Residential Real Estate News

Wealthy Renters Are Taking Over More of the U.S. Rental Market

Residential News » Miami Edition | By Michael Gerrity | March 14, 2025 8:40 AM ET

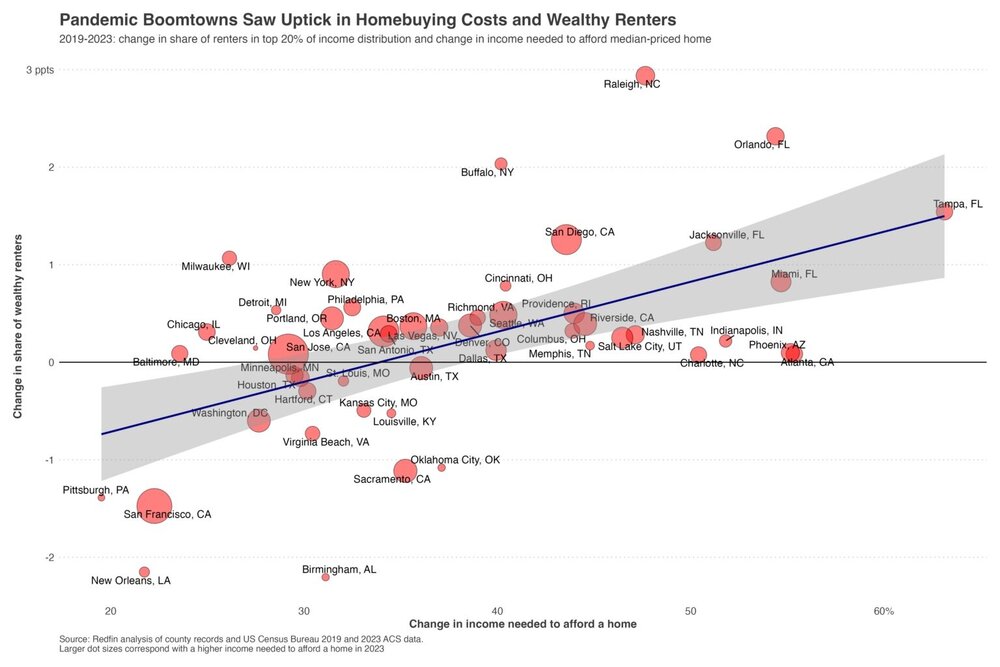

New data from Redfin shows that nearly three-quarters of the most populous U.S. metro areas (35 out of 50) have seen an increase in wealthy renters, with Raleigh, NC, and Orlando, FL, leading the trend.

"For many, renting is about flexibility," said Juan Castro, a Redfin Premier real estate agent in Orlando. "The U.S. economy and job market are evolving, and people want the freedom to move as opportunities arise."

In Raleigh, the percentage of affluent renters has climbed from 4.8% in 2019 to 7.7%--the largest jump among the top 50 metros. Orlando follows at 10.8% (up from 8.5%), alongside Buffalo, NY (6.6%, up from 4.6%), Tampa, FL (9.4%, up from 7.9%), and San Diego (9.3%, up from 8%).

According to Redfin Senior Economist Elijah de la Campa, "Many affluent Americans are opting to rent rather than buy because home prices have surged far more than rental costs in recent years. With mortgage rates near 7%, renting allows them to allocate funds toward other, potentially more lucrative investments."

Renting Is Increasingly Appealing to the Wealthy

In each of the metros mentioned above, the typical wealthy renter earns more than enough to buy a median-priced home. However, home prices in these areas have risen significantly since 2019, making renting a more attractive option. Four of the five top metros in this trend are in the Sun Belt, where home prices skyrocketed during the pandemic.

Tampa, for instance, saw its median home sale price jump 67.4% from 2019--the highest increase among the metros Redfin analyzed. The income required to afford a typical home in Tampa has also risen 63.1%, while rent costs, though up 51.6%, have increased at a slower rate than home prices.

Nationwide, the income needed to afford the median-priced home has surged 36.9% since 2019, compared to a 28.1% rise in rent. Redfin's analysis found that for every 10% drop in home buying affordability, the share of wealthy renters in a metro increased by 0.5 percentage points--a statistically significant correlation.

Beyond financial considerations, some affluent Americans are choosing to rent for lifestyle flexibility. "I have friends who sold their homes to rent so they could quickly relocate if their dream job appeared in another state," Castro noted. "Many believe remote work won't last and don't want to be tied down to a home that could be difficult to sell."

Florida, in particular, saw home prices soar during the pandemic. However, over the past year, prices in some areas have begun to decline due to natural disasters, rising HOA fees, and increased insurance costs.

Wealthy Renters Are Concentrated in Costly Housing Markets

San Jose, CA, has the highest share of affluent renters, with 11% of renters earning in the top 20% of local incomes. Other metros with a high percentage of wealthy renters include:

- Orlando, FL: 10.8%

- San Francisco, CA: 10.4%

- New York, NY: 10.3%

- Seattle, WA: 9.9%

These cities have long been among the most expensive places to buy a home, with Orlando being a recent addition due to its pandemic-era housing boom. The median home price in San Jose, for example, sits at $1.4 million--the highest in the country.

Despite their high earnings, wealthy renters in these metros find renting significantly more affordable than homeownership. In San Jose, an affluent renter spends only 10.5% of their income on rent, compared to 21% on a mortgage--a larger gap than in any other major metro.

Tech hubs like San Francisco and Seattle have long driven up housing costs due to their concentration of wealth. Between 2000 and 2019, Seattle saw the share of affluent renters rise from 6.7% to 9.5%--the largest increase in the nation--while San Francisco and San Jose followed closely behind.

"Many high earners could buy a median-priced home, but they're renting while saving up for their ideal luxury property," de la Campa explained. "In rapidly appreciating markets--whether Silicon Valley in the 2000s or Sun Belt cities during the pandemic--it takes longer to afford that dream home, keeping people in the rental market longer."

The Cities with the Fewest Wealthy Renters

Oklahoma City has the lowest percentage of affluent renters, with just 4.7% of renters in the top 20% income bracket. Other metros with relatively low shares include:

- Cincinnati, OH: 4.8%

- Hartford, CT: 5%

- Cleveland, OH: 5.1%

- Providence, RI: 5.2%

These areas have some of the country's most affordable home buying costs, which likely encourages more affluent residents to purchase homes rather than rent.

Cities Where the Share of Wealthy Renters Has Declined

Some metros have actually seen a decrease in wealthy renters. Birmingham, AL, experienced the largest decline, with its share of affluent renters dropping from 7.6% in 2019 to 5.4% in 2023. Other metros with significant declines include:

- New Orleans, LA: 5.4% (down from 7.5%)

- San Francisco, CA: 10.4% (down from 11.9%)

- Pittsburgh, PA: 5.8% (down from 7.2%)

- Sacramento, CA: 5.9% (down from 7%)

- Oklahoma City, OK: 4.7% (down from 5.8%)

Birmingham, New Orleans, Pittsburgh, and Oklahoma City all have home prices below the national average, and the income needed to buy a home in these metros has increased less than the national rate--potentially driving more affluent residents toward homeownership.

Pittsburgh, for example, has seen the smallest rise in income needed to afford a home--up just 19.5% from 2019. A typical affluent Pittsburgh resident earns at least $145,295 per year, nearly four times the income required to afford a median-priced home, making ownership an easy choice.

San Francisco is an outlier. While it remains one of the most expensive housing markets, many residents left during the pandemic, causing home prices to drop. Those who remained were able to find better deals on homes, leading to a decrease in wealthy renters.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

- Meet HAL, Real Estate Agent of the Future

- U.S. Homes Are Selling at Slowest Pace in 5 Years in Early 2025

- Pending Home Sales Dive Across America in December

- Greater Miami Residential Sales Uptick 3 Percent Annually in 2024

- U.S. Mortgage Applications Downtick in late January

- Under Biden, 2024 Marked the Slowest U.S. Home Sales Period in 30 Years

- Single-family Rent Growth in U.S. Slows to Lowest Rate in 14 Years

- Housing Starts Spike 15 Percent in America in Late 2024

- Day One: Trump Issues Executive Order on Emergency Price Relief for U.S. Housing

- 89 Percent of Homes Destroyed by Los Angeles Fires Were Single-Family Residences

- New AI-Powered Global Listings Service Under Construction

- World Property Media to Commence Industry Funding Round to Launch WPC TV

- Mortgage Rates in America Above 7 Percent, Again

- U.S. Residential Foreclosures Dip 10 Percent Annually in 2024

- U.S. Residential Asking Rents End 2024 at Lowest Levels in 3 Years

- World Property Markets to Commence Industry-wide Joint Venture Fundraise

- One Third of U.S. Homeowners Say They Will Never Sell

- Catastrophic Wildfires Devastating Tens of Billions of Dollars of Southern California Properties

- Is Greenland Soon Going to be Trump's Biggest Real Estate Deal?

- Greater Las Vegas Home Sales Jump 19 Percent Annually in December