Residential Real Estate News

California Home Sales Dive 36 Percent Annually in April

Residential News » Los Angeles Edition | By Michael Gerrity | June 7, 2023 8:46 AM ET

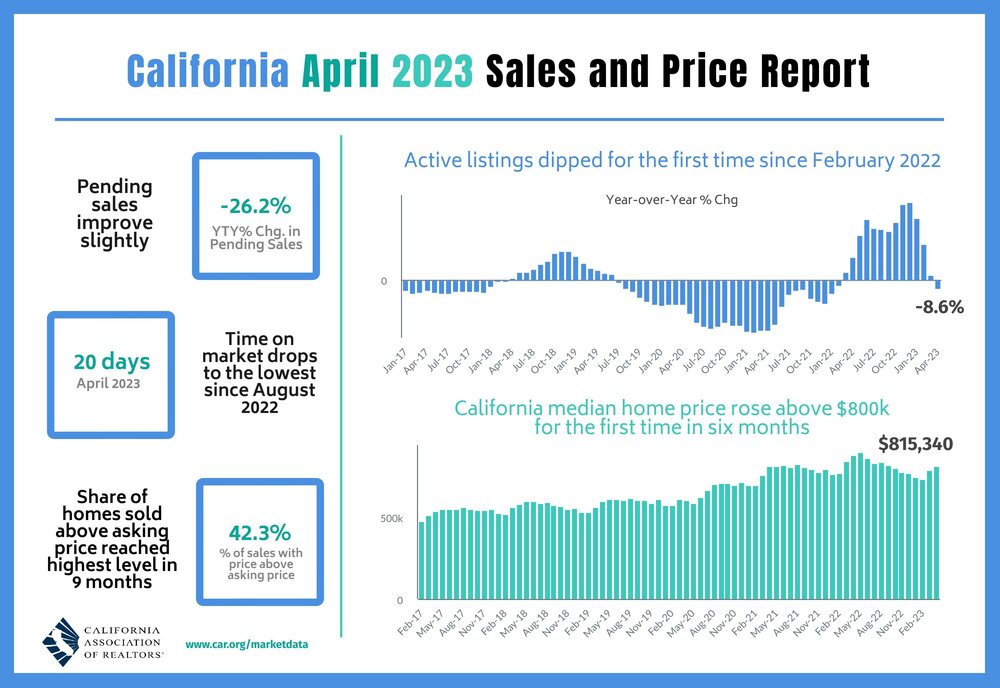

According to the California Association of Realtors, a surge in mortgage interest rates suppressed California home sales in April 2023, while the statewide median home price climbed above the $800,000 level for the first time in six months.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 267,880 in April, according to information collected by C.A.R. The statewide annualized sales figure represents what would be the total number of homes sold during 2023 if sales maintained the April pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

April's sales pace was down 4.7 percent on a monthly basis from 281,050 in March and down 36.1 percent from a year ago, when a revised 418,970 homes were sold on an annualized basis. Sales of existing single-family homes in California remained below the 300,000-unit pace for the seventh consecutive month.

"While home sales declined in April, the market is getting more competitive as we're seeing time on the market before selling down to 20 days in April from 33 days in January and the share of homes sold above asking price double from one in five at the beginning of the year to more than two in five in April," said C.A.R. President Jennifer Branchini. "This increase in market competition continued to provide support to the statewide median home price in April, which climbed above $800,000 for the first time in six months."

California's median home price surpassed $800,000 in April for the first time since October 2022, increasing 3.0 percent from March's $791,490 to $815,340. Despite the price improvement since early this year, April's median price was lower on a year-over-year basis for the sixth consecutive month, declining 7.8 percent from the revised $884,680 recorded last April. The sizable drop in median price from last year was due partly to the strong price surge in early 2022 when homebuyers rushed into the market to take advantage of low rates before the Fed began aggressively raising rates.

"Home sales remained soft as the lock-in effect continued to tighten housing supply and keep would-be sellers from listing their homes for sale, which contributed to a 30 percent year-over-year drop in new statewide active listings ― the largest drop since May 2020 when the pandemic shutdown took place," said C.A.R. Senior Vice President and Chief Economist Jordan Levine. "A surge in borrowing costs as mortgage rates surpassed 7% in late February and early March also contributed to the market weakness, as many transactions that opened in those two months were closed in April."

As such, C.A.R. has revised its 2023 Housing Market Forecast and projects existing single-family home sales to reach 279,900 units in 2023, a decline of 18.2 percent from the 342,000 units sold in 2022. While home prices in general are expected to improve in the second half of the year, the California median home price is projected to decrease 5.6 percent to $776,600 in 2023, down from the annual median price of $822,300 recorded in 2022. The updated projection on the statewide median price is an increase from the estimate of $758,600 forecast last October. C.A.R. also projects the 30-year fixed mortgage interest rate to average 6.3 percent for the year.

Other key points from C.A.R.'s April 2023 resale housing report include:

- At the regional level, sales declines accelerated in all regions, with the Central Coast dropping the most at -42.8 percent. The Far North (41.8 percent) followed closely behind as four of the six counties in the region recorded a drop of more than 40 percent. Sales in the San Francisco Bay Area (-38.5 percent), Southern California (-37.4 percent) and the Central Valley (-36.7 percent) all declined at a faster pace than the prior month, with each region falling by more than a third on a year-over-year basis.

- All 51 counties tracked by C.A.R. registered a sales decline from the previous year, with sales in 44 counties dropping more than 30 percent and sales in five counties sliding more than 50 percent from a year ago. Mariposa (-80.8 percent) had the largest sales drop, followed by Calaveras (-59.0 percent) and Santa Cruz (-58.4 percent). Lassen (-4.8 percent) was the only county with less than 10 percent annual sales decrease. Closed sales should improve in many markets the upcoming month, however, as 39 counties experienced a monthly increase in pending sales.

- At the regional level, median home prices continued to drop from a year ago in all major regions, but only one region posted a double-digit decline compared to three regions in the prior month. The San Francisco Bay Area (-16.7 percent) remained the region with the biggest sales drop, as six out of nine counties in the Bay Area region fell more than 10 percent year-over-year. The sharp decline is partly attributed to the base effect, as prices surged a year ago when many homebuyers tried to close transactions before rates climbed further. Central Valley (-8.0 percent) and Southern California (-6.2 percent) recorded the second and third largest drop in April, respectively, followed by the Far North (-3.8 percent) and Central Coast (-2.9 percent).

- More than three-quarters of all counties experienced year-over-year price declines in April, with 13 counties falling more than 10 percent. Mono (-50.1 percent) had the biggest drop of all counties, followed by San Francisco (-22.8 percent), Alameda (-18.0 percent) and San Mateo (-18 percent). On a positive note, 12 counties registered an increase in their median price from last April, a jump from six counties in March. The price increases were either mild or moderate for most counties, with only one county's median price surging by double-digits. Glenn (24.1 percent) had the biggest gain in price of all counties again in April, followed by Amador (6.7 percent) and Monterey (5.4 percent).

- Housing inventory in California bounced back after dipping month-over-month for two straight months. The statewide Unsold Inventory Index (UII) in April 2023 also increased from last year, jumping 38.9 percent on a year-over-year basis. The surge in the UII continued primarily due to low housing demand as existing home sales remained below the 300,000 benchmark. All price ranges recorded an increase in the UII of more than 20 percent in from a year ago, with the $1 million and higher price sector gaining the most (64.7 percent), followed by the $500,000-$749,000 price range (33.3 percent), the sub-$500,000 (26.3 percent) and the $750,000-$999,000 sector (21.1 percent).

- The median number of days it took to sell a California single-family home was 20 days in April and 11 days in April 2022.

C.A.R.'s statewide sales-price-to-list-price ratio was 100 percent in April 2023 and 104.2 percent in April 2022.

The statewide average price per square foot for an existing single-family home was $395, down from $433 in April a year ago. - The 30-year, fixed-mortgage interest rate averaged 6.34 percent in April, up from 4.98 percent in April 2022, according to Freddie Mac.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years