices and loan fees, plus diminishing appeal of rental properties, deter second-home buyers

Mortgage rates rose to a two-decade high in August, keeping demand low for both primary homes and second homes. Still-high home prices, the elevated cost of other goods and services, the uncertain economy, and a lack of new listings are also holding back buyers of both home types.

But the drop in demand for vacation homes is bigger, due to a variety of factors:

- It's more expensive to buy a second home. The typical home in a seasonal town--where many second homes are located--sells for $564,000, up 5% from a year earlier. That's compared with $421,000 for homes in non-seasonal towns, also up 5%. Mortgage rates for second homes are also typically higher. Finally, the federal government increased loan fees for second homes in 2022, often adding tens of thousands of dollars to the cost of purchasing a home.

- Many workers are returning to the office. The allure of second homes has diminished as many companies call workers back to the office, at least part of the time.

- Short-term rentals are less attractive. Buying a vacation home to rent it out on a short-term rental site like Airbnb may be less attractive than it once was. Local governments including New York City are instituting new short-term rental regulations, like new taxes and strict permitting, that cut into profits and make the business more difficult.

- The long-term rental market is cooling. Buying a vacation home to rent it out long term is less attractive, too. The rental market has cooled from its pandemic peak; although asking rents are still high, many landlords are being forced to offer concessions to attract renters. Plus, there's a rising number of vacancies for landlords to fill, with many new units set to hit the market soon.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Asia Pacific Hotel Investment Slows Amid Selective Capital Flows

- Asia Pacific Hotel Investment Cools in First Half of 2025

- Short Term Rental Occupancies Plunge Mid-2025 as U.S. Travelers Pull Back

- Short-term Vacation Rentals Outperform U.S. Hotels in Q2

- Record Setting 72.2 Million Americans Traveling for July Fourth Holiday

- Record 45.1 Million Americans to Travel Over 2025 Memorial Day Weekend

- U.S. Vacation Home Sales Fall to Lowest Level Since 2018

- Disney Announces New Landmark Theme Park Resort in Abu Dhabi

- Despite Geopolitical Uncertainty, European Hotel Values Rise

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season