The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Global Commercial Property Investment Plummets 57 Percent in Q2

Commercial News » Los Angeles Edition | By Michael Gerrity | August 3, 2020 9:00 AM ET

Coronavirus weighs heavily worldwide on the commercial investment market in 2020

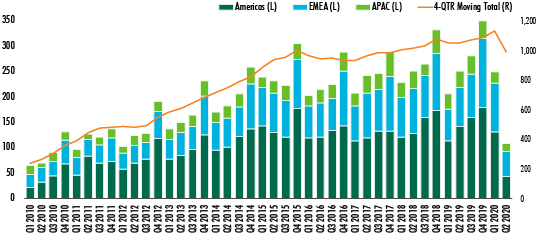

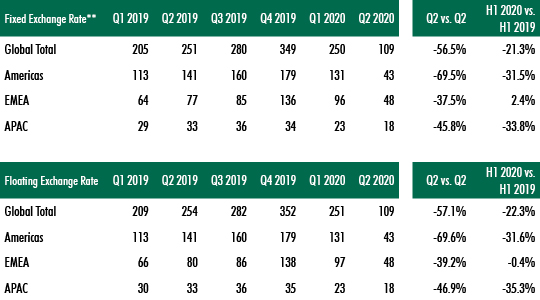

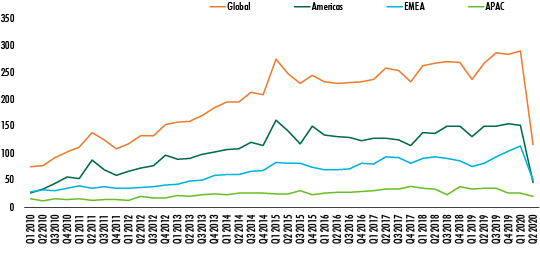

According to a new report by CBRE, much weaker commercial real estate investment volumes in the second quarter of 2020 reflect the impact of lockdown measures and border controls enacted to combat the COVID-19 crisis. Global investment volume fell by 57% year-over-year to $109 billion, the lowest quarterly total since 2010.

The Americas region was hit the hardest, with a 70% year-over-year decline mainly due to fewer large portfolio transactions and the absence of entity-level deals. EMEA and APAC had 38% and 46% declines in total volume, respectively, as uncertainty and restrictions hampered investor sentiment.

The strength of Q1 led to a relatively moderate 21% decrease in H1 2020 investment volume. Q2 may have marked the low point as countries reopen their economies and business activity resumes. Investors are looking for a gradual recovery beginning in H2 2020.

The Americas

Americas investment volume fell to $43 billion in Q2, the lowest level since 2010 and only 30% of the Q2 2019 volume. The U.S. accounted for 93% of the region's investment activity. The Americas saw a 77% decline in portfolio sales year-over-year and had no entity-level transactions.

Industrial assets demonstrated resilience despite having a 50% year-over-year decline in Q2 investment volume. Two Prologis M&A deals in Q1 pushed industrial investment up 17% year-over-year in H1 2020. Excluding the two Prologis transactions, industrial investment declined by 18% in H1, still outperforming all other sectors in the same period. Retail investment volume fell by 74% year-over-year in Q2, followed by a 72% decline for both the office and multifamily sectors. Hotel assets were the most severely impacted, with a 90% drop in volume and the lowest quarterly total since 2003.

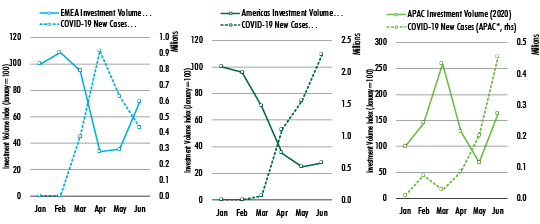

Americas' city level decline in investment activity seems correlated with the level of new COVID-19 cases (Figure 2). Cities suffering from the worst infection rates saw some of the steepest declines in Q2 investment volume, including Seattle (-84%), Orlando (-81%), Los Angeles (-80%) and New York (-71%). The continued surge of COVID-19 cases in the U.S., Brazil and parts of Latin America will hinder the rebound of investment activity in those areas.

If testing levels, tracking and treatments improve as expected in H2 2020, so will business confidence and investment activity. Increased clarity on pricing and rental rates should tempt discount-seeking investors to re-enter the market.

EMEA

EMEA investment volume fell by 38% year-over-year to $48 billion in Q2--a significantly less severe downturn than for other world regions and accounting for 44% of total global investment volume in Q2 (relative to its average share of 33% over the past five years). EMEA's Q2 slump was fully offset by a record Q1 this year, resulting in a 2% year-over-year increase in H1 2020 investment volume.

Economic uncertainty will continue to temper investment in 2020 but signs of recovery were seen in June. The industrial (-34%) and multifamily (-29%) sectors remain attractive, with core industrial yields expected to reach record lows. Value-add office assets are vulnerable to repricing. Retail investment had a smaller-than-expected decrease of 23% in investment volume year-over-year, thanks to large-ticket deals in Germany and France. Hotel investment volume fell by 83% to its lowest quarterly level in nearly a decade.

Germany (-20%), Netherlands (-23%) and Poland (-22%) saw relatively modest year-over-year declines in Q2 investment volume compared with the rest of Europe. Switzerland (+174%) bucked the trend and nearly doubled its volume year-over-year, in large part because Thailand's Central Group and Austria's Signa acquired Swiss department store chain Globus. The U.K. (-56%), France (-57%) and Sweden (-45%) were hit hard by the pandemic and registered sharp declines in Q2 investment volume. As European economies move ahead with staged reopening, further rebound is expected in H2 2020.

APAC

APAC investment volume fell by 46% year-over-year to nearly $18 billion in Q2, the lowest quarterly total since 2012. The resurgence of COVID-19 cases in China, Japan and Australia, and the ongoing first wave of infections in India, raised concerns over the region's economic outlook and lengthened the recovery timeline of investment activity.

Following the global trend, APAC industrial investment volume decreased by only 17% year-over-year in Q2 and by 8% in H1. Office investment volume, which accounted for 56% of all APAC transactions in Q2, fell by 46%, as investors turned to smaller deals or partial stakes in highly priced assets. The retail and hotel sectors remained under pressure, reporting their lowest quarterly totals since the Global Financial Crisis. However, retail assets with residential components showed improved investor interest. In the Pacific, domestic investors showed interest in big-box retail assets with long-term leases from grocery tenants.

Among the three regions, APAC had the smallest quarter-over-quarter decrease in Q2 investment volume at -23%. Sizeable deals in Australia (-21%) and South Korea

(-36%) helped limit their declines in volume. Greater China (-49%), Japan (-48%) and Singapore (-57%) fared worse due to reduced activity in gateway markets like Tokyo and Beijing. Investors appear willing to re-enter the market if price discounts are provided.

2020 Global Commercial Forecast

CBRE's full-year global investment forecast has been adjusted down slightly to -38% from -32% due to the resurgence of COVID-19 cases in the Americas, which could delay economic recovery. A global rebound in investment activity is still expected to begin before year-end given the general improvement in containing COVID-19.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More