Commercial Real Estate News

Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

Commercial News » New York City Edition | By Michael Gerrity | November 12, 2024 6:05 AM ET

New research by CBRE shows that the commercial real estate lending market continued its upward trajectory in the third quarter of 2024, with a notable increase in acquisition financing and strong issuance across asset classes, including large office transactions.

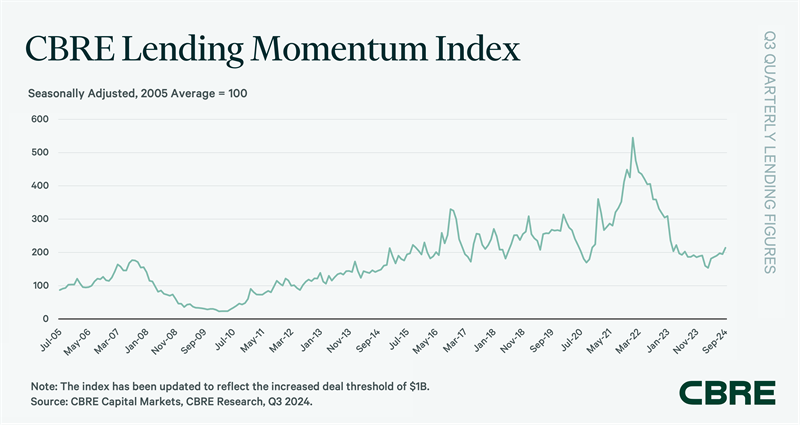

The CBRE Lending Momentum Index, which monitors the rate of CBRE-originated commercial loan closings in the U.S., rose by 13% from Q2 2024 and by 15% year-over-year, indicating enhanced lending activity. The index closed Q3 2024 at 214, approaching the pre-pandemic five-year average of 229.

In Q3 2024, the average spread on closed commercial mortgage loans was 183 basis points (bps), down 35 bps from the previous year and stable from Q2 2024. Multifamily loan spreads narrowed slightly to 168 bps for the quarter.

"With attractive leverage available throughout Q3, acquisition financing increased compared to both last quarter and the same period last year. The CMBS single-asset, single-borrower market remained robust across asset classes. Large office transactions in New York City particularly highlighted the return of debt liquidity for high-quality office assets backed by top-tier institutional sponsors at conservative leverage," noted James Millon, U.S. President of Debt & Structured Finance at CBRE.

Additionally, recent base rate cuts and expectations for further Federal Reserve rate reductions have led some lenders to capitalize on improved capital markets by de-leveraging their balance sheets through significant loan sales, maximizing returns on these positions.

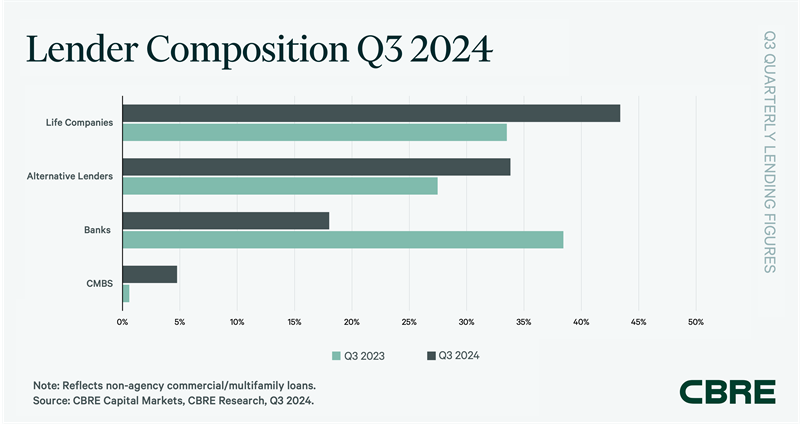

Life companies led CBRE's non-agency loan closings, accounting for 43% of the total in Q3 2024, up from 33% a year prior. Alternative lenders, including debt funds and mortgage REITs, held a 34% share, a 27% rise year-over-year, with debt fund origination volume among alternative lenders surging by 70% over the past year.

Banks contributed 18% of non-agency loan closings, down from 38% a year earlier, as caution grew over potential distress and regulatory pressures. However, there are positive signs in syndicated loans backed by high-quality assets like industrial, multifamily, and data centers.

CMBS conduits accounted for the remaining 5% of origination volume in Q3 2024, a 1% increase from a year earlier. Total CMBS issuance, including single-asset, single-borrower loans, reached $29 billion in Q3 2024, a threefold increase over the previous year.

Q3 2024 also saw slight changes in underwriting standards, with average underwritten cap rates and debt yields rising 20 bps from the previous quarter to 6%. Debt yields increased by 15 bps to 9.9%, while the average Loan-to-Value (LTV) ratio climbed to 62.8% from 61.6%.

Government agency lending on multifamily assets grew significantly, up 40% to $28 billion in Q3 2024. The CBRE Agency Pricing Index, which tracks average fixed agency mortgage rates on 7-10-year permanent loans, declined to 5.8% in Q3 2024 from 6% in Q2 but rose from 5.7% a year ago.

"Our fastest-growing segment was in the GSE space, which saw an 80% year-over-year increase in Q3, as lower base rates generated higher achievable proceeds for borrowers compared to other capital sources," Millon added.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher