Commercial Real Estate News

Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

Commercial News » New York City Edition | By Michael Gerrity | July 29, 2024 8:42 AM ET

According to the Mortgage Bankers Association's latest commercial real estate finance (CREF) Loan Performance Survey, U.S. delinquency rates for mortgages backed by commercial properties declined slightly during the second quarter of 2024.

"The delinquency rate for most property types declined last quarter, with the exception of loans backed by office properties, which experienced an increase," said Jamie Woodwell, MBA's Head of Commercial Real Estate Research. "Even so, the pace of increase in the delinquency rate for office property loans appears to have slowed in recent quarters."

Added Woodwell, "Commercial properties are working through changes in interest rates, property values, and the fundamentals of some properties. Each property and loan faces a unique mix of conditions depending on that property's type and subtype, market and submarket, owner, vintage, deal terms and more. As more loans mature throughout the year, more properties will be adjusting to these new conditions."

U.S. Commercial Mortgage Data Highlights

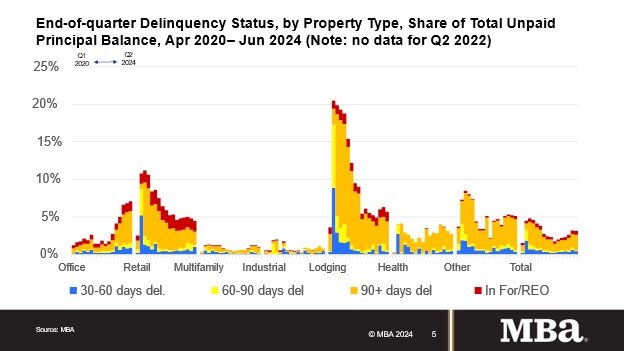

- 97.0% of outstanding loan balances were current or less than 30 days late at the end of the quarter, up from 96.8% in the first quarter of 2024.

- 2.5% were 90+ days delinquent or in REO, unchanged from the previous quarter.

- 0.2% were 60-90 days delinquent, down from 0.3% the previous quarter.

- 0.4% were 30-60 days delinquent, unchanged from the previous quarter.

- The share of loans that were delinquent increased for office properties and decreased for other property types.

- 7.1% of the balance of office property loan balances were 30 days or more days delinquent, up from 6.8% at the end of last quarter.

- 5.8% of the balance of lodging loans were delinquent, down from 6.3% the previous quarter.

- 4.5% of retail balances were delinquent, down from 4.7%.

- 1.1% of multifamily balances were delinquent, down from 1.2%.

- 0.8% of the balance of industrial property loans were delinquent, down from 1.2%.

- Among capital sources, CMBS loan delinquency rates saw the highest levels despite seeing a decrease during the quarter.

- 4.8% of CMBS loan balances were 30 days or more delinquent, down from 5.2% last quarter.

- Non-current rates for other capital sources remained more moderate.

- 0.9% of FHA multifamily and health care loan balances were 30 days or more delinquent, up from 0.8%.

- 1.1% of life company loan balances were delinquent, down from 1.2%.

- 0.4% of GSE loan balances were delinquent, unchanged from the previous quarter.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher