Commercial Real Estate News

Commercial Property Cap Rate Expansion Likely to Continue in 2023

Commercial News » New York City Edition | By Michael Gerrity | March 20, 2023 8:43 AM ET

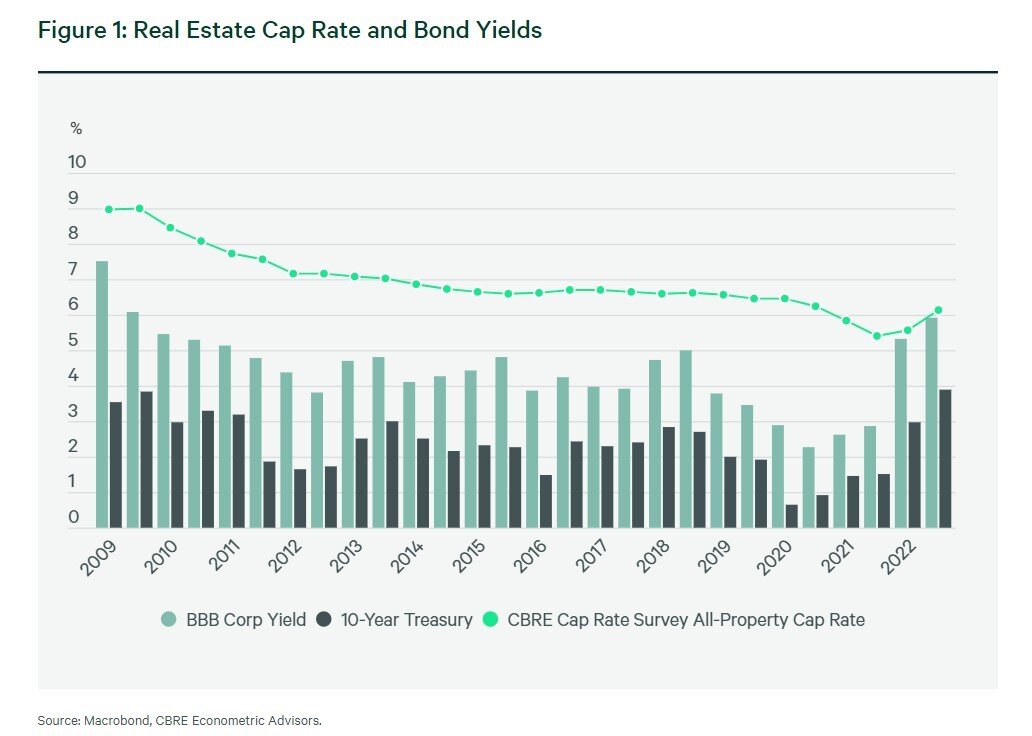

According to a new CBRE survey, U.S. capitalization rate expansion is likely to continue in the short-term for most real estate asset types, but could peak later this year and should decrease in 2024 as the end of the Federal Reserve's rate-hiking cycle is anticipated.

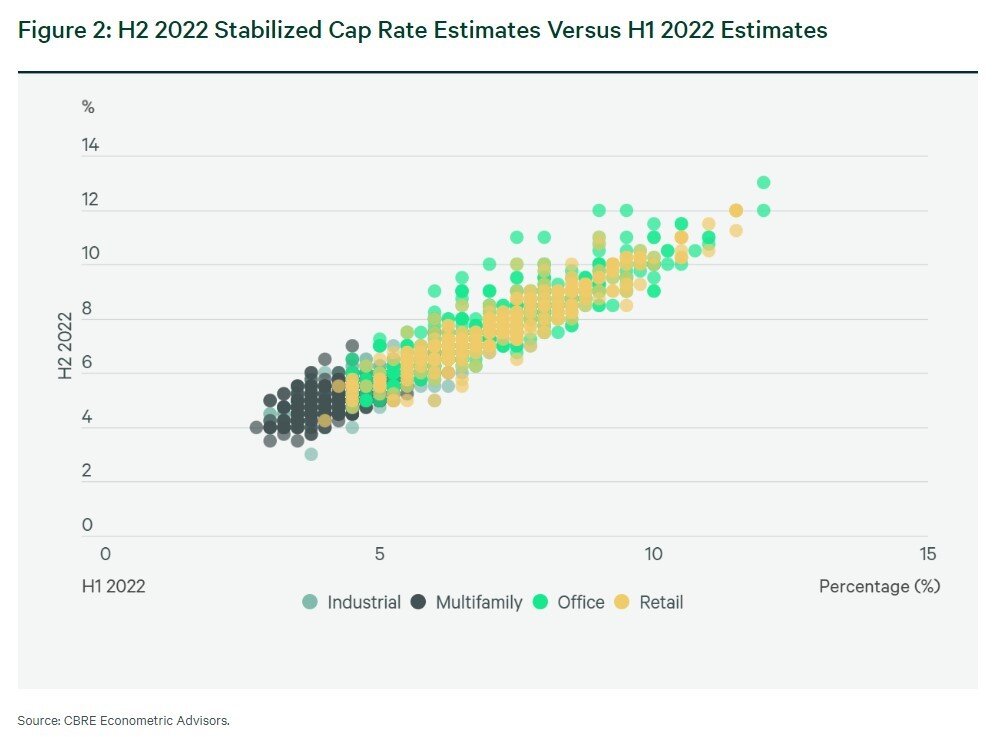

The CBRE survey found that all property types reported cap rates increases in the second half of 2022. Despite strong real estate fundamentals, higher borrowing costs and uncertainty around monetary policy are forcing cap rates upward. In some instances, industrial and multifamily cap rates are below current borrowing costs.

On average, cap rate estimates are up 60 basis points from CBRE's previous survey, reflecting substantial monetary tightening by the Federal Reserve and wider commercial mortgage spreads. An overwhelming majority of respondents across sectors are expecting cap rates to increase another 25 bps over the next six months, with expectations for the greatest upward shift in lower quality office and retail spaces.

With interest rates expected to peak later this year, the end of cap rate expansion may be in sight for most asset types. CBRE forecasts that the federal funds rate will likely exceed 5% in 2023, falling to about 2% by 2025.

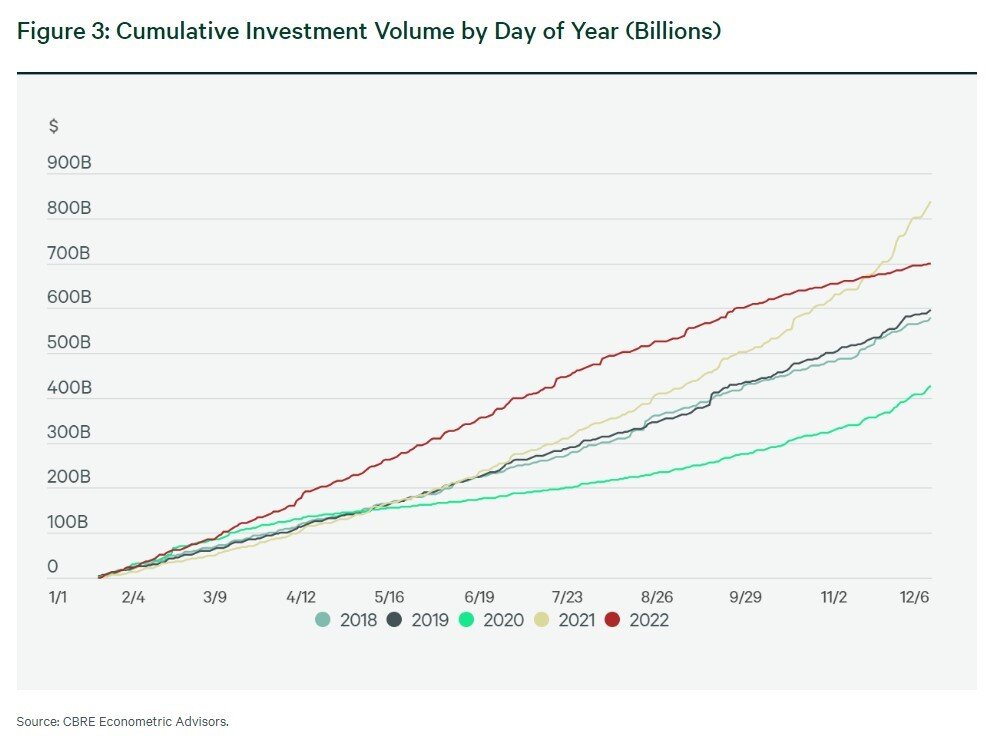

"Rapid increases in interest rates over the past year have meant that lower pricing on acquisitions is necessary to achieve healthy returns. This is before factoring in the risk premium associated with market uncertainty that keeps many buyers on the sidelines," said Tom Edwards, Global President of Valuation & Advisory Services for CBRE. "We believe that cap rates will peak later this year and that price discovery over the next three to six months will narrow the dislocation between buyers and sellers, and lead to higher transaction volume."

The survey found that lenders are increasingly cautious, and respondents are expecting average Loan-To-Value ratios (LTV) to fall over the next six months, especially for the office sector. Respondents are expecting the industrial and multifamily sectors to lead commercial real estate performance over the next year, followed by hotels and retail.

"Tighter lending conditions and more distress--particularly for office--are expected to characterize the market over the next 12-24months," said Rachel Vinson, U.S. President of Debt & Structured Finance for CBRE. "Borrowers will wait to transact if their capital structures allow. Properties with declining values and maturing debt may be forced to sell or default, giving rise to additional distress in the market."

CBRE's survey, which examined investment sentiment on market conditions and capitalization rates for stabilized properties, revealed several key findings. Capitalization rates--usually called cap rates--measure a property's value by dividing its annual income by its sale price. A lower cap rate generally indicates a higher value.

CBRE 2023 Market Outlook:

- Industrial: While a large share of respondents believe a robust supply pipeline will put downward pressure on rent growth and valuations, a majority believe there is enough demand to absorb this new capacity. While respondents expected fewer deals being completed and reduced buyer interest in 2023, after the completion of this survey, CBRE professionals noted market activity strengthened in January and the first half of February 2023.

- Multifamily: Rising interest rates have led to more multifamily purchases in which mortgage rates exceed the cap rate. While some respondents expect this gap to narrow, an equally large number expects the gap to persist. Respondents are assuming lower rental growth over the next several years on the back of record rental growth rates in 2022.

- Retail: Sentiment is more positive for quality suburban neighborhood retail properties, especially as consumers have spent more on local goods and services that are close to home. Tenant mix has become increasingly important, resulting in a growing premium for centers with a strong anchor tenant. With high inflation protection, falling availability rates, and limited supply, asking rents are expected to increase for the foreseeable future. Retail may present an opportunity for investors looking for value.

- Office: Lenders are increasingly cautious and less willing to lend against lower quality and older office properties. While some respondents hope conversion to other uses will limit the downside, few believe it can be executed at the scale needed to materially lower vacancy and prevent rent declines for older office buildings.

- Hotel: Increased flexibility in work patterns is driving demand for group travel as teams come together at events and corporate offsites to engage and collaborate. This has made group travel one of the fastest growing hotel demand segments. In addition, H2 2022 recorded growth in traditional free and independent traveler (FIT) business travel, which is expected to continue to strengthen in 2023, fueled by employment growth and the further easing of international travel restrictions.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.