Commercial Real Estate News

U.S. West Coast Dominates Self Storage Demand

Commercial News » Las Vegas Edition | By Michael Gerrity | March 20, 2025 8:15 AM ET

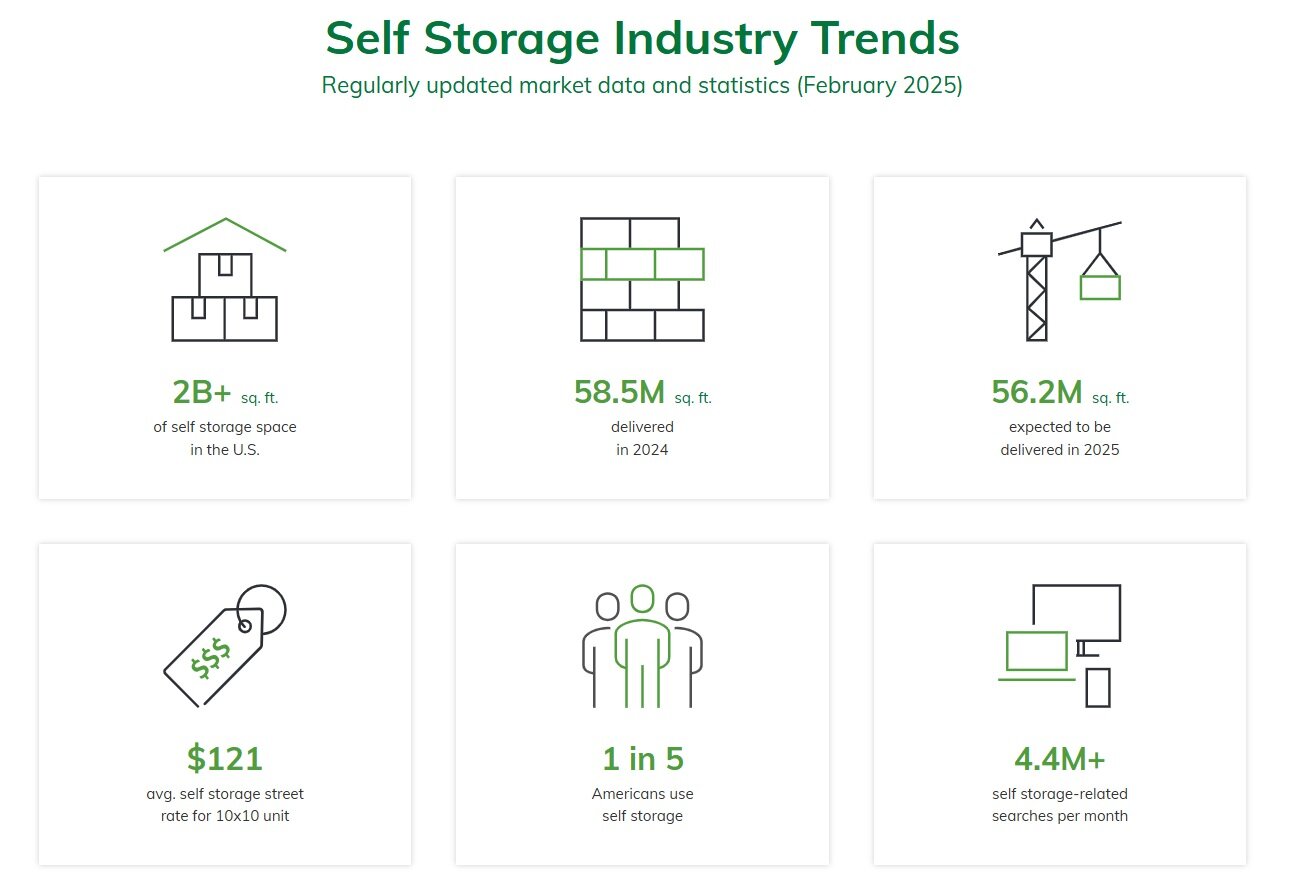

According to StorageCafe, life events continue to shape the U.S. self-storage market, with moving, housing affordability, and economic shifts fueling sustained demand. Interest in self-storage has surged by 88% since 2020, reaching an all-time high of 25 million annual searches in 2024.

As the industry navigates post-pandemic fluctuations and oversaturation in some markets, it has adapted to better serve customers when and where storage is most needed. In 2024 alone, the national self-storage sector delivered 58.5 million square feet of rentable space.

With the market expanding alongside shifting housing and economic trends, one key question emerges: Where is all this demand coming from? Historically, self-storage has been driven by the "4 Ds"--dislocation, death, divorce, and downsizing. However, the pandemic introduced two additional factors: decluttering and distribution. The rise of remote work and e-commerce has further amplified the need for extra space, solidifying the "6 Ds" as the new framework for understanding self-storage growth.

Identifying the Strongest Self-Storage Markets

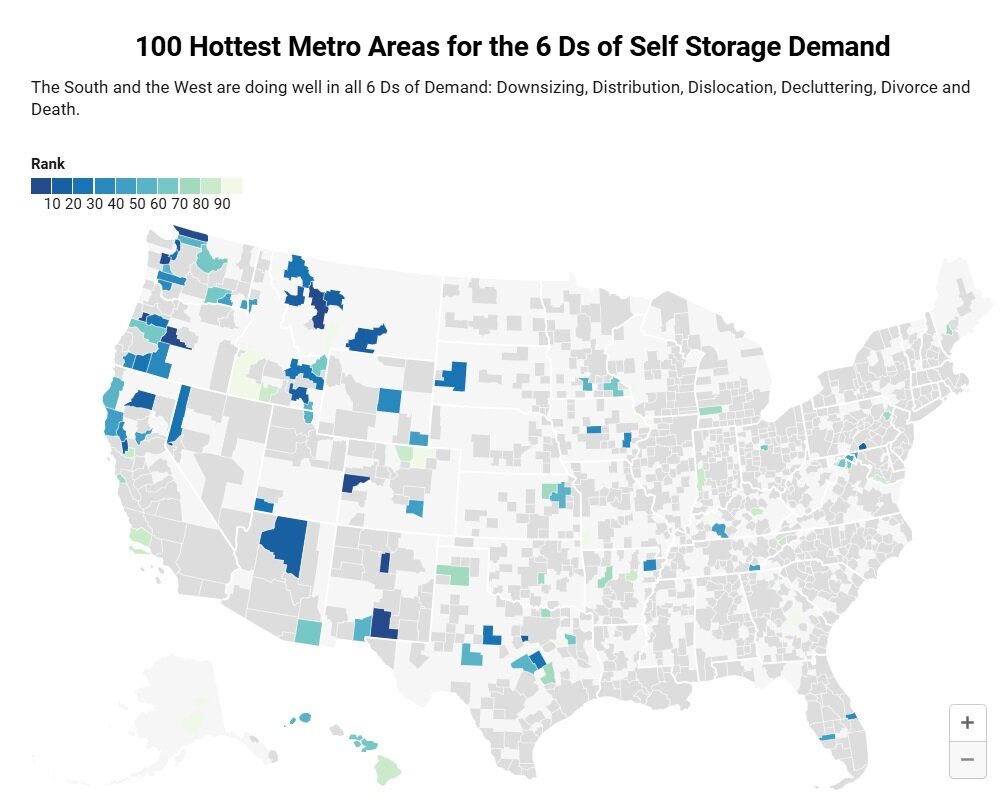

To pinpoint where demand is most concentrated, StorageCafe analyzed over 500 U.S. metro areas. The results show that the West dominates self-storage interest, with 59 metros ranking in the top 100 demand hotspots. The South follows with 26 metros, while the Midwest and Northeast lag behind with 13 and 3 metros, respectively.

Notably, the West claims all of the top 10 spots. States like Washington, California, and Oregon are hubs for small-space living, outdoor recreation, and discretionary spending--factors that naturally drive self-storage interest. Limited home space, downsizing, decluttering, and distribution needs are among the biggest contributors to demand in the region.

Top U.S Cities for Self-Storage Demand

At the city level, Carson City, NV, ranks #1 in self-storage interest, says StorageCafe. Key demand drivers include downsizing, decluttering, and distribution. The city leads in online searches related to downsizing, ranks second in self-storage search interest, and boasts a high concentration of small businesses (second per capita in the nation). Additionally, Carson City has a 15% divorce rate--the 10th-highest nationwide--and a 7% population increase over the past five years, reinforcing strong demand. In response, developers have expanded self-storage capacity, with the city now offering 19 square feet per capita, well above industry norms.

Shelton, WA, ranks second, driven by business storage needs, a significant senior population in the downsizing stage, and strong interest in decluttering.

Corvallis, OR, ranks third, showcasing a diverse range of demand factors. The city ranks #9 for downsizing-related searches and #11 for self-storage interest, while its large student population further boosts demand. Business storage is also on the rise, especially as the local manufacturing sector expands. Future housing growth is expected to sustain self-storage needs in the coming years.

Montana: A Self-Storage Hotspot

StorageCafe says Montana also stands out for its self-storage demand, fueled by a high concentration of empty nesters downsizing and individuals relocating due to life events. The state is home to several top-ranking metros, including Helena (#5), Missoula (#10), Billings (#13), and Great Falls (#15). Missoula leads the nation in online searches for self-storage, while Great Falls ranks #5 in downsizing-related searches.

Despite having some of the largest single-family homes in the U.S., Montana's apartment renters face space constraints, with units averaging 828 square feet--below the national average of 849 square feet. This contributes to the growing demand for off-site storage solutions.

Additionally, many Montana homeowners' associations prohibit parking RVs, boats, and other large items on residential properties. As a result, self-storage has become a practical solution, particularly in the West, where RV ownership is highest.

California's Growing Need for Storage

California's storage demand extends beyond high housing costs, frequent moves, and limited living space. With some of the most expensive real estate in the country, many renters share larger households, further increasing storage needs. In fact, over half of the top 20 metros with the largest household sizes are in California.

For example, El Centro, CA, has one of the highest household sizes in the rankings, averaging 3.45 people per household--making additional storage space even more essential, reports StorageCafe.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

Reader Poll

In 2025, which region of the world are you most likely to buy or invest in real estate?