Commercial Real Estate News

Global Commercial Property Investment Hits $800 Billion in 2021

Commercial News » New York City Edition | By Michael Gerrity | November 1, 2021 8:05 AM ET

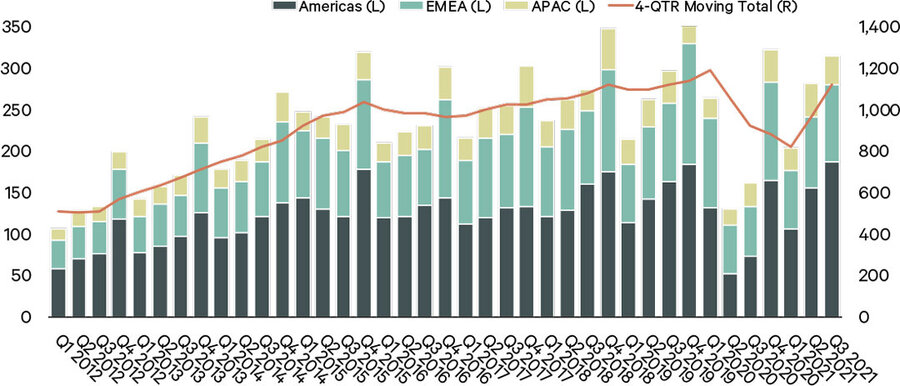

Commercial Investment Volume Grows 95 Percent Annually in Q3

According to global property consultant CBRE, with nearly half of the world's population vaccinated and COVID delta variant infections subsiding, global GDP is on track to reach pre-COVID levels by year's end. With ample liquidity and global bond yields low despite higher inflation, investors eagerly deployed capital to commercial real estate in Q3, putting 2021 on pace for record annual investment volume.

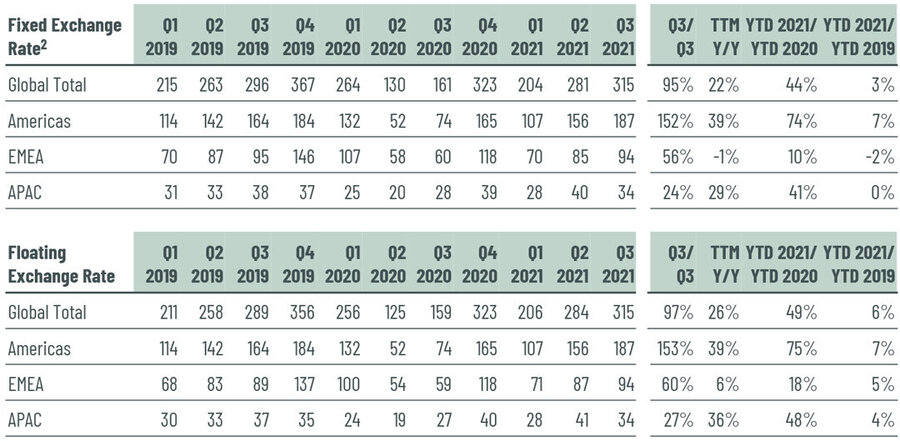

Global investment volume grew by 95% year-over-year in Q3 to $315 billion. All three global regions--Americas, EMEA and Asia-Pacific--reported strong investment activity that was on par with 2019 levels. On a year-to-date basis, global volume exceeded that of 2020 by 44% and 2019 by 3%.

Investor interest in the multifamily sector, especially in the U.S., Germany and Sweden, significantly drove investment volume growth in Q3. Industrial & logistics property acquisitions remained popular across regions. Office and retail investment volumes are still recovering but the value resilience of high-quality assets suggests improving market conditions.

The Americas

The Americas investment volume continued to show remarkable strength in Q3 2021, led by the U.S. multifamily sector. The region's total investment volume surged by 152% year-over-year in Q3 and by 74% year-to-date. Excluding entity-level transactions, investment volume grew by 141% year-over-year. Compared with the pre-COVID trend, the accelerated growth of Sun Belt markets has offset a shortage of large-ticket office transactions in gateway markets so far this year, but the comeback of trophy office sales is highly anticipated and critical for a full recovery of commercial real estate investment.

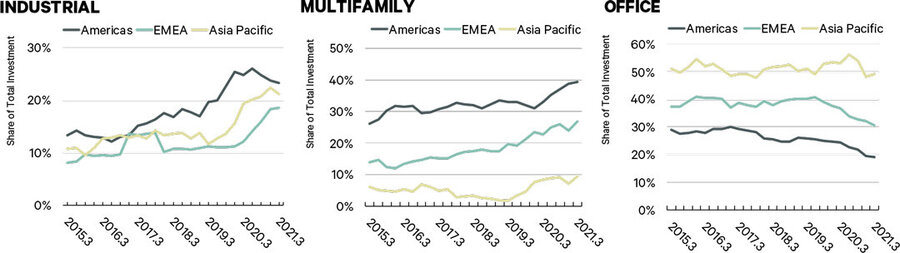

The multifamily sector's share of total Americas volume rose to 39% in Q3 from an average of 28% between 2015 and 2019. Sun Belt markets led by Dallas, Atlanta and Phoenix had a boom in population and employment growth that led to significant capital inflows over the past 12 months.

Meanwhile, after two years of exceptional performance, the industrial sector showed some signs of easing back, as its share of total volume dropped to 23%. The industrial sector is expected to stay healthy on the back of e-commerce and manufacturing growth, but investors are becoming more selective in the face of record-low cap rates.

Hotel sales have recovered well in the past six months, driven by coastal markets and portfolio acquisitions. With easing travel restrictions, domestic and international tourism should support a further rebound of service-based retail and hospitality.

The office sector's share of total investment volume dropped to a new low of 19% in the region. Retail's share fell to 9%. Delayed returns to the office and a potential cultural shift toward flexible working have caused investors to mainly focus on stabilized core assets. Office cap rates, albeit based on fewer trades than normal, were largely on par with pre-COVID levels. In the retail sector, cap rates fell for grocery-anchored shopping centers. Suburban assets outperformed urban assets, mainly driven by higher returns.

EMEA

Economic reopening and a reduction in COVID infections, particularly in Europe, have restored investor confidence and returned EMEA investment volume to its pre-COVID trend. The region's total volume grew by 56% year-over-year in Q3 to $94 billion. Year-to-date investment volume grew by 10% over the same period in 2020 and was on par (-2%) with 2019.

Sweden (186%), Netherlands (126%), Germany (96%) and the U.K. (68%) led the year-over-year rebound in Q3, primarily driven by a fast-growing multifamily/residential sector, including a $10.6 billion (€9.1 billion) residential portfolio acquisition by Heimstaden across Germany and the Nordics. The U.K.'s industrial sector also attracted a large amount of capital from cross-border investors.

The multifamily and industrial sectors' share of total EMEA investment volume reached 27% and 19%, respectively, in Q3. Both sectors received a significant boost from the pandemic as capital moved primarily toward these two outperforming sectors. Markets in Germany, Sweden and Netherlands have matured with increased multifamily supply. The U.K. and other markets are expected to follow, driving further growth across the continent. Investor appetite and user demand for industrial properties remained strong due to e-commerce growth.

The office sector's share of total investment dropped to 31% from roughly 40% pre-COVID, due to lingering uncertainty on office usage. But it still had the highest share of all sectors, as rental rate growth resumed in Tier I markets and occupiers started to return and make leasing decisions.

Despite a continued decline in retail investment volume, a rebound appears likely in coming quarters based on the relatively low pricing of retail assets. An uptick in hotel investment in Q3 implied the worst was over for the sector, with very few distress sales.

Asia Pacific

Asia-Pacific's investment volume grew by 24% year-over-year in Q3 to $34 billion. Year-to-date volume stands at $102 billion, up by 41% from the same period in 2020 and exactly on par with the comparable 2019 level. The ongoing supply-chain disruption and rising commodity prices have affected the region's economic outlook, which will likely dampen investment volume in 2022.

Hong Kong (354%), Australia (121%) and Japan (89%) led the year-over-year growth in Q3. In Japan, the $2.5 billion sale/leaseback of Dentsu's headquarters office echoed a global trend of corporate occupiers moving owned real estate off their balance sheets. Other major office markets like Seoul, Shanghai, Melbourne and Hong Kong also performed well in Q3. Besides trophy assets, secondary offices in prime locations with the potential for upgrading or repositioning are also attracting interest based on flight-to-quality demand from occupiers. The office sector's share of total Asia-Pacific investment volume remained close to 50%.

Industrial's share of total investment fell slightly quarter-over-quarter to 21% in Q3, but remained well above the 2015-2019 average of 13%. Almost all countries experienced strong growth during the pandemic, especially Australia and Mainland China. Strong investor demand accelerated cap rate compression in core assets and prompted investors to move up the risk curve.

The retail and multifamily sectors each accounted for roughly 10% of total investment with an upward trend in Q3. Hotel investment has yet to pick up, waiting for a broader lift of travel restrictions. These sectors serve as potential upside for Q4 and next year, as capital will seek counter-cyclical opportunities amid the tight yield environment.

Global Forecast

Global commercial real estate investment is poised for a strong Q4 and a record year in 2021. Strong momentum continues for multifamily and industrial investment, while retail and hotel investment is expected to rebound with increased international mobility. The highly anticipated office recovery is taking place in suburban markets, with urban markets likely to follow next year.

CBRE estimates that annual global investment volume will increase by roughly 28% in 2021 and, due to a strong base, by a more moderate 8% in 2022.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.