Commercial Real Estate News

2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

Commercial News » Miami Edition | By WPJ Staff | September 1, 2023 7:19 AM ET

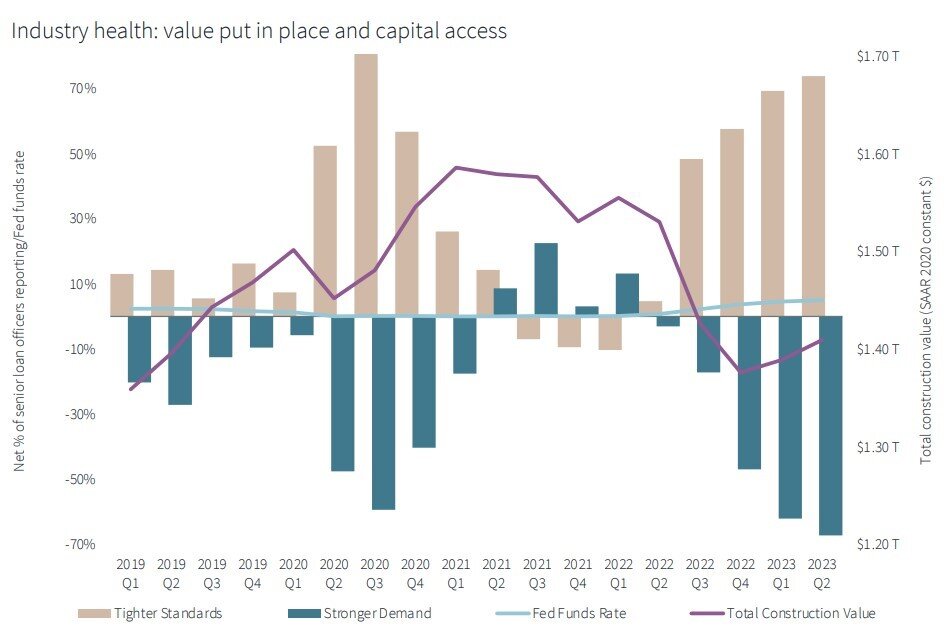

According to a new report by JLL, with the federal funds rate at 5%, demand for construction loans has plummeted and standards are tightening across the board. While the impact on construction spending has not fully been realized, and further slowdowns are anticipated, value put in place is creeping up again as more publicly funded projects in infrastructure and manufacturing break ground and the construction industry remains healthy overall. Total construction spending should be up roughly 6% year-over-year due largely to the federal boost.

JLL further reports threats to the construction industry (geopolitics, inflation, recession, natural disasters, etc.) remain unresolved but are increasingly perceived as less immediate. Overall industry sentiment remains positive as consumer spending and the labor market continue to outperform forecasts.

However, construction activity is expected to slow in the upcoming quarters, and the resolution or escalation of these threats will impact demand, costs, and recovery.

Construction wages climbed 17% since January 2020 nationally and, with just 4% unemployment and 374,000 job openings, tackling the current pipeline is still top of mind. Even with starts slowing down, JLL expects wages to trend upwards in the next months to 5-7% total year-over-year growth.

Of the major materials divisions tracked by JLL, only two are forecast at or above a 10% increase year-over-year, while the average expected growth is just 4%. The increase is below prior years' growth by a significant margin and reflects stabilization and improvements in the supply chain.

Final demand, which includes margins and overhead as well as labor and materials, fell 1.1% from the prior quarter start in July. The decline, when contrasted against modest materials growth and strong wage growth, reflects firms' changing strategies to the anticipated slowdown and shifting conditions for various sectors, says JLL.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.