Commercial Real Estate News

Import Surge Fuels Demand for Warehouse Space by U.S. Seaports

Commercial News » Los Angeles Edition | By Michael Gerrity | April 21, 2021 8:15 AM ET

Driving vacancy rates lower and rents higher

According to global real estate consultant CBRE, industrial markets at major U.S. port cities have come under additional strain from big increases in U.S. imports, fueling demand for warehouse space in markets with already scant availability.

This increase in imports, which amounts to double-digit percentage gains from year-ago levels in many markets, has resulted from retailers seeking to bolster their inventories in the wake of pandemic-related demand and global supply chain shocks like the recent blockage of the Suez Canal.

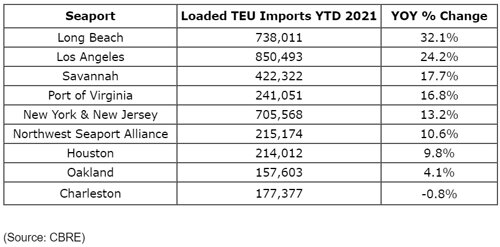

CBRE reports west Coast ports such as Long Beach and Los Angeles have seen the biggest surge, with year-to-date loaded imports increasing 32.1 percent and 24.2 percent, respectively. On the East Coast, Savannah (17.7%), Port of Virginia (16.8%) and New York and New Jersey (13.2%) have all seen significant increases as well.

This activity has increased demand for warehouse space in seaport markets, pushing down their average vacancy rate to 3.6% at the end of 2020, one percentage point lower than the national average. Low availability may persist for some time. Only 75 million sq. ft. is under construction in these markets, with more than a third preleased. All of this equates to rental rates hitting record highs.

"With all of the volatility and consumer changes of the past year, retailers and manufacturers have learned to build-up a healthy safety stock of inventory to limit supply chain disruptions," said John Morris, executive managing director and leader of CBRE's Americas Industrial & Logistics business. "While this will help protect consumers, it has put a strain on seaport industrial markets, as they need more supply to meet this surging demand. Without more construction, we will see rental rates continue to soar."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.