Residential Real Estate News

Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

Residential News » New Orleans Edition | By Michael Gerrity | November 21, 2024 7:12 AM ET

Competition for buying homes easing fastest in Louisiana, Florida and Texas

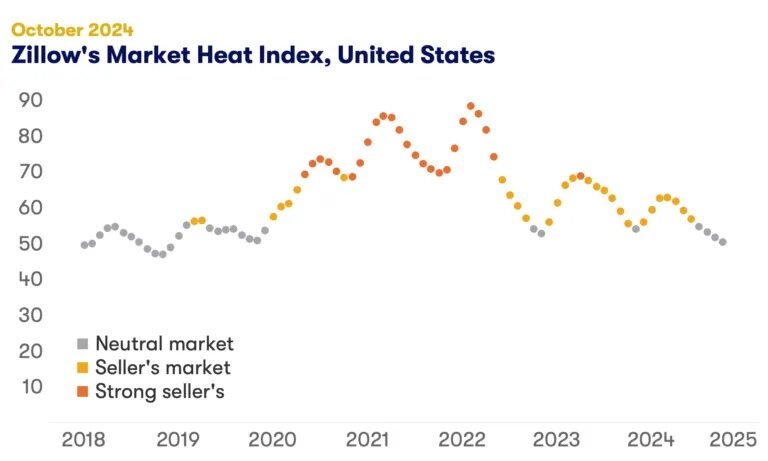

According to Zillow's latest market report, U.S. homebuyers are finding more leverage in negotiations nationwide as competition eased in October 2024. The company's market heat index shows that conditions are gradually shifting toward a buyer's market as activity slows heading into winter.

"We're seeing buyer competition wane as mortgage rates climb back toward 7%, coinciding with the typical winter cooldown," said Skylar Olsen, Zillow's chief economist. "Inventory is slowly recovering, and price cuts remain relatively common, offering persistent buyers opportunities to secure deals or negotiate valuable concessions."

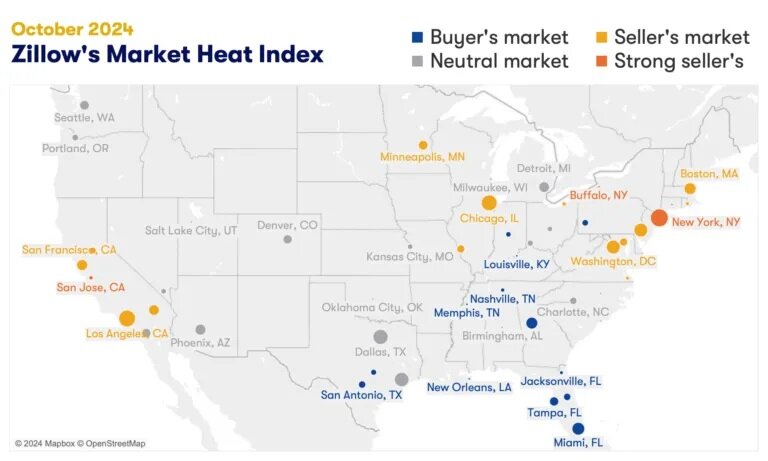

While rising mortgage rates and seasonal patterns affect the market nationwide, inventory trends vary by region. For instance, Southern states experience fewer winter weather disruptions, allowing housing activity to remain steadier. Additionally, inventory recovery from pandemic-era lows is further tipping the scales in favor of buyers, particularly in areas like Texas, Florida, and the New Orleans metro.

Buyers Gaining Ground in Key Markets

In October, Pittsburgh and Louisville joined 11 other major metros where buyers now have an edge in negotiations, following cities like Indianapolis, Nashville, and Atlanta, which transitioned to buyer's markets in September. Inventory levels have played a critical role in this shift. The 13 major markets currently favoring buyers rank among the top 20 nationwide in inventory recovery compared to pre-pandemic levels.

Reduced competition is also contributing to slower home value appreciation. The steepest monthly declines in home values have been recorded in Austin, Dallas, Atlanta, Tampa, and San Antonio. Southern markets, in particular, are seeing listings stay on the market longer compared to pre-pandemic trends.

Nationwide inventory is still recovering from the sharp deficit triggered by the pandemic, though significant progress has been made. As of now, inventory levels are about 28% below pre-pandemic norms for this time of year--the smallest gap since September 2020 and an improvement from the 36% deficit recorded in March.

New construction is playing a key role in balancing the market. In areas where builders have managed to meet demand more effectively, home prices and rent growth have largely stabilized.

Mortgage Rate Volatility Remains a Challenge

A brief dip in mortgage rates in September offered temporary relief to buyers, but rates edged higher again in October, eroding some affordability gains. Monthly mortgage payments on a typical home increased by 2.8% in October after four months of declines.

Despite this recent uptick, payments remain over $100 lower than their May peak and $179 less than October 2023 levels for buyers making a 20% down payment. However, mortgage rates are expected to remain volatile in the coming months, posing ongoing challenges for buyers navigating the market.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years