Commercial Real Estate News

North American Flex Office Market Evolved During Covid Pandemic

Commercial News » Miami Edition | By Michael Gerrity | February 8, 2022 9:03 AM ET

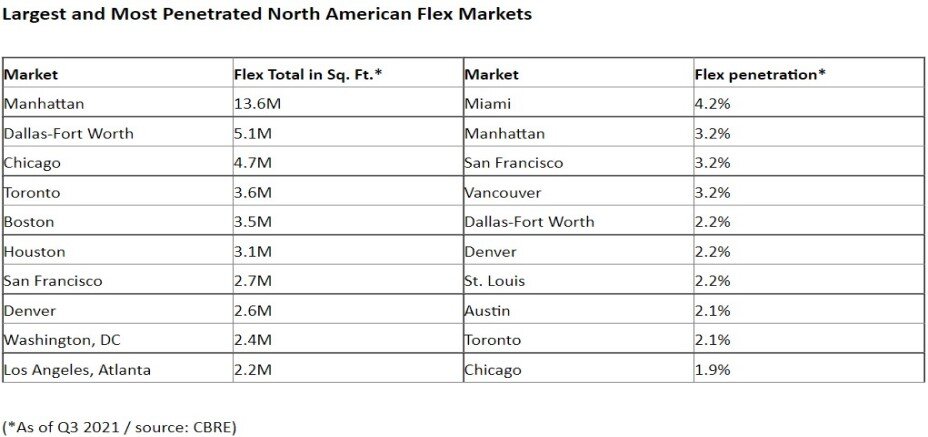

Manhattan, Dallas-Fort Worth, Chicago, Toronto rank atop the largest flex markets; Most penetrated include Miami, Manhattan, San Francisco

Based on a new report by CBRE, North America's flex-office sector has evolved through the pandemic into a more sophisticated version of itself, gradually shifting to rely more on large companies as users and helping employers to accommodate changing patterns of office use.

The flex sector, a rapidly expanding niche in 2018 and 2019, has slimmed down since early 2020. CBRE's annual analysis of the sector found that, in the 12 months ended in September, North American flex-space providers collectively trimmed their square footage by 9 percent to slightly more than 80 million sq. ft. Similarly, the sector's penetration as a percentage of overall office space declined to 1.75 percent from roughly 2 percent.

Having reset itself, the flex sector is poised for growth this year as big companies increasingly embrace the format's versatility to handle changing staffing levels and fluctuating office attendance. A CBRE survey of 185 U.S.-based companies found that large companies anticipate adding more flex space to their office portfolios. Last year, nearly a quarter of the survey's respondents had a significant portion (more than 10 percent) of their office portfolio in flex space. By 2023, half expect to be at or past that threshold.

To that end, major flex-office providers recently reported gains in their business with big companies, or enterprise users.

"Flex space has become a skeleton key that companies can use to address their changing office needs," said Julie Whelan, CBRE's Global Head of Occupier Research. "They can use it to adjust their office portfolio as they figure out how hybrid work will affect their employees' office-use patterns. They can use flex space as a short-term base when they initially expand into new markets to tap new and more affordable labor pools. Some will add flex space in suburban locations to offer employees offices for occasional use closer to their homes. In short, flex space allows companies to be more nimble."

Different Flavors of Flex

CBRE defines flex space to include multiple formats of office space leased for shorter-than-traditional terms. That includes coworking, which often entails communal desks and common areas used by a flex operator's occupants. But it also includes faster-growing models, such as private suites and enterprise offerings, which dedicate offices or entire floors for exclusive use by individual companies.

Among flex options that have gained traction as companies experiment with new work arrangements are the core-plus flex model in which users occupy long-term space and flex space in the same building or campus, and subscription-based services that allow employees to work from any of a flex provider's locations across the market, country or globe.

"The flex industry matured in the past two years," said Christelle Bron, Leader of CBRE's Americas Agile Real Estate Practice. "Building owners now are far more involved in facilitating flex options in their properties. Companies can choose from a variety of flex options to suit their office needs. And flex providers are expanding into secondary markets."

Market Comparison

CBRE analyzed flex offices in 49 North American markets, finding that 15 recorded a net expansion of their flex square footage in the year ended in September, 28 notched a net contraction, and six saw no change. The biggest expanders were secondary and satellite markets such as the San Francisco Peninsula (a 13.9 percent gain) and suburban Maryland (5.9 percent gain). Houston (5.2 percent gain) was the largest market to post an increase.

The ranks of the largest markets didn't change much despite most paring their flex square footage. Naturally, there is overlap between the largest markets and the most penetrated.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.