The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Asian Commercial Investment in U.S. Spikes 40 Percent

Commercial News » New York City Edition | By Michael Gerrity | October 8, 2014 2:15 PM ET

There is a growing Tsunami of money now flowing into the U.S. from the far east.

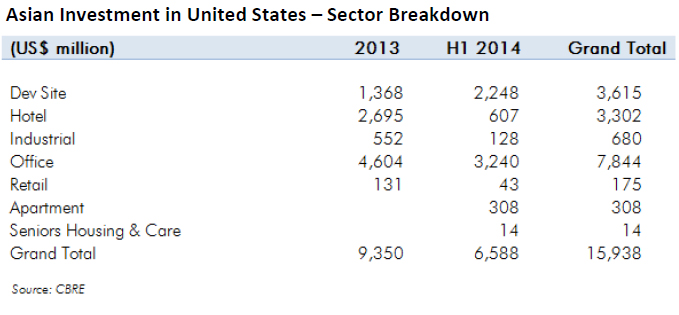

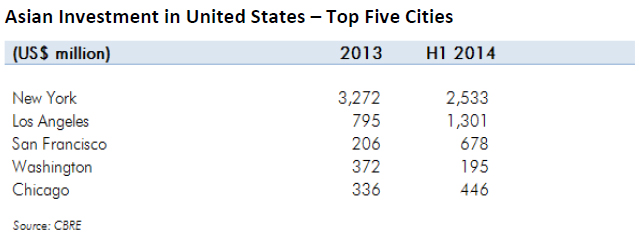

According to global real estate consultant CBRE, Asian investment in U.S. commercial assets in the first half of 2014 is up over 40% over the same time period in 2013 to $16.1 billion.

Most Active Sources of Capital:

- Singapore 29%

- Hong Kong 25%

- China 23%

- Malaysia 5%

The transaction follows the recent acquisition of the former Robinsons-May department store site on Wilshire Boulevard in Beverly Hills, Los Angeles by Wanda Group, China's largest property developer. This transaction--one of the largest on the West Coast in recent years--comes as Asian investors, particularly Chinese developers, have diversified their commercial real estate acquisitions in the U.S., with a strong focus on the West Coast.

CBRE has been tracking the increase of Asian investment in U.S. commercial real estate--overall investment (all sectors) in the first half of 2014, and the full year will easily surpass the entire value of all investments made in 2013.

The acquisition of The Waldorf Astoria by Anbang Insurance Group Co. Ltd means that Asian investment in New York commercial real estate has already surpassed figures for the entire year of 2013. Hotel transactions by Asian investors in the U.S. to date this year have also surpassed volumes for the entire year of 2013.

Kevin Mallory, Global Head of CBRE Hotels tells World Property Journal, "This transaction represents the highest price ever paid for a single hotel asset in the United States, and the most paid for a standing building by a Chinese investor. New regulations allow Chinese insurers to invest up to 15% of their assets in "non-self-use" real estate. With over $1.2 trillion in assets - the recent regulatory change allows for significant allocations of capital to the real estate sector. Most insurance funds allocate approximately 6% of their investment funds to real estate of which 20% could typically be invested off-shore. These rather significant allocations, combined with the opportunity to invest at better risk adjusted yields thank can be achieved domestically will result in an acceleration of off-shore investments like the Waldorf."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More