Commercial Real Estate News

Airport Adjacent Warehouses Enjoying Big Rent Premiums in 2022

Commercial News » Miami Edition | By Michael Gerrity | October 12, 2022 8:31 AM ET

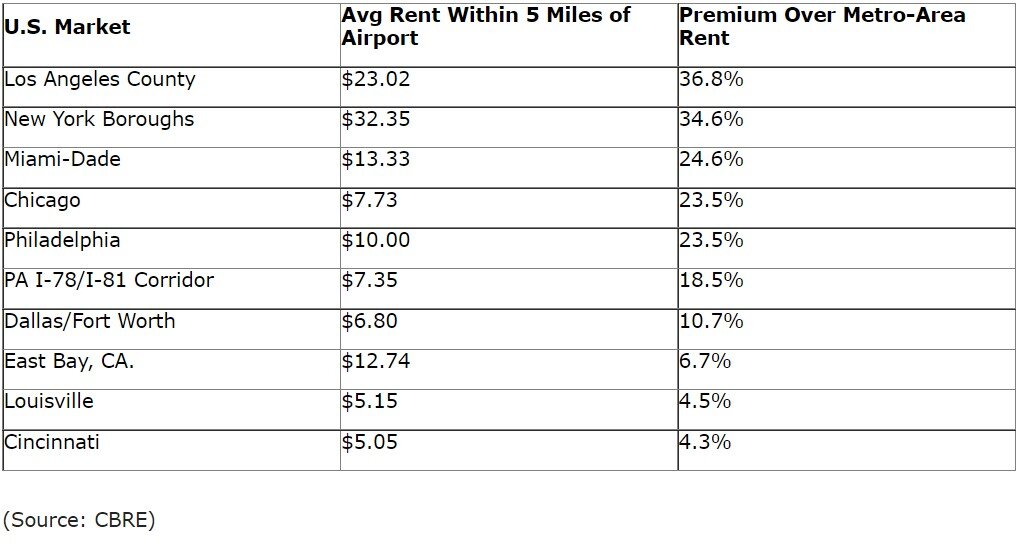

According to a new report from CBRE, pressure to provide quick delivery of electric machinery, jewels, pharmaceuticals and other products has fueled demand for airport-adjacent warehouses and pushed rents in those submarkets to sizeable premiums.

An analysis by CBRE found that average rents for warehouses within a five-mile radius of major airports are 18.8 percent higher than the average for their metropolitan areas. The analysis spanned the 20 busiest U.S. airports for airfreight.

Warehouses in close proximity to major airports are coveted by shippers needing to use the speed of airfreight to transport high-dollar goods packaged in small enough sizes and quantities to fit on airplanes. Supply of such warehouses is limited in many dense airport submarkets like those around John F. Kennedy International Airport in New York, Los Angeles International Airport and Miami International Airport.

"The immediacy of e-commerce deliveries and the generally faster pace of business than in past decades, among other factors, have made airport warehouses a critical link in many supply chains," said John Morris, CBRE Americas President of Industrial & Logistics. "Rents for these properties will continue to exceed their market averages for the foreseeable future."

CBRE found that the largest share - 42.7 percent - of leasing activity in airport-warehouse markets so far this year was done by third party-logistics companies. That's a greater share than 3PLs claim of overall U.S. warehouse leasing, 35.6 percent. The reason: Shippers, retailers and other companies often hire 3PLs to handle shipping of small-lot goods via high-cost airfreight.

The second largest share of leasing activity near airports went to general retail and wholesale companies at 32.2 percent. Food and beverage companies are a distant third at 5.2 percent.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.