The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

California Home Sales Set 15-Year Record in November

Residential News » Los Angeles Edition | By Michael Gerrity | January 18, 2021 8:25 AM ET

Despite ongoing Coronavirus lockdowns for months in California, home sales remained high in November 2020, breaking the 500,000 sales benchmark for the first time since January 2009. This is the highest sales level in 15 years, says the California Association of Realtors.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 508,820 units in November 2020, C.A.R. reports. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the November pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

November sales rose 5.0 percent from 484,510 in October and were up 26.3 percent from a year ago, when 402,880 homes were sold on an annualized basis. The year-over-year, double-digit sales gain was the fourth consecutive and the largest yearly gain since May 2009.

"Home-buying interest is at levels that we have not seen for years, setting the stage for a stronger-than-expected comeback that fully recovered all the sales that the market lost in the first half of the year due to the pandemic," said 2021 C.A.R. President Dave Walsh, vice president and manager of the Compass San Jose office. "Housing supply remains an issue, however, as we will likely see a shortage of homes for sale in the near term, which will put upward pressure on prices and dampen affordability for those who haven't been able to take advantage of low rates."

"Home-buying interest is at levels that we have not seen for years, setting the stage for a stronger-than-expected comeback that fully recovered all the sales that the market lost in the first half of the year due to the pandemic," said 2021 C.A.R. President Dave Walsh, vice president and manager of the Compass San Jose office. "Housing supply remains an issue, however, as we will likely see a shortage of homes for sale in the near term, which will put upward pressure on prices and dampen affordability for those who haven't been able to take advantage of low rates."

After breaking the $700,000 benchmark for the past three months, California's median home price dipped 1.7 percent on a month-to-month basis to $$699,000 in November, down from October's $711,300. Home prices, however, continued to gain on a year-over-year basis with the statewide median price surging 18.5 percent from $589,770 recorded last November. The double-digit increase from last year was the fourth in a row and the highest 12-month gain since February 2014. The gain was also higher than the six-month average of 9.7 percent observed between May 2020 and October 2020.

"California's housing market continues to be the bright spot in the economy, but the direction and pace of the recovery will hinge on the coronavirus pandemic and the distribution of the vaccine in the coming months," said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. "The rise in COVID-19 cases and tighter constraints on economic activity recently imposed will likely have implications for the housing market as renters and homeowners face adverse impacts to their incomes, which is why Congress should pass additional relief for renters, homeowners, and workers as soon as possible."

Perhaps due to rising cases of the Coronavirus, fewer consumers said it is a good time to sell in December, according to C.A.R.'s monthly Consumer Housing Sentiment Index. Conducted earlier this month, the poll found that 55 percent of consumers said it is a good time to sell, down from 59 percent a month ago, but up from 51 percent a year ago. Meanwhile, low interest rates continue to fuel the optimism for homebuying; just over one-fourth (27 percent) of the consumers who responded to the poll believed that now is a good time to buy a home, up from last year, when 24 percent said it was a good time to buy a home.

Other key California home sales trends include:

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 508,820 units in November 2020, C.A.R. reports. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the November pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

November sales rose 5.0 percent from 484,510 in October and were up 26.3 percent from a year ago, when 402,880 homes were sold on an annualized basis. The year-over-year, double-digit sales gain was the fourth consecutive and the largest yearly gain since May 2009.

Dave Walsh

After breaking the $700,000 benchmark for the past three months, California's median home price dipped 1.7 percent on a month-to-month basis to $$699,000 in November, down from October's $711,300. Home prices, however, continued to gain on a year-over-year basis with the statewide median price surging 18.5 percent from $589,770 recorded last November. The double-digit increase from last year was the fourth in a row and the highest 12-month gain since February 2014. The gain was also higher than the six-month average of 9.7 percent observed between May 2020 and October 2020.

"California's housing market continues to be the bright spot in the economy, but the direction and pace of the recovery will hinge on the coronavirus pandemic and the distribution of the vaccine in the coming months," said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. "The rise in COVID-19 cases and tighter constraints on economic activity recently imposed will likely have implications for the housing market as renters and homeowners face adverse impacts to their incomes, which is why Congress should pass additional relief for renters, homeowners, and workers as soon as possible."

Perhaps due to rising cases of the Coronavirus, fewer consumers said it is a good time to sell in December, according to C.A.R.'s monthly Consumer Housing Sentiment Index. Conducted earlier this month, the poll found that 55 percent of consumers said it is a good time to sell, down from 59 percent a month ago, but up from 51 percent a year ago. Meanwhile, low interest rates continue to fuel the optimism for homebuying; just over one-fourth (27 percent) of the consumers who responded to the poll believed that now is a good time to buy a home, up from last year, when 24 percent said it was a good time to buy a home.

Other key California home sales trends include:

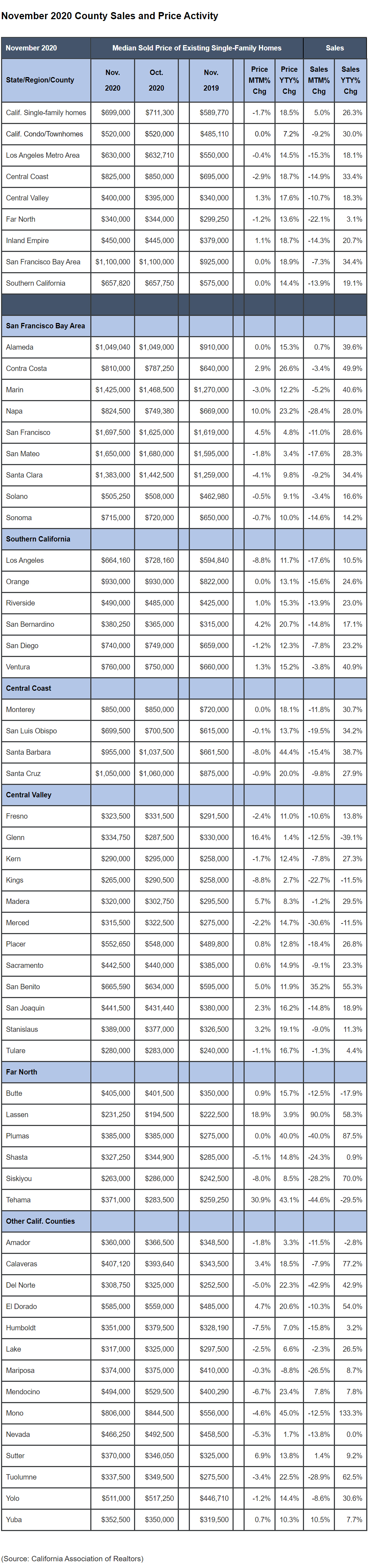

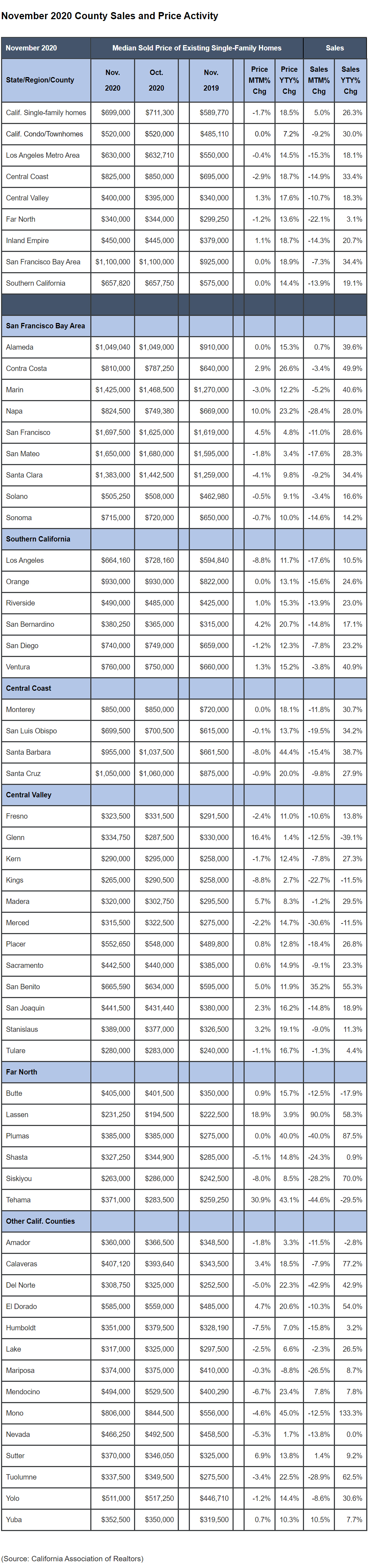

- At the regional level, sales continued to increase by double-digits in most major regions in November, at a year-over-year growth rate of more than 18 percent in all but the Far North. The San Francisco Bay Area had the highest gain of 34.4 percent over last year, followed by the Central Coast (33.4 percent), Southern California (19.1 percent) and the Central Valley (18.3 percent). The Far North region had a more moderate sales performance in November compared to other regions, but still improved 3.1 percent from a year ago. On a year-to-date basis, sales in the Central Coast region has already surpassed 2019's level by 4.3 percent, while Southern California (-0.7 percent), the San Francisco Bay Area (-1.2 percent), the Central Valley (-1.5 percent) and the Far North (-2.6 percent) continued to trail slightly behind last year's level.

- With homebuying interest remaining high, sales in resort communities continued to exhibit robust gain from the prior year. Mammoth Lakes had the biggest increase in November, with sales surging 400 percent from November 2019, followed by South Lake Tahoe (81.4 percent), Big Bear (73.9 percent), and Lake Arrowhead (58.1 percent). Through the first 11 months of the year, resort markets have been outperforming the state in general. On a year-to-date basis, sales increased 97 percent in Big Bear, 51.5 percent in South Lake Tahoe, 48.4 percent in Lake Arrowhead, and 31.7 percent in Mammoth Lakes.

- At the regional level, all major regions posted an increase in the median price from a year ago by more than 10 percent. The San Francisco Bay Area median price remained at its record high in November, rising 18.9 percent from last year. Five of the nine counties in the region continued to increase by double digits, while the rest were up more modestly. The Central Coast region had the second largest median price increase at 18.7 percent, followed by the Central Valley (17.6 percent), Southern California (14.4 percent), and the Far North (13.6 percent).

- All but one of the 51 counties C.A.R. tracks reported a year-over-year price gain, with 37 of them increasing by 10 percent or more. Mono had the highest price growth, with a year-over-year increase of 45 percent. Mariposa was the only county with a drop in its median price, declining 8.8 percent from the same month last year.

- Price growth in many of the resort communities continued to outpace the rest of California.In November, Big Bear's median price jumped from last year by 40.8 percent, followed by South Lake Tahoe (39.6 percent), and Lake Arrowhead (32.0 percent). Mammoth Lakes had a slight price decline of 2.5 percent in November from last year. Home prices in these areas are expected to grow solidly in the short term, as demand remains on an upward trend and available supply continues to decline rapidly.

- With a resurgence in COVID-19 cases in recent weeks and the market entering the traditional holiday season, active listings declined from the prior month as expected, contributing to a substantial decline in inventory. Active listings fell 46.6 percent from last year and continued to drop more than 40 percent on a year-over-year basis for the sixth straight month. The Unsold Inventory Index (UII) fell sharply from 3.1 months in November 2019 to 1.9 months this November. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

- Except for the Bay Area, all major regions experienced a year-over-year decline in active listings of 40 percent or more in November. The Central Valley had the biggest year-over-year drop of 53.3 percent in November, followed by Southern California (49.0 percent), Central Coast (-46.3 percent), Far North (-40.1 percent), and the San Francisco Bay Area (-18.7 percent).

- All but two of the 51 counties reported by C.A.R. experienced a year-over-year decline in active listings in November. Madera had the biggest drop from last year, with a decline of 69.9 percent, followed by San Joaquin (-69.3 percent) and Sutter (-67.3 percent). Twenty-seven counties had less than half the active listings they had in November 2019. San Francisco (73.8 percent) and San Mateo (18.2 percent) remained the only counties in California with an increase in active listings from the prior year.

- The median number of days it took to sell a California single-family home was 9 days in November, down from 25 in November 2019. The November 2020 figure was the lowest ever recorded.

- C.A.R.'s statewide sales-price-to-list-price ratio was 100.5 percent in November 2020 and 98.4 percent in November 2019. The ratio in November 2020 was the highest ever recorded in the past 30 years, another indication that shows how the supply and demand imbalance is impacting the California housing market.

- The statewide average price per square foot for an existing single-family home was $332 in November 2020 and $288 in November 2019. The November 2020 figure was the highest since August 2007.

- The 30-year, fixed-mortgage interest rate averaged 2.77 percent in November, down from 3.70 percent in November 2019, according to Freddie Mac. The five-year, adjustable mortgage interest rate was an average of 3.0 percent, compared to 3.41 percent in November 2019.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More